PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858840

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858840

ADAS Semiconductors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

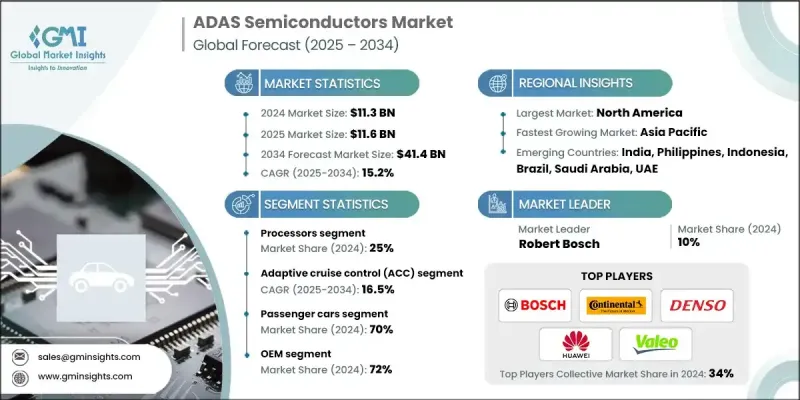

The Global ADAS Semiconductors Market was valued at USD 11.3 billion in 2024 and is estimated to grow at a CAGR of 15.2% to reach USD 41.4 billion by 2034.

The market is experiencing rapid growth due to stricter safety standards, greater demand for automated driving features, and the increasing integration of ADAS technologies in vehicles. Automakers are incorporating a wide range of semiconductor components, including high-performance microcontrollers, radar chips, lidar interface ICs, image signal processors, and AI accelerators, to improve decision-making, real-time perception, energy efficiency, and reliability. Tier-1 suppliers and vehicle manufacturers are also advancing technologies like sensor fusion, predictive analytics, and AI-driven systems to comply with tough safety regulations. The development of semiconductors with better packaging, improved thermal conductivity, and lower power consumption is crucial for handling large data volumes and adhering to regulations such as Euro NCAP, NHTSA, and UNECE. Additionally, the COVID-19 pandemic exposed vulnerabilities in the semiconductor supply chain, prompting companies to diversify and outsource. As the automotive industry moves toward electrification and autonomous vehicles, investments in automotive chips have increased, with new business models such as subscription-based services and chipset integration partnerships offering scalable and flexible solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.3 Billion |

| Forecast Value | $41.4 Billion |

| CAGR | 15.2% |

In 2024, the processors segment held a 25% share and is expected to grow at the highest rate, with a CAGR of 17%, driven by the increasing demand for high-performance computing to support advanced ADAS features and enhance vehicle autonomy. The automotive sector is progressively adopting vehicles with centralized domain controls and AI-powered system-on-chips (SoCs) that can process complex sensor data, perform real-time decision-making, and implement sophisticated algorithms like deep learning and computer vision.

The adaptive cruise control (ACC) segment held a 22% share in 2024. Although ACC is not the most widely used feature, its demand is expected to grow at a CAGR of 16.5% between 2025 and 2034, driven by its ability to automatically adjust vehicle speed based on traffic conditions, improving both comfort and safety.

U.S. ADAS Semiconductors Market held a dominant share of 85% generating USD 2.91 billion in 2024. The strong presence of automotive research and development, along with early adoption of safety technologies and government-imposed safety standards, has solidified the U.S. as a leader in this industry. Leading car manufacturers are actively integrating advanced radar, camera, and AI-powered chips into their vehicles, catering to the growing consumer demand for safety and driver-assistance features.

Key players in the ADAS Semiconductors Market include NVIDIA, Mobileye (Intel), Continental, Denso, Robert Bosch, Qualcomm, Tesla, ZF Friedrichshafen, Huawei, and VALEO. To strengthen their market position, companies in the ADAS Semiconductors Market are focusing on several key strategies. They are heavily investing in research and development (R&D) to develop cutting-edge chips that meet the increasingly sophisticated needs of ADAS, such as real-time processing and enhanced sensor fusion. Collaborations and partnerships with automakers are also being pursued to integrate AI and machine learning into their products, thus offering more efficient and scalable solutions. Furthermore, companies are enhancing their product offerings with low-power, high-performance semiconductors that can handle large data sets, meeting the demands of advanced safety systems and autonomous driving capabilities.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Application

- 2.2.4 Vehicle

- 2.2.5 End Use

- 2.2.6 Level of autonomy

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise in demand for advanced safety features and regulatory mandates.

- 3.2.1.2 Surge in autonomous and semi-autonomous vehicle adoption.

- 3.2.1.3 Growing integration of AI and machine learning in ADAS.

- 3.2.1.4 Expansion of EVs requiring high-performance ADAS solutions.

- 3.2.1.5 Increase in sensor fusion and multi-sensor ADAS architectures.

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost of ADAS semiconductor solutions limiting mass adoption.

- 3.2.2.2 Complexity in integration across diverse vehicle platforms.

- 3.2.3 Market opportunities

- 3.2.3.1 Development of low-power, AI-optimized automotive semiconductors.

- 3.2.3.2 Growing partnerships between OEMs and semiconductor companies.

- 3.2.3.3 Rising demand for 77GHz radar and lidar integration chips.

- 3.2.3.4 Expansion of ADAS in emerging markets.

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Cybersecurity & Functional Safety Integration

- 3.13.1 Automotive cybersecurity framework implementation

- 3.13.2 Hardware security module (HSM) integration

- 3.13.3 Secure boot & chain of trust

- 3.13.4 ISO 21434 cybersecurity compliance

- 3.13.5 Threat modeling & risk assessment

- 3.13.6 Security by design methodologies

- 3.13.7 Incident response & recovery systems

- 3.13.8 Privacy-preserving computing techniques

- 3.14 Disruptive technology integration & adoption

- 3.14.1 Neuromorphic computing for adas applications

- 3.14.2 Chiplet architecture & disaggregated design

- 3.14.3 Processing-in-memory (PIM) technologies

- 3.14.4 Photonic computing integration potential

- 3.14.5 Quantum computing future applications

- 3.14.6 RISC-V open architecture adoption

- 3.14.7 Edge ai accelerator integration

- 3.14.8 Analog AI computing solutions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021-2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Processors

- 5.3 Sensors

- 5.4 Memory

- 5.5 Power Management ICs

- 5.6 Connectivity & Interface

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Adaptive Cruise Control (ACC)

- 6.3 Blind Spot Detection System (BSD)

- 6.4 Park Assistance

- 6.5 Lane Departure Warning System (LDWS)

- 6.6 Tire Pressure Monitoring System (TPMS)

- 6.7 Autonomous Emergency Braking (AEB)

- 6.8 Adaptive Front Lights (AFL)

- 6.9 Others

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021-2034 ($Bn, Units)

- 7.1 Key trends

- 7.1.1 Passenger cars

- 7.1.1.1 Hatchbacks

- 7.1.1.2 Sedans

- 7.1.1.3 SUVs

- 7.1.1.4 MPVs

- 7.1.2 Commercial vehicles

- 7.1.2.1 Light commercial vehicles (LCVs)

- 7.1.2.2 Medium commercial vehicles (MCVs)

- 7.1.2.3 Heavy commercial vehicles (HCVs)

- 7.1.1 Passenger cars

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Level of Autonomy, 2021-2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Level 1 (Driver assistance)

- 9.3 Level 2 (Partial automation)

- 9.4 Level 3 (Conditional automation)

- 9.5 Level 4 (High automation)

- 9.6 Level 5 (Full automation)

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Philippines

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Continental

- 11.1.2 Denso

- 11.1.3 Huawei

- 11.1.4 Mobileye (Intel)

- 11.1.5 NVIDIA

- 11.1.6 Qualcomm

- 11.1.7 Robert Bosch

- 11.1.8 Tesla

- 11.1.9 VALEO

- 11.1.10 ZF Friedrichshafen

- 11.2 Regional Players

- 11.2.1 Analog Devices

- 11.2.2 Apvit

- 11.2.3 Baidu Apollo

- 11.2.4 Infineon

- 11.2.5 Innoviz Technologies

- 11.2.6 Luminar Technologies

- 11.2.7 Magna International

- 11.2.8 Microchip Technology

- 11.2.9 NXP semiconductors

- 11.2.10 ON Semiconductor

- 11.2.11 Rohm Semiconductor

- 11.2.12 Toshiba Electronic Devices

- 11.2.13 Velodyne Lidar

- 11.3 Emerging Players

- 11.3.1 Ambarella

- 11.3.2 Black Sesame

- 11.3.3 Hailo Technologies

- 11.3.4 Horizon Robotics

- 11.3.5 Lattice Semiconductor

- 11.3.6 SiTime

- 11.3.7 Xilinx