PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844284

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1844284

Africa Electrostatic Precipitator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

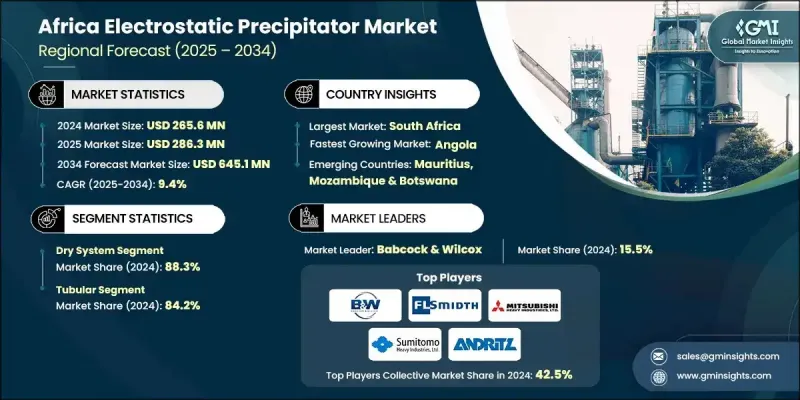

Africa Electrostatic Precipitator Market was valued at USD 265.6 million in 2024 and is estimated to grow at a CAGR of 9.4% to reach USD 645.1 million by 2034.

Increasing implementation of stringent air quality regulations across the region is playing a critical role in driving adoption. Government bodies are prioritizing pollution control through environmental programs that focus on energy efficiency, cleaner air, and sustainable industrial growth. These initiatives are accelerating the uptake of ESP technology across key industries. Electrostatic precipitators, known for their efficiency in removing fine particulate matter from industrial emissions, are now seen as vital for controlling pollution at its source. As industrialization continues across emerging African economies, businesses are modernizing their emission control infrastructure to comply with tightening regulations. This modernization includes retrofitting older units and upgrading existing systems to ensure adherence to stricter standards, especially in high-emission sectors like cement, petrochemicals, and power generation. South Africa continues to lead the regional market due to its high dependence on coal-powered energy and heavy industries, both of which produce substantial airborne pollutants. Growing regulatory enforcement targeting these sectors is resulting in more widespread deployment of ESP systems to help achieve cleaner operations, better compliance, and improved efficiency across industrial facilities.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $265.6 Million |

| Forecast Value | $645.1 Million |

| CAGR | 9.4% |

The dry ESP systems segment held 88.3% share in 2024 and is forecasted to grow at a CAGR of 9% through 2034. The rising need to align with international emission norms is compelling industries to adopt advanced solutions, with dry ESPs becoming integral in managing challenging pollutants like sticky or moisture-heavy particulates. These systems are gaining traction in high-emission environments due to their superior handling of complex industrial waste streams.

The tubular ESP designs segment held 84.2% share in 2024 and will grow at a CAGR of 9.3% between 2025 and 2034. Their efficiency and scalability in high-volume applications make them especially suitable for continuous operations. Tubular plate configurations offer multiple collection lanes, supporting higher throughput and enhanced filtration performance, making them the preferred option for large-scale industrial use across Africa.

The Botswana Electrostatic Precipitator Market is projected to reach USD 9.8 million by 2034. The country's reliance on coal-based power and the growth of cement and construction sectors are creating strong demand for particulate emission control. ESP systems play a key role in managing dust and flue gases, making them critical for meeting environmental standards while maintaining operational efficiency. As infrastructure investment rises, so does the need for reliable dust collection solutions, further supporting market expansion.

Key industry participants shaping the Africa Electrostatic Precipitator Market include Mitsubishi Heavy Industries, Hitachi, J&C Engineering (Pty) Ltd, Redecam, Morobi GEECO Power (Pty) Ltd, Valmet, Siemens Energy, Sumitomo Heavy Industries, GEECOM, Lesedi, Intensiv-Filter Himenviro, Alstom, Actom, Scheuch GmbH, GEA Group, Wood Plc, FLSmidth, ANDRITZ GROUP, DGC AFRICA, Enviropol Engineers, Hamon, Babcock and Wilcox Enterprises, KC Cottrell, DUCON, DURR Group, DURAG Group, and Thermax. Companies operating in the Africa Electrostatic Precipitator Market are implementing targeted strategies to solidify their regional presence. Key approaches include strategic collaborations with local engineering and construction firms to support turnkey installation and retrofitting projects. Firms are also focusing on technological upgrades to develop more energy-efficient and maintenance-friendly ESP systems. By customizing solutions for Africa's high-dust, high-temperature industrial environments, companies are addressing market-specific needs. Expansion of local service networks is another core tactic, enabling faster maintenance response and improved client support. Additionally, players are investing in awareness campaigns to educate industries on emission control compliance and long-term cost savings.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 System trends

- 2.4 Design trends

- 2.5 Emitting industry trends

- 2.6 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Cost structure analysis

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

- 3.7.1 Political factors

- 3.7.2 Economic factors

- 3.7.3 Social factors

- 3.7.4 Technological factors

- 3.7.5 Legal factors

- 3.7.6 Environmental factors

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis, by country, 2024

- 4.2.1 Botswana

- 4.2.2 Nigeria

- 4.2.3 Egypt

- 4.2.4 South Africa

- 4.2.5 Angola

- 4.2.6 Mozambique

- 4.2.7 Mauritius

- 4.2.8 Zambia

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By System, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Wet

- 5.3 Dry

Chapter 6 Market Size and Forecast, By Design, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Plate

- 6.3 Tubular

Chapter 7 Market Size and Forecast, By Emitting Industry, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Power generation

- 7.3 Chemicals and petrochemicals

- 7.4 Cement

- 7.5 Metal processing & mining

- 7.6 Manufacturing

- 7.7 Marine

- 7.8 Others

Chapter 8 Market Size and Forecast, By Country, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 Botswana

- 8.3 Nigeria

- 8.4 Egypt

- 8.5 South Africa

- 8.6 Angola

- 8.7 Mozambique

- 8.8 Mauritius

- 8.9 Zambia

Chapter 9 Company Profiles

- 9.1 Alstom

- 9.2 Actom

- 9.3 ANDRITZ GROUP

- 9.4 Babcock and Wilcox Enterprises

- 9.5 DGC AFRICA

- 9.6 DUCON

- 9.7 DURR Group

- 9.8 DURAG Group

- 9.9 Enviropol Engineers

- 9.10 FLSmidth

- 9.11 GEA Group

- 9.12 GEECOM

- 9.13 Hamon

- 9.14 Hitachi

- 9.15 Intensiv-Filter Himenviro

- 9.16 J&C Engineering (Pty) Ltd

- 9.17 KC Cottrell

- 9.18 Lesedi

- 9.19 Mitsubishi Heavy Industries

- 9.20 Morobi GEECO Power (Pty) Ltd

- 9.21 Redecam

- 9.22 Scheuch GmbH

- 9.23 Siemens Energy

- 9.24 Sumitomo Heavy Industries

- 9.25 Thermax

- 9.26 Valmet

- 9.27 Wood Plc