PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928970

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928970

Fuel Cell Electric Vehicle Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

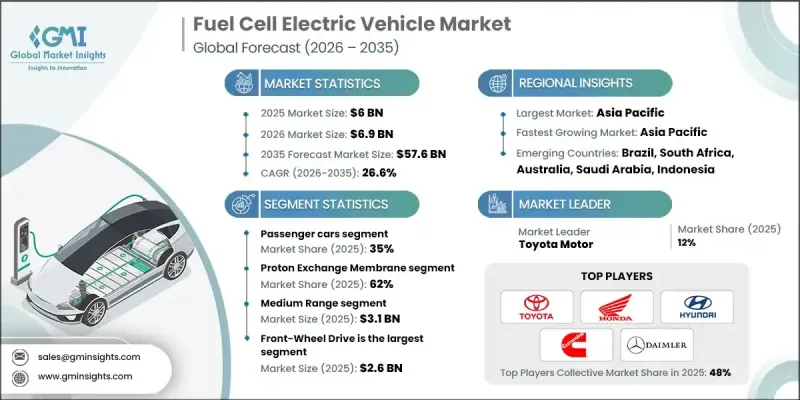

The Global Fuel Cell Electric Vehicle Market was valued at USD 6 billion in 2025 and is estimated to grow at a CAGR of 26.6% to reach USD 57.6 billion by 2035.

Growth is driven by rising adoption of fuel cell electric vehicles in public transportation, logistics, and passenger vehicle segments due to their long-range performance and fast refueling capabilities. Government policies, subsidies, and tax incentives aimed at promoting clean energy are encouraging investor participation and opening new markets, further fueling industry expansion. Supply chain disruptions have affected FCEV sales, but automakers are accelerating the development of hydrogen platforms faster than ever before. Companies are showcasing next-generation fuel cell technologies and preparing production-level vehicles for commercial deployment, signaling a strong commitment to decarbonizing transportation. Growing environmental awareness and sustainability goals are motivating both consumers and governments to prioritize zero-emission mobility, making FCEVs increasingly appealing as countries strive to reduce greenhouse gas emissions.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $6 Billion |

| Forecast Value | $57.6 Billion |

| CAGR | 26.6% |

The passenger car segment held 35% share in 2025 and is expected to grow at a CAGR of 27.8% from 2026 to 2035. Passenger FCEVs are rapidly evolving as automakers refine powertrain designs and optimize integration for daily use. Increasing consumer awareness about sustainability and low-emission mobility is accelerating adoption of hydrogen-powered passenger cars. Manufacturers are focusing on enhancing driving range, reducing refueling times, and improving overall vehicle efficiency to match or exceed the performance of traditional internal combustion and battery electric vehicles. Advanced infotainment, safety features, and connectivity options are being incorporated to meet modern consumer expectations.

The proton exchange membrane (PEM) fuel cells segment held 62% share in 2025 and is projected to grow at a CAGR of 28.9% through 2035. PEM fuel cells operate at lower temperatures than conventional fuel cells, enabling quick start-ups, better adaptation to frequent stop-and-go driving, and reduced thermal management requirements. Advances are achieving high efficiencies, longer durability, and reduced platinum use, improving cost competitiveness while sustaining performance for commercial applications.

China Fuel Cell Electric Vehicle Market generated USD 1.79 billion in 2025. Government programs and private investments are driving rapid FCEV adoption, with national initiatives aiming to deploy tens of thousands of fuel cell vehicles while expanding hydrogen refueling infrastructure across multiple provinces.

Key players in the Global Fuel Cell Electric Vehicle Market include Bosch, Honda Motor, Ballard Power Systems, General Motors Company, Daimler, BMW, Toyota Motor, Volkswagen, Hyundai Motor Company, and PowerCell Sweden. Companies in the Global Fuel Cell Electric Vehicle Market are strengthening their position by investing heavily in R&D to enhance fuel cell efficiency, durability, and cost-effectiveness. They are forming strategic alliances with automotive manufacturers, technology providers, and infrastructure developers to accelerate vehicle deployment and expand global reach. Firms are actively developing hydrogen refueling networks, offering integrated mobility solutions, and standardizing vehicle platforms to improve interoperability. Additional strategies include optimizing supply chains, localizing production, launching pilot programs, and leveraging government incentives to build market credibility and drive adoption across public and commercial transportation sectors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Fuel Cell

- 2.2.4 Range

- 2.2.5 Drive

- 2.2.6 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material suppliers

- 3.1.1.2 Component suppliers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 Distribution channel

- 3.1.1.6 End Use

- 3.1.2 Cost structure

- 3.1.3 Profit margin

- 3.1.4 Value addition at each stage

- 3.1.5 Vertical integration trends

- 3.1.6 Disruptors

- 3.1.1 Supplier landscape

- 3.2 Impact on forces

- 3.2.1 Growth drivers

- 3.2.1.1 Decarbonization mandates & emissions regulations

- 3.2.1.2 Hydrogen infrastructure expansion

- 3.2.1.3 Commercial fleet adoption in logistics & public transport

- 3.2.1.4 Incentives & subsidies for clean vehicles

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Hydrogen refueling infrastructure scarcity

- 3.2.2.2 Fuel cell system durability & maintenance

- 3.2.3 Market opportunities

- 3.2.3.1 Battery-hybrid & fuel cell integration

- 3.2.3.2 Hydrogen supply chain & green hydrogen adoption

- 3.2.3.3 Regional hydrogen policies & industrial partnerships

- 3.2.3.4 Expansion into material handling and niche industrial vehicles

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S. NHTSA Low-Speed Vehicle (LSV) Standards (FMVSS 500)

- 3.4.1.2 U.S. State-Level Street-Legal LSV Rules

- 3.4.1.3 Canada Transport Canada LSV Regulations

- 3.4.2 Europe

- 3.4.2.1 EU Quadricycle Category L6e / L7e

- 3.4.2.2 UNECE Vehicle Safety Regulations

- 3.4.2.3 EU Battery Regulation

- 3.4.2.4 EU End-of-Life Vehicle Directive

- 3.4.3 Asia-Pacific

- 3.4.3.1 China GB Standards for NEVs and LSVs

- 3.4.3.2 India CMVR Rules for Electric Vehicles

- 3.4.3.3 Japan MLIT Micro-Mobility Regulations

- 3.4.4 Latin America

- 3.4.4.1 Brazil CONTRAN Standards

- 3.4.4.2 Argentina IRAM Standards

- 3.4.4.3 Mexico NOM Vehicle Standards

- 3.4.5 Middle East & Africa

- 3.4.5.1 Saudi Arabia SASO Standards

- 3.4.5.2 UAE ESMA Regulations

- 3.4.5.3 GSO Gulf Standards for Electric Vehicles

- 3.4.5.4 South Africa SANS Regulations

- 3.4.1 North America

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Technology trends & innovation ecosystem

- 3.7.1 Current technologies

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Patent analysis

- 3.10 Production statistics

- 3.10.1 Production hubs

- 3.10.2 Consumption hubs

- 3.10.3 Export and import

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.11.5 Carbon footprint considerations

- 3.12 Feasibility & adoption of low-speed vehicles assessment

- 3.12.1 Total Cost of Ownership (TCO) benchmarking

- 3.12.2 Battery, charging & powertrain viability

- 3.12.3 Street-legality & compliance economics

- 3.12.4 Application-level ROI & payback

- 3.12.5 Infrastructure readiness & operating risk

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia-Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Key developments

- 4.5.1 Mergers & acquisitions

- 4.5.2 Partnerships & collaborations

- 4.5.3 New product launches

- 4.5.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Bn, Units)

- 5.1 Key trends

- 5.2 Passenger Cars

- 5.2.1 Sedans

- 5.2.2 Hatchbacks

- 5.2.3 SUVs

- 5.3 Commercial Vehicles

- 5.3.1 Light commercial vehicles (LCV)

- 5.3.2 Medium commercial vehicles (MCV)

- 5.3.3 Heavy commercial vehicles (HCV)

- 5.4 Two & Three Wheelers

Chapter 6 Market Estimates & Forecast, By Fuel Cell, 2022 - 2035 ($Bn, units)

- 6.1 Key trends

- 6.2 Proton Exchange Membrane

- 6.3 Phosphoric Acid Fuel Cell

- 6.4 Solid Oxide Fuel Cell

Chapter 7 Market Estimates & Forecast, By Range, 2022 - 2035 ($Bn, Units)

- 7.1 Key trends

- 7.2 Short Range (Below 250 Miles)

- 7.3 Medium Range (250 - 500 Miles)

- 7.4 Long Range (Above 500 Miles)

Chapter 8 Market Estimates & Forecast, By Drive, 2022 - 2035 ($Bn, Units)

- 8.1 Key trends

- 8.2 Front-Wheel Drive (FWD)

- 8.3 Rear-Wheel Drive (RWD)

- 8.4 All-Wheel Drive (AWD)

Chapter 9 Market Estimates & Forecast, By Application, 2022 - 2035 ($Bn, Units)

- 9.1 Key trends

- 9.2 Personal use

- 9.3 Commercial fleet

- 9.3.1 Last-mile delivery

- 9.3.2 Logistics & freight

- 9.3.3 Ride-hailing & shared mobility

- 9.4 Public transportation

- 9.5 Industrial & material handling

- 9.6 Government & infrastructure projects

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn, Units)

- 10.1 North America

- 10.1.1 US

- 10.1.2 Canada

- 10.2 Europe

- 10.2.1 UK

- 10.2.2 Germany

- 10.2.3 France

- 10.2.4 Italy

- 10.2.5 Spain

- 10.2.6 Belgium

- 10.2.7 Netherlands

- 10.2.8 Sweden

- 10.2.9 Russia

- 10.3 Asia Pacific

- 10.3.1 China

- 10.3.2 India

- 10.3.3 Japan

- 10.3.4 Australia

- 10.3.5 Singapore

- 10.3.6 South Korea

- 10.3.7 Vietnam

- 10.3.8 Indonesia

- 10.4 Latin America

- 10.4.1 Brazil

- 10.4.2 Mexico

- 10.4.3 Argentina

- 10.5 MEA

- 10.5.1 South Africa

- 10.5.2 Saudi Arabia

- 10.5.3 UAE

Chapter 11 Company Profiles

- 11.1 Global players

- 11.1.1 Toyota Motor

- 11.1.2 Hyundai Motor Company

- 11.1.3 Honda Motor

- 11.1.4 General Motors Company

- 11.1.5 Daimler / Daimler Truck

- 11.1.6 BMW

- 11.1.7 Audi / Volkswagen

- 11.1.8 Bosch

- 11.1.9 Ballard Power Systems

- 11.1.10 PowerCell Sweden

- 11.1.11 Nikola

- 11.1.12 Plug Power

- 11.1.13 Hino Motors

- 11.2 Regional players

- 11.2.1 SAIC Motor

- 11.2.2 Tata Motors

- 11.2.3 Renault

- 11.2.4 Nissan Motor

- 11.2.5 First Automotive Works (FAW)

- 11.2.6 Changan Automobile

- 11.2.7 Yutong

- 11.2.8 Foton

- 11.2.9 Higer Bus

- 11.3 Emerging players

- 11.3.1 Riversimple

- 11.3.2 REV