PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833619

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833619

Hydrogen Pipeline Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2035

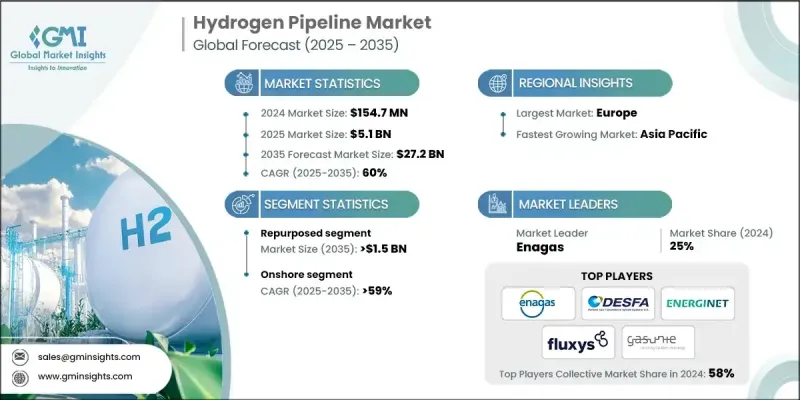

The global hydrogen pipeline market was estimated at USD 154.7 million in 2024 and is expected to grow from USD 5.1 billion in 2025 to USD 27.2 billion by 2035, at a CAGR of 60%.

Governments and industries worldwide are committing to net-zero emissions targets, driving massive investments in clean hydrogen as a key decarbonization tool-especially for hard-to-abate sectors like steel, chemicals, and heavy transport. This fuels demand for reliable hydrogen transport infrastructure, including pipelines.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2035 |

| Start Value | $154.7 Million |

| Forecast Value | $27.2 Billion |

| CAGR | 60% |

Rising Demand for the Repurposed Sector

The repurposed segment held a significant share in 2024, as operators look for cost-effective solutions to accelerate infrastructure deployment. Instead of building new lines from scratch, companies are converting existing natural gas pipelines to carry hydrogen an approach that reduces capital expenditure and shortens development timelines. This method is particularly appealing in regions with extensive legacy gas networks, offering a practical bridge between current fossil-based systems and future green energy distribution.

Increasing Demand for Onshore

The onshore segment generated significant revenues in 2024, owing to its logistical advantages, lower installation costs, and easier regulatory approvals compared to offshore infrastructure. Onshore pipelines are essential for connecting production sites, such as electrolysis plants, with industrial users, hydrogen refueling stations, and export terminals. This segment is especially critical for enabling regional hydrogen hubs and corridors across industrial zones.

Europe to Emerge as a Lucrative Region

Europe hydrogen pipeline market held a sizeable share in 2024, fueled by ambitious climate goals, coordinated infrastructure plans, and strong regulatory support through the EU Hydrogen Strategy. Major countries like Germany, the Netherlands, and Spain are investing heavily in transnational pipeline networks to connect production and consumption hubs across borders. The growth is also benefiting from cross-industry collaborations, government funding, and repurposing gas networks under initiatives like the European Hydrogen Backbone.

Major players in the hydrogen pipeline market are Denys, Terega, ENERGINET, Siemens Energy, GRTgaz, REN, Fluxys, Bonatti, Tekfen, The ROSEN Group, Spiecapag, Corinth Pipeworks, TENARIS, DESFA, Snam, ONTRAS Gastransport, Enagas, Gasunie, EUROPIPE, and GAZ-SYSTEM.

To strengthen their position in the evolving hydrogen pipeline market, companies are pursuing a combination of technological innovation, strategic partnerships, and regulatory alignment. Many are investing in advanced pipeline materials and monitoring systems to address hydrogen's safety challenges and meet future standards. Collaborations with renewable energy developers and industrial hydrogen users are enabling vertically integrated value chains and guaranteed demand. In addition, firms are actively engaging with policymakers to shape regulatory frameworks, ensuring smoother project approvals and eligibility for funding. Geographic diversification, particularly in Europe and Asia, is another key strategy, allowing companies to tap into high-growth markets and balance project risk across regions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 Base estimates and calculations

- 1.1.4 Base year calculation

- 1.1.5 Key trends for market estimates

- 1.2 Forecast model

- 1.3 Primary research & validation

- 1.3.1 Primary sources

- 1.4 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2035

- 2.2 Business trends

- 2.3 Type trends

- 2.4 Classification trends

- 2.5 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Cost structure analysis

- 3.5 Potential Pipeline Projects

- 3.6 Growth potential analysis

- 3.7 Porter's analysis

- 3.7.1 Bargaining power of suppliers

- 3.7.2 Bargaining power of buyers

- 3.7.3 Threat of new entrants

- 3.7.4 Threat of substitutes

- 3.8 PESTEL analysis

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Type, 2021 - 2035 (USD Million, Km)

- 5.1 Key trends

- 5.2 Onshore

- 5.3 Offshore

Chapter 6 Market Size and Forecast, By Classification, 2021 - 2035 (USD Million, Km)

- 6.1 Key trends

- 6.2 New

- 6.3 Repurposed

Chapter 7 Market Size and Forecast, By Region, 2021 - 2035 (USD Million, Km)

- 7.1 Key trends

- 7.2 North America

- 7.3 Europe

- 7.4 Asia Pacific

- 7.5 Rest of World

Chapter 8 Company Profiles

- 8.1 Bonatti

- 8.2 Corinth Pipeworks

- 8.3 DESFA

- 8.4 Denys

- 8.5 Enagas S.A.

- 8.6 Energinet

- 8.7 EUROPIPE

- 8.8 Fluxys

- 8.9 Gasunie

- 8.10 GAZ-SYSTEM

- 8.11 GRTgaz

- 8.12 ONTRAS Gastransport GmbH

- 8.13 REN

- 8.14 Siemens Energy

- 8.15 Spiecapag

- 8.16 Snam

- 8.17 Tekfen

- 8.18 Tenaris

- 8.19 Terega

- 8.20 The ROSEN Group