PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833630

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833630

North America Waste Heat Recovery Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

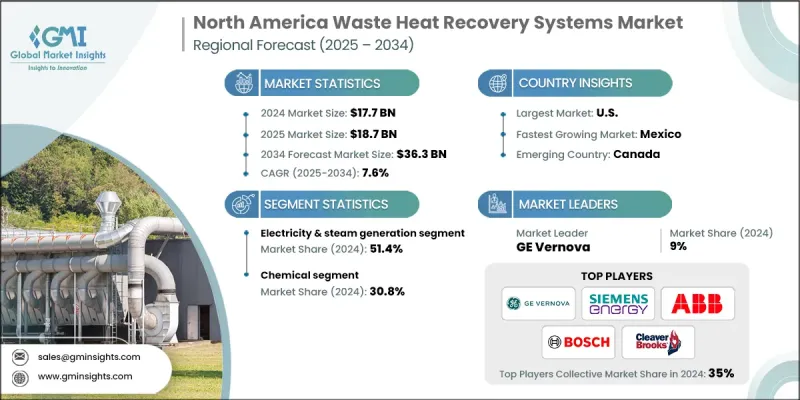

North America Waste Heat Recovery Systems Market was valued at USD 17.7 billion in 2024 and is estimated to grow at a CAGR of 7.6% to reach USD 36.3 billion by 2034.

Industries across North America are under increasing pressure to reduce energy consumption and operating costs. Waste heat recovery systems offer a proven solution to capture and reuse lost thermal energy, making them a top choice for energy-intensive sectors like manufacturing, chemicals, and oil & gas.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $17.7 Billion |

| Forecast Value | $36.3 Billion |

| CAGR | 7.6% |

Electricity & Steam Generation to Gain Traction

The electricity and steam generation segment held a significant share in 2024. As industries seek to lower operational costs and increase on-site energy independence, waste heat is increasingly being converted into steam and power through technologies like the Organic Rankine Cycle (ORC) and high-efficiency boilers. These systems are especially valuable in continuous processing industries such as cement, refining, and steel, where high-temperature exhaust gases are readily available.

Rising Adoption of Chemical

The chemical segment held a sizeable share in 2024, owing to its high thermal energy requirements and the generation of consistent, high-grade waste heat. Processes such as distillation, cracking, and reforming produce substantial heat emissions, making the sector highly suitable for recovery technologies. Companies operating in this space are leveraging heat exchangers, regenerative thermal oxidizers, and heat-to-power solutions to improve energy efficiency and reduce emissions.

U.S. to Emerge as a Propelling Region

United States waste heat recovery systems market generated a substantial share in 2024, owing to its expansive industrial base and progressive energy efficiency standards. From manufacturing and petrochemicals to data centers and food processing, a wide range of sectors are deploying waste heat recovery technologies to reduce energy costs and improve sustainability metrics.

Major players operating in the North America waste heat recovery systems market are Inproheat Industries Ltd., Climeon, Indeck Power Equipment Company, GE Vernova, Viessmann Group, Ormat Technologies Inc., 247Solar, Thermax, Solex Thermal Science, ConDex Systems Inc., Rentech Boiler Systems, Inc., Bionomic Industries, Inc., Innovative Steam Technologies (IST), Siemens Energy, Bosch Industriekessel GmbH, EnviroPower Renewable Inc., ABB, Cleaver-Brooks, SeebeckCell Technologies, and DURR Group.

To strengthen their market position, companies in the North America waste heat recovery systems space are focusing on modular system design, digital optimization, and sector-specific customization. Leading firms are investing in R&D to develop compact, high-efficiency systems that can operate across varied temperature ranges and industrial processes. Many are also integrating AI and IoT technologies for real-time performance monitoring and predictive maintenance, offering greater operational control to end users. Strategic partnerships with EPC contractors, utilities, and OEMs are enabling broader market penetration, while turnkey project delivery and performance-based contracts are helping build long-term client relationships.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technology factors

- 3.6.5 environmental factors

- 3.6.6 Legal factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digitalization and IoT integration

- 3.7.2 Emerging market penetration

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024, by country

- 4.2.1 U.S.

- 4.2.2 Canada

- 4.2.3 Mexico

- 4.3 Strategic initiative

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Pre-heating

- 5.3 Electricity & steam generation

- 5.3.1 Steam rankine cycle

- 5.3.2 Organic rankine cycle

- 5.3.3 Kalina cycle

- 5.4 Other

Chapter 6 Market Size and Forecast, By Temperature, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 < 230 °C

- 6.3 230-650 °C

- 6.4 > 650 °C

Chapter 7 Market Size and Forecast, By End Use, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Petroleum refining

- 7.3 Cement

- 7.4 Heavy metal manufacturing

- 7.5 Chemical

- 7.6 Pulp & paper

- 7.7 Food & beverage

- 7.8 Glass

- 7.9 Other

Chapter 8 Market Size and Forecast, By Country, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 U.S.

- 8.3 Canada

- 8.4 Mexico

Chapter 9 Company Profiles

- 9.1 247Solar

- 9.2 ABB

- 9.3 Bionomic Industries, Inc.

- 9.4 Bosch Industriekessel GmbH

- 9.5 Cleaver-Brooks

- 9.6 Climeon

- 9.7 ConDex Systems Inc.

- 9.8 DURR Group

- 9.9 EnviroPower Renewable Inc.

- 9.10 GE Vernova

- 9.11 Indeck Power Equipment Company

- 9.12 Innovative Steam Technologies (IST)

- 9.13 Inproheat Industries Ltd.

- 9.14 Ormat Technologies Inc.

- 9.15 Rentech Boiler Systems, Inc.

- 9.16 SeebeckCell Technologies

- 9.17 Siemens Energy

- 9.18 Solex Thermal Science

- 9.19 Thermax

- 9.20 Viessmann Group