PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833667

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833667

Combination Vaccines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

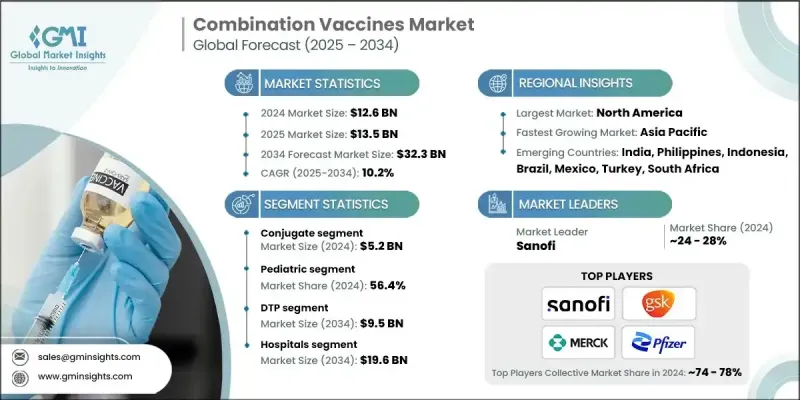

The Global Combination Vaccines Market was valued at USD 12.6 billion in 2024 and is estimated to grow at a CAGR of 10.2% to reach USD 32.3 billion by 2034.

This surge is fueled by increasing emphasis on disease prevention through proactive healthcare. Combination vaccines are gaining strong momentum as they streamline immunization by merging protection against multiple diseases into one dose. This not only minimizes the number of injections required but also enhances compliance, simplifies logistics, and improves vaccination coverage-particularly in underserved regions. As healthcare systems seek more efficient solutions, these vaccines are proving vital in supporting high-throughput immunization efforts with fewer clinic visits and reduced operational burden. Their scalable nature makes them crucial in both national and global vaccination strategies, reinforcing their growing relevance in public health.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.6 Billion |

| Forecast Value | $32.3 Billion |

| CAGR | 10.2% |

The conjugate vaccine segment generated USD 5.2 billion in 2024, backed by its strong safety profile and reliable performance, especially among infants and young children. These vaccines, which use a protein-linked antigen to provoke stronger immune responses, are widely incorporated into immunization programs targeting diseases caused by polysaccharide-coated pathogens. Their inclusion in procurement pipelines has significantly strengthened their presence in both developed and emerging economies.

The holding segment held a 56.4% share in 2024; the pediatric segment remains the primary driver of combination vaccine consumption. High birth rates and widespread adoption of multivalent immunization schedules have ensured that pediatric demand remains resilient. Backed by policy mandates and international support, these vaccines are routinely administered in early life stages, helping reduce disease burden and medical visits while optimizing immunization efforts across populations.

North America Combination Vaccines Market held 40.2% share in 2024. The region benefits from advanced healthcare infrastructure, proactive public health initiatives, and robust vaccine R&D. Investment in combination vaccine innovation, coupled with heightened awareness and uptake, continues to support regional dominance. National immunization guidelines and regular administration of combined vaccines for children further boost market penetration across the United States and Canada.

Leading Combination Vaccines Market participants include Merck, Pfizer, Sinovac, GSK, Serum Institute of India, Sanofi, Takeda, CSL, Daiichi Sankyo, Bharat Biotech, AstraZeneca, Panacea Biotec, Meiji, MTPC, Beijing Minhai Biological Technology, Mitsubishi Tanabe Pharma, Emergent BioSolutions, and Walvax Biotechnology. Companies competing in the combination vaccines market are investing heavily in expanding their product portfolios through advanced R&D to introduce new multivalent formulations that target emerging and re-emerging diseases. Strategic partnerships with government agencies, health organizations, and procurement bodies are helping secure large-scale contracts and improve global distribution. Regulatory alignment and fast-track approvals are also central to gaining market traction.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Technology trends

- 2.2.3 Age group trends

- 2.2.4 Disease trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising emphasis on preventive healthcare

- 3.2.1.2 Growing demand for convenience & compliance

- 3.2.1.3 Government initiatives and supportive measures

- 3.2.1.4 Expanding pediatric immunization programs

- 3.2.1.5 Enhanced clinical awareness and immunization guidelines

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory approval processes

- 3.2.2.2 High development and production costs

- 3.2.2.3 Cold chain & storage challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Growing public-private partnerships for vaccine distribution

- 3.2.3.2 Expanding adult vaccination programs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Pipeline analysis

- 3.6 Technology landscape

- 3.7 Investment and funding landscape

- 3.8 Future market trends

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Company matrix analysis

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Conjugate

- 5.3 Live attenuated

- 5.4 Inactivated

- 5.5 Recombinant

- 5.6 Toxoid

- 5.7 Other technologies

Chapter 6 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Pediatric

- 6.3 Adult

Chapter 7 Market Estimates and Forecast, By Disease, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Diphtheria, Tetanus, and Pertussis (DTP)

- 7.3 Polio

- 7.4 Hepatitis

- 7.5 Influenza

- 7.6 Human Papillomavirus (HPV)

- 7.7 Varicella

- 7.8 Measles, Mumps, and Rubella (MMR)

- 7.9 Other diseases

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.2.1 Public

- 8.2.2 Private

- 8.3 Specialty clinics

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AstraZeneca

- 10.2 Beijing Minhai Biological Technology

- 10.3 Bharat Biotech

- 10.4 CSL

- 10.5 Daiichi Sankyo

- 10.6 Emergent BioSolutions

- 10.7 GlaxoSmithKline (GSK)

- 10.8 Meiji

- 10.9 Merck

- 10.10 Mitsubishi Tanabe Pharma (MTPC)

- 10.11 Panacea Biotec

- 10.12 Pfizer

- 10.13 Sanofi

- 10.14 Serum Institute of India

- 10.15 Sinovac

- 10.16 Takeda

- 10.17 Walvax Biotechnology