PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858801

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858801

North America Automated Breast Ultrasound Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

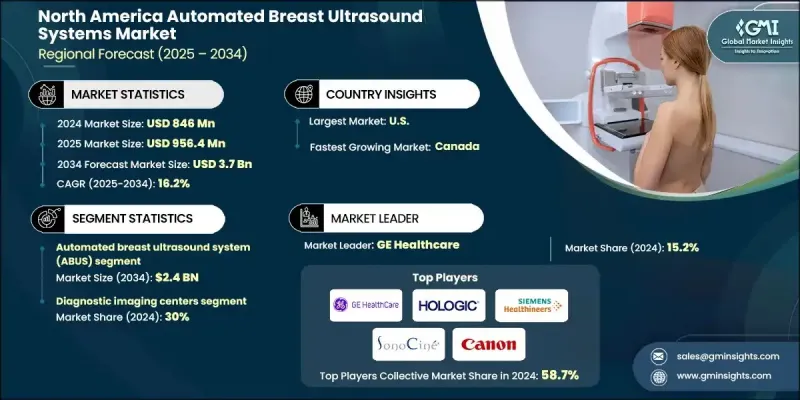

North America Automated Breast Ultrasound Systems Market was valued at USD 846 million in 2024 and is estimated to grow at a CAGR of 16.2% to reach USD 3.7 billion by 2034.

The rapid market growth is attributed to the increasing breast cancer incidence, ongoing advancements in ABUS technology, and strong awareness campaigns backed by public health initiatives. Automated breast ultrasound offers enhanced 3D imaging capabilities, enabling improved detection in patients with dense breast tissue. Technology is gaining widespread acceptance in hospitals, imaging centers, and breast care facilities due to its ability to reduce operator variability and deliver consistent, high-resolution imaging. Government-backed screening programs and educational initiatives are further boosting adoption rates, particularly among women at high risk. ABUS leverages wide automated transducers to capture standardized three-dimensional images, outperforming handheld alternatives in accuracy and workflow efficiency. As awareness grows and clinical outcomes improve, ABUS is becoming a vital part of routine screening protocols across the region, helping detect abnormalities earlier and with greater clarity.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $846 Million |

| Forecast Value | $3.7 Billion |

| CAGR | 16.2% |

The ABUS segment generated USD 538.6 million in 2024 and is projected to reach USD 2.4 billion by 2034, growing at a CAGR of 16.4%. Integration of advanced features such as volumetric imaging, digital enhancement, and automation continues to reshape breast cancer diagnostics. These improvements are elevating diagnostic precision, streamlining workflow, and expanding the technology's reach throughout North America.

The diagnostic imaging centers segment held a 30% share in 2024. These centers are experiencing strong growth as they offer specialized imaging solutions in outpatient environments, improving accessibility and reducing diagnostic wait times. Their rising role in breast imaging, particularly with ABUS technology, is contributing significantly to the expansion of the market. By investing in ABUS, these centers enhance their diagnostic offerings and meet the growing demand for high-accuracy breast cancer screening tools.

Canada Automated Breast Ultrasound Systems Market reached USD 87.6 million in 2024. Market expansion in Canada is being driven by an increase in breast cancer cases alongside public sector initiatives that promote early detection through organized screening and awareness campaigns. Additionally, breakthroughs in ABUS technology-such as AI-assisted interpretation, 3D capabilities, and high-resolution imaging-are significantly improving access and diagnostic accuracy across Canadian healthcare systems.

Key companies shaping the North America Automated Breast Ultrasound Systems Market include CapeRay Medical, Siemens Healthineers, GE Healthcare, Hitachi, Theraclion, QView Medical, Hologic, Supersonic Imagine, Shantou Institute of Ultrasonic Instruments, Canon, Metritrack, Delphinus Medical Technologies, Seno Medical Instruments, and Koninklijke Philips. To secure a competitive edge in the North America Automated Breast Ultrasound Systems Market, companies are pursuing innovation-led strategies and strategic collaborations. Leading manufacturers are focused on integrating artificial intelligence, advanced image processing, and automation features into ABUS systems to enhance diagnostic precision and reduce user dependency. Additionally, firms are expanding partnerships with healthcare networks and imaging providers to strengthen distribution and adoption. Regulatory approvals and product certifications are being fast-tracked to accelerate market entry. Many companies are also investing in awareness and training programs to educate radiologists and clinicians, ensuring effective system utilization while deepening market penetration.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Country trends

- 2.2.2 Product trends

- 2.2.3 End Use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of breast cancer in North America

- 3.2.1.2 Rising technological advancements in automated breast ultrasound systems

- 3.2.1.3 Increasing national breast screening programs across the North America

- 3.2.1.4 Rising awareness and favorable government initiatives regarding breast cancer

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of the automated breast ultrasound system

- 3.2.2.2 Lack of skilled or trained personnel

- 3.2.3 Market opportunities

- 3.2.3.1 Rising adoption of AI-integrated ABUS for predictive breast cancer screening

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Canada

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Pricing analysis, 2024

- 3.8 Future market trends

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Automated breast ultrasound system (ABUS)

- 5.3 Automated breast volume scanner (ABVS)

- 5.4 Other products

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals

- 6.3 Diagnostic imaging centers

- 6.4 Specialty clinics

Chapter 7 Market Estimates and Forecast, By Country, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 U.S.

- 7.3 Canada

Chapter 8 Company Profiles

- 8.1 Canon

- 8.2 CapeRay Medical

- 8.3 Delphinus Medical Technologies

- 8.4 GE Healthcare

- 8.5 Hitachi

- 8.6 Hologic

- 8.7 Koninklijke Philips

- 8.8 Metritrack

- 8.9 QView Medical

- 8.10 SonoCine, Inc.

- 8.11 Supersonic Imagine

- 8.12 Siemens Healthineers

- 8.13 Seno Medical Instruments Inc.

- 8.14 Shantou Institute of Ultrasonic Instruments

- 8.15 Theraclion