PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858984

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1858984

Europe Steam Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

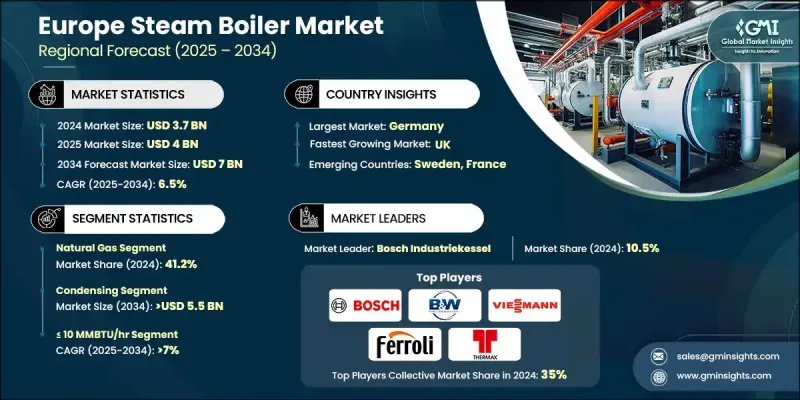

Europe Steam Boiler Market was valued at USD 3.7 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 7 billion by 2034.

The market growth was driven by rising demand for energy-efficient heating solutions, rapid industrialization, and the growing adoption of cleaner technologies across multiple sectors. Steam boilers, which play a critical role in power generation, manufacturing, food processing, and chemical industries, are witnessing a resurgence in demand as companies across Europe focus on reducing carbon emissions while maintaining operational efficiency. Stricter environmental regulations, coupled with government incentives to encourage the use of low-emission and high-efficiency boilers, are reshaping the market landscape. Additionally, the rising need for reliable heating systems in commercial and residential sectors, combined with the ongoing modernization of aging industrial infrastructure, is further fueling market growth across the region.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.7 Billion |

| Forecast Value | $7 Billion |

| CAGR | 6.5% |

The oil-fired steam boiler segment will reach USD 1.2 billion by 2034. High calorific value and availability of abundant fuel supply are some of the prominent factors favoring the deployment of these boilers. Rising demand for lubricants, petrol, diesel, LNG, and other petroleum products will stimulate the product demand. Refineries deploy some of the largest industrial boilers for distillation purposes. Surging domestic shale oil output from the Permian, the Bakken, and other shale basins, coupled with rising exports, will further complement the business outlook.

The condensing boilers segment held a 61.6% share in 2024. The widespread adoption of condensing boilers is driven by their ability to deliver lower heating costs, enhanced energy efficiency, and improved safety during operation. Industries such as hospitality, healthcare, and manufacturing are increasingly investing in these systems to meet stringent environmental regulations while optimizing operational expenses.

Germany Steam Boiler Market was valued at USD 487.4 million in 2024, due to its strong industrial base, advanced manufacturing infrastructure, and strict energy-efficiency regulations. The country is also at the forefront of adopting renewable-integrated boiler systems as part of its ambitious carbon neutrality goals. The UK and France follow closely, with strong demand in food and beverage, power generation, and healthcare industries. Meanwhile, Eastern Europe is emerging as a promising growth region, supported by rising industrial investments, infrastructure modernization, and growing adoption of cleaner energy technologies to align with EU climate objectives.

Prominent companies operating in the Europe Steam Boiler Market include Bosch Industriekessel GmbH, Babcock & Wilcox Enterprises Inc., Cleaver-Brooks Inc., Hurst Boiler & Welding Co. Inc., Fulton Boiler Works Inc., Thermodyne Boilers, Viessmann Group, Byworth Boilers, Forbes Marshall, and Miura Boiler Co. Ltd. The competitive landscape of the Europe Steam Boiler Market is shaped by a mix of global giants and regional players, each focusing on innovation, energy efficiency, and compliance with stringent emission regulations. Companies are investing in next-generation boiler technologies, hybrid systems, and integration with renewable energy sources to maintain their market edge. Strategic partnerships, mergers and acquisitions, and continuous R&D investments are also central to the growth strategies of leading players in this sector.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Market estimates & forecast parameters

- 1.3 Forecast model

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario analysis framework

- 1.4 Primary research and validation

- 1.4.1 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Paid Sources

- 1.5.2 Sources, by region

- 1.6 Research trail & scoring components

- 1.6.1 Research trail components

- 1.6.2 Scoring components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

- 1.8 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.1.1 Business trends

- 2.1.2 Capacity trends

- 2.1.3 Fuel trends

- 2.1.4 Technology trends

- 2.1.5 Application trends

- 2.1.6 Country trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of steam boiler

- 3.8 Price trend analysis (USD/ MMBTU/hr)

- 3.8.1 By capacity

- 3.8.2 By fuel

- 3.9 Emerging opportunities & trends

- 3.10 Investment analysis & future prospects

- 3.11 Digital transformation & industry 4.0 integration

- 3.12 Sustainability initiatives & compliances

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by country, 2024

- 4.2.1 France

- 4.2.2 UK

- 4.2.3 Poland

- 4.2.4 Italy

- 4.2.5 Spain

- 4.2.6 Austria

- 4.2.7 Germany

- 4.2.8 Sweden

- 4.2.9 Russia

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.4.1 Key partnerships & collaborations

- 4.4.2 Major M&A activities

- 4.4.3 Product innovations & launches

- 4.4.4 Market expansion strategies

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 5.1 Key trends

- 5.2 ≤ 10 MMBTU/hr

- 5.3 > 10 - 50 MMBTU/hr

- 5.4 > 50 - 100 MMBTU/hr

- 5.5 > 100 - 250 MMBTU/hr

- 5.6 > 250 MMBTU/hr

Chapter 6 Market Size and Forecast, By Fuel, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 6.1 Key trends

- 6.2 Natural gas

- 6.3 Oil

- 6.4 Coal

- 6.5 Others

Chapter 7 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 7.1 Key trends

- 7.2 Condensing

- 7.3 Non-condensing

Chapter 8 Market Size and Forecast, By Application, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 8.1 Key trends

- 8.2 Commercial

- 8.2.1 By application

- 8.2.1.1 Offices

- 8.2.1.2 Healthcare facilities

- 8.2.1.3 Educational institutions

- 8.2.1.4 Lodgings

- 8.2.1.5 Retail stores

- 8.2.1.6 Others

- 8.2.2 By capacity

- 8.2.2.1 ≤ 10 MMBTU/hr

- 8.2.2.2 > 10 - 50 MMBTU/hr

- 8.2.2.3 > 50 - 100 MMBTU/hr

- 8.2.2.4 > 100 - 250 MMBTU/hr

- 8.2.2.5 > 250 MMBTU/hr

- 8.2.3 By fuel

- 8.2.3.1 Natural gas

- 8.2.3.2 Oil

- 8.2.3.3 Coal

- 8.2.3.4 Others

- 8.2.4 By technology

- 8.2.4.1 Condensing

- 8.2.4.2 Non-condensing

- 8.2.1 By application

- 8.3 Industrial

- 8.3.1 By application

- 8.3.1.1 Food processing

- 8.3.1.2 Pulp & paper

- 8.3.1.3 Chemical

- 8.3.1.4 Refining

- 8.3.1.5 Primary metal

- 8.3.1.6 Others

- 8.3.2 By capacity

- 8.3.2.1 ≤ 10 MMBTU/hr

- 8.3.2.2 > 10 - 50 MMBTU/hr

- 8.3.2.3 > 50 - 100 MMBTU/hr

- 8.3.2.4 > 100 - 250 MMBTU/hr

- 8.3.2.5 > 250 MMBTU/hr

- 8.3.3 By fuel

- 8.3.3.1 Natural gas

- 8.3.3.2 Oil

- 8.3.3.3 Coal

- 8.3.3.4 Others

- 8.3.4 By technology

- 8.3.4.1 Condensing

- 8.3.4.2 Non-condensing

- 8.3.1 By application

Chapter 9 Market Size and Forecast, By Country, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 9.1 Key trends

- 9.2 France

- 9.3 UK

- 9.4 Poland

- 9.5 Italy

- 9.6 Spain

- 9.7 Austria

- 9.8 Germany

- 9.9 Sweden

- 9.10 Russia

Chapter 10 Company Profiles

- 10.1 Babcock & Wilcox Enterprises

- 10.2 Babcock Wanson

- 10.3 Bosch Industriekessel

- 10.4 Clayton Industries

- 10.5 Cleaver-Brooks

- 10.6 Cochran

- 10.7 Doosan Enerbility

- 10.8 FERROLI

- 10.9 Forbes Marshall

- 10.10 Fulton

- 10.11 GE Vernova

- 10.12 Hoval

- 10.13 Hurst Boiler & Welding

- 10.14 John Cockerill

- 10.15 John Wood Group

- 10.16 Maxima Boilers

- 10.17 Mitsubishi Heavy Industries

- 10.18 Miura America

- 10.19 PARKER BOILER

- 10.20 Thermax

- 10.21 Viessmann

- 10.22 Weil-McLain