PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858810

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858810

Europe Veterinary Orthopedic Implants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

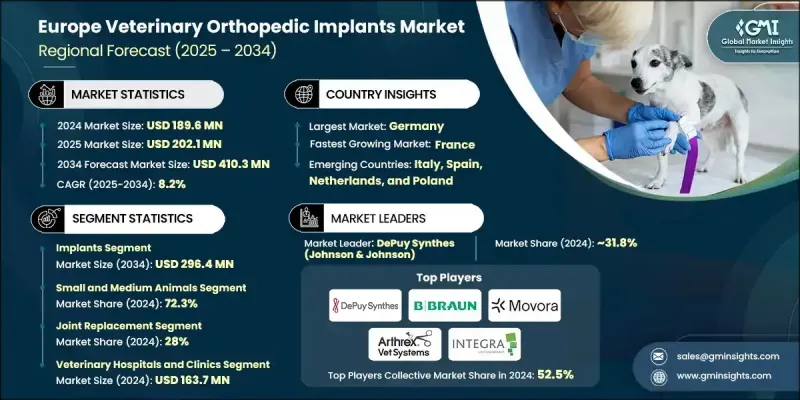

Europe Veterinary Orthopedic Implants Market was valued at USD 189.6 million in 2024 and is estimated to grow at a CAGR of 8.2% to reach USD 410.3 million by 2034.

This growth is fueled by the rising number of pets across Europe and an increasing incidence of orthopedic conditions such as fractures, ligament injuries, and joint diseases in companion animals. As the demand for advanced medical treatments in pets grows, the market for implants designed to restore bone function or replace damaged joints is gaining momentum. These implants, typically made from stainless steel or titanium, are now preferred over traditional options due to their superior strength, biocompatibility, and faster recovery outcomes. With the rise in complex injuries, veterinary hospitals and clinics are increasingly turning to high-performance fixation systems like locking plates and intramedullary nails for better stability and fewer complications. In addition, the adoption of minimally invasive surgical methods is transforming clinical practice, with surgeons opting for implants that support small-incision procedures and enable faster recovery, enhancing comfort for pets and confidence among owners.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $189.6 Million |

| Forecast Value | $410.3 Million |

| CAGR | 8.2% |

In 2024, the implants segment generated USD 134.9 million and is forecasted to grow to USD 296.4 million by 2034. This growth is strongly tied to the rising pet population across Europe and the growing demand for premium orthopedic solutions. Increased awareness of advanced treatment options is encouraging pet owners to seek high-quality surgical care for conditions such as hip dysplasia, osteoarthritis, and cruciate ligament injuries. The prevalence of orthopedic issues in dogs continues to drive growth across veterinary clinics and hospitals.

The small and medium animals segment held a 72.3% share in 2024. In contrast, large animals represented a 27.7% share. Livestock such as goats, pigs, and sheep are essential to the region's agriculture, and their exposure to orthopedic problems, often due to confined farming and rapid growth cycles, is pushing demand for surgical interventions in these species as well.

UK Veterinary Orthopedic Implants Market held a 16.5% share in 2024. The country's strong veterinary infrastructure, high awareness levels among pet owners, and rising pet humanization trends have all contributed to increasing the number of orthopedic procedures. Urbanization, coupled with growing interest in premium pet care, is fueling the demand for treatments targeting arthritis, fractures, and joint issues in companion animals.

Leading participants in the Europe veterinary orthopedic implants industry include Veterinary Instrumentation, Arthrex Vet Systems, Integra LifeSciences, Orthomed, Ortho Max, Fusion Implants, Rita Leibinger, Movora (Vimian Group), AmerisourceBergen Corporation (Cencora, Inc.), Narang Medical Limited, GPC Medical Ltd., DePuy Synthes (Johnson & Johnson), BlueSAO, GerVetUSA, and B. Braun. To strengthen their foothold in the Europe Veterinary Orthopedic Implants Market, key players are focusing on expanding their product portfolios through innovation in implant materials and designs. Many are investing in R&D to create lightweight, durable, and biocompatible solutions that suit a wider range of animal sizes and conditions. Strategic partnerships with veterinary clinics and universities are also helping companies drive product adoption and expand their customer base. Additionally, several manufacturers are increasing their regional presence through distribution agreements and direct-to-vet marketing strategies, while offering hands-on training programs to support product utilization and build practitioner trust across Europe.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional

- 1.3.2 Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Country

- 2.2.2 Product

- 2.2.3 Animal type

- 2.2.4 Application

- 2.2.5 End Use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising pet ownership and humanization

- 3.2.1.2 Aging companion-animal population

- 3.2.1.3 Increasing veterinary spending and insurance adoption

- 3.2.1.4 Ongoing product innovation

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of procedures

- 3.2.2.2 Shortage of skilled surgeons

- 3.2.2.3 Competition from non-surgical alternatives

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into underpenetrated regions

- 3.2.3.2 Development of advanced biomaterials

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Pet population, by country

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Implants

- 5.2.1 Plates

- 5.2.1.1 TPLO plates

- 5.2.1.2 TTA plates

- 5.2.1.3 Trauma plates

- 5.2.1.4 Specialty plates

- 5.2.1.5 Other plates

- 5.2.2 Joint implants

- 5.2.3 Bone screws and anchors

- 5.2.4 Pins and wires

- 5.2.5 Other implants

- 5.2.1 Plates

- 5.3 Instruments

Chapter 6 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Small and medium animals

- 6.2.1 Dogs

- 6.2.2 Cats

- 6.2.3 Other small and medium animals

- 6.3 Large animals

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Tibial plateau leveling osteotomy (TPLO)

- 7.3 Tibial tuberosity advancement (TTA)

- 7.4 Joint replacement

- 7.4.1 Hip replacement

- 7.4.2 Knee replacement

- 7.4.3 Elbow replacement

- 7.4.4 Ankle replacement

- 7.5 Trauma

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Veterinary hospitals and clinics

- 8.3 Other End Use

Chapter 9 Market Estimates and Forecast, By Country, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Germany

- 9.3 UK

- 9.4 France

- 9.5 Italy

- 9.6 Spain

- 9.7 Poland

- 9.8 Netherlands

Chapter 10 Company Profiles

- 10.1 AmerisourceBergen Corporation (Cencora, Inc.)

- 10.2 Arthrex Vet Systems

- 10.3 B. Braun

- 10.4 BlueSAO

- 10.5 DePuy Synthes (Johnson & Johnson)

- 10.6 Fusion Implants

- 10.7 GerVetUSA

- 10.8 GPC Medical Ltd.

- 10.9 Integra LifeSciences

- 10.10 Movora (Vimian Group)

- 10.11 Narang Medical Limited

- 10.12 Ortho Max

- 10.13 Orthomed

- 10.14 Rita Leibinger

- 10.15 Veterinary Instrumentation