PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858827

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858827

Asia Pacific Veterinary Orthopedic Implants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

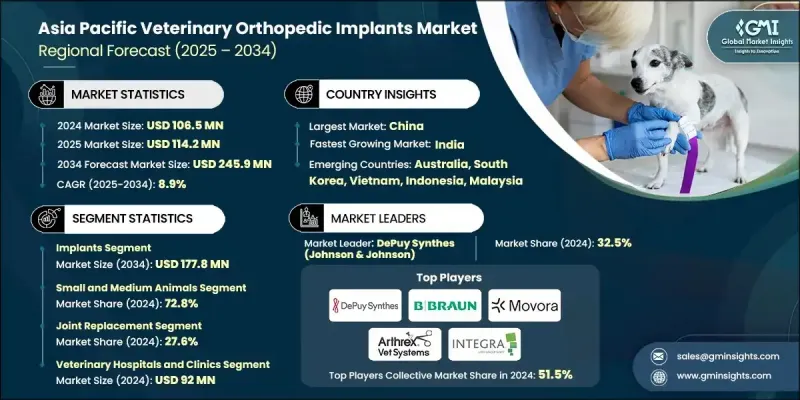

Asia Pacific Veterinary Orthopedic Implants Market was valued at USD 106.5 million in 2024 and is estimated to grow at a CAGR of 8.9% to reach USD 245.9 million by 2034.

The expansion is driven by a surge in companion and livestock animal populations across the region, coupled with a rise in musculoskeletal and joint-related conditions. Increasing disposable income in countries such as China and India, along with the rapid enhancement of veterinary infrastructure, continues to make specialty animal care more accessible. As pet ownership becomes more widespread and owners seek advanced treatments, the demand for high-quality orthopedic implants is on the rise. Veterinary orthopedic implants are used to treat fractures, stabilize joints, and aid in bone regeneration, utilizing materials such as stainless steel and titanium. These devices include bone plates, screws, wires, pins, and joint prosthetics designed to handle different animal biomechanics. There's a noticeable shift in the market toward minimally invasive implant solutions that support smaller incisions, faster healing, and reduced post-surgical pain. As animal recovery outcomes improve and surgical procedures become less invasive, veterinarians and pet owners alike are opting for modern implant technologies that deliver quicker rehabilitation with greater comfort.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $106.5 Million |

| Forecast Value | $245.9 Million |

| CAGR | 8.9% |

In 2024, the implants segment generated USD 75.9 million and is projected to hit USD 177.8 million by 2034. Rising demand for veterinary implants is closely tied to the steady increase in pet populations and a broader understanding of orthopedic implant options among pet owners. As more households adopt pets, particularly dogs, the need for advanced surgical care continues to climb. The prevalence of conditions such as osteoarthritis, hip dysplasia, cranial cruciate ligament injuries, and bone fractures is also growing, fueling demand for orthopedic implants across animal healthcare settings. The segment is further supported by the rising adoption of total joint replacement implants, especially for aging pets requiring hip and knee interventions.

The small and medium animals segment held a 72.8% share in 2024. Dogs and cats dominate the region's pet population, and the increasing willingness of pet owners to invest in specialized treatments for injuries and degenerative conditions is fueling growth. Orthopedic treatments for these animals, including ligament repair and bone fixation procedures, are becoming routine in veterinary clinics and specialty hospitals. The focus on feline and canine orthopedic care continues to shape the market, with advanced surgical tools and implants tailored specifically for these species gaining traction.

China Veterinary Orthopedic Implants Market was valued at USD 30.6 million in 2024. China remains a key contributor to regional market share due to its expanding middle-class population, rising pet ownership, and growing preference for premium veterinary care. Increased investments in pet health, paired with a maturing veterinary services ecosystem, are accelerating the adoption of orthopedic implants for animal treatment throughout the country.

Key players actively contributing to the Asia Pacific Veterinary Orthopedic Implants Market industry include Narang Medical Limited, GPC Medical Ltd., Integra LifeSciences, Orthomed, BlueSAO, Arthrex Vet Systems, AmerisourceBergen Corporation (Cencora, Inc.), DePuy Synthes (Johnson & Johnson), Fusion Implants, Auxein Medical, Movora (Vimian Group), Ortho Max, Rita Leibinger, Veterinary Instrumentation, GerVetUSA, and B. Braun. Companies operating in the Asia Pacific Veterinary Orthopedic Implants Market are focusing on several strategic actions to gain a competitive edge. Many are investing in advanced R&D to develop lightweight, biocompatible implants that support quicker recovery and better surgical outcomes. Regional expansion through distributor partnerships and localized manufacturing helps reduce supply chain delays and costs. To strengthen market presence, firms are also prioritizing product portfolios tailored to species-specific requirements, particularly for small animals.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional

- 1.3.2 Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Country trends

- 2.2.2 Product trends

- 2.2.3 Animal type trends

- 2.2.4 Application trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing pet ownership and humanization

- 3.2.1.2 Advancements in veterinary healthcare infrastructure

- 3.2.1.3 Rising incidence of pet obesity and joint disorders

- 3.2.1.4 Growth of pet insurance

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of trained veterinary professionals

- 3.2.2.2 Risk of infections and implant failure

- 3.2.2.3 Price sensitivity among pet owners

- 3.2.3 Market opportunities

- 3.2.3.1 Adoption of 3D printing technology

- 3.2.3.2 Expansion of veterinary education and training

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Pet population, by country

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Implants

- 5.2.1 Plates

- 5.2.1.1 TPLO plates

- 5.2.1.2 TTA plates

- 5.2.1.3 Trauma plates

- 5.2.1.4 Specialty plates

- 5.2.1.5 Other plates

- 5.2.2 Joint implants

- 5.2.3 Bone screws and anchors

- 5.2.4 Pins and wires

- 5.2.5 Other implants

- 5.2.1 Plates

- 5.3 Instruments

Chapter 6 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Small and medium animals

- 6.2.1 Dogs

- 6.2.2 Cats

- 6.2.3 Other small and medium animals

- 6.3 Large animals

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Tibial Plateau Leveling Osteotomy (TPLO)

- 7.3 Tibial Tuberosity Advancement (TTA)

- 7.4 Joint replacement

- 7.4.1 Hip replacement

- 7.4.2 Knee replacement

- 7.4.3 Elbow replacement

- 7.4.4 Ankle replacement

- 7.5 Trauma

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Veterinary hospitals and clinics

- 8.3 Other end use

Chapter 9 Market Estimates and Forecast, By Country, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 China

- 9.3 Japan

- 9.4 India

- 9.5 Australia

- 9.6 South Korea

- 9.7 Singapore

- 9.8 Malaysia

- 9.9 Vietnam

- 9.10 Thailand

- 9.11 Indonesia

- 9.12 Philippines

Chapter 10 Company Profiles

- 10.1 AmerisourceBergen Corporation (Cencora, Inc.)

- 10.2 Arthrex Vet Systems

- 10.3 B. Braun

- 10.4 BlueSAO

- 10.5 DePuy Synthes (Johnson & Johnson)

- 10.6 Fusion Implants

- 10.7 GerVetUSA

- 10.8 GPC Medical Ltd.

- 10.9 Integra LifeSciences

- 10.10 Movora (Vimian Group)

- 10.11 Narang Medical Limited

- 10.12 Ortho Max

- 10.13 Orthomed

- 10.14 Rita Leibinger

- 10.15 Veterinary Instrumentation