PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871079

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871079

Cryogenic Valve for Industrial Gas Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

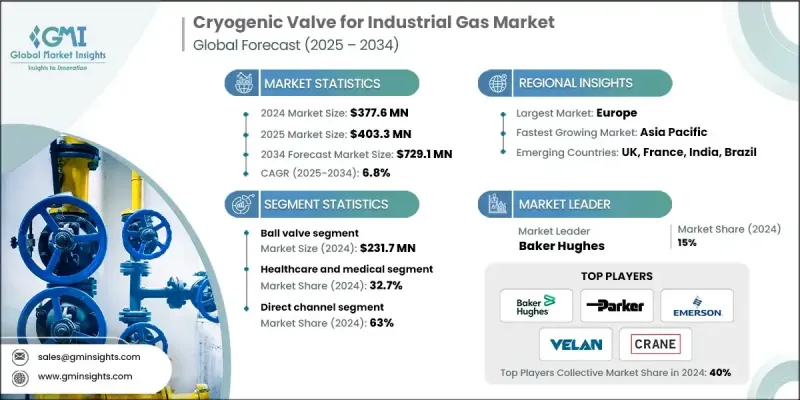

The Global Cryogenic Valve for Industrial Gas Market was valued at USD 377.6 million in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 729.1 million by 2034.

The market is witnessing steady growth driven by rising demand for specialty gases such as oxygen, nitrogen, and argon used extensively in ferrous and non-ferrous metallurgical processes. These gases require advanced cryogenic valves capable of handling extremely low temperatures while maintaining high performance and safety. The growing adoption of industrial gases across multiple sectors, including healthcare, energy, and manufacturing, continues to create demand for efficient and durable cryogenic valve systems. Innovation in valve design, such as the introduction of extended bonnets, metal bellows seals, and enhanced top-entry configurations, is helping manufacturers improve efficiency, limit heat leakage, and extend product lifespan. Additionally, additive manufacturing technologies like 3D printing are transforming valve production by offering higher precision, reduced waste, and faster prototyping cycles. These advancements allow producers to develop customized, high-performance components suited for critical applications. As industries move toward automation and advanced gas distribution networks, the role of cryogenic valves becomes increasingly vital in ensuring safety, reliability, and compliance with stringent quality standards.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $377.6 million |

| Forecast Value | $729.1 million |

| CAGR | 6.8% |

The butterfly valve segment held a 25.3% share in 2024, owing to its compact structure, cost-effectiveness, and adaptability in managing varying pressure and temperature conditions. Its versatile application across industrial operations has strengthened its presence in the global valve industry. With rising infrastructure investments and growing requirements in water and wastewater treatment, the demand for these valves continues to expand. Their ability to deliver reliable performance in both cryogenic and ambient conditions makes them a preferred choice for large-scale industrial gas systems.

The direct distribution channel held a 63% share in 2024. Direct procurement enhances supply chain efficiency by reducing intermediaries, ensuring faster delivery, and maintaining high product quality. Industries that rely on precision and reliability, such as semiconductors, energy, and healthcare, benefit significantly from these streamlined procurement models. Direct supply not only guarantees consistent quality control but also reduces lead times and costs, allowing manufacturers to respond promptly to customer needs. This approach helps companies build long-term client relationships, enhance operational performance, and strengthen their market competitiveness.

Asia Pacific Cryogenic Valve for Industrial Gas Market will grow at a CAGR of 7.2% from 2025 to 2034. Rapid industrialization and urban expansion across countries like India and China are driving market demand for cryogenic valves in industrial gas applications. The region's increasing emphasis on energy infrastructure, healthcare, and manufacturing has further amplified growth opportunities. Substantial government investment in industrial and energy projects is also supporting market expansion. The growing share of the Asia Pacific market underscores its importance as a key growth hub for cryogenic valve manufacturers globally.

Key players operating in the Global Cryogenic Valve for Industrial Gas Market include Microfinish, Flowserve, Parker Hannifin, Kitz, Emerson, Bray International, Herose, PK Valve and Engineering, Baker Hughes, Rego, Swagelok, Crane Company, Powell Valves, Trimteck, and Velan. To strengthen their foothold, major companies in the cryogenic valve for industrial gas market are prioritizing product innovation, advanced manufacturing methods, and expansion into emerging economies. Leading manufacturers are integrating smart monitoring technologies and enhanced sealing solutions to improve valve reliability and performance in cryogenic environments. Investment in additive manufacturing and automation is optimizing production efficiency while reducing costs. Strategic partnerships and mergers are being pursued to expand product portfolios and regional reach.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Valve type

- 2.2.3 Valve size

- 2.2.4 Gas type

- 2.2.5 Application

- 2.2.6 End Use

- 2.2.7 Distribution Channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for specialty industrial gases

- 3.2.1.2 Expansion of air separation units (ASUs)

- 3.2.1.3 Focus on operational safety and efficiency

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost of compliance and certification

- 3.2.2.2 Limited skilled workforce for maintenance

- 3.2.3 Opportunities

- 3.2.3.1 Growth in medical and laboratory gas applications

- 3.2.3.2 Automation and smart valve technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Valve type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code-8481)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Gap analysis

- 3.10 Risk assessment and mitigation

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Valve type, 2021-2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Ball valves

- 5.2.1 Floating ball valves

- 5.2.2 Trunnion mounted ball valves

- 5.2.3 Specialized oxygen service ball valves

- 5.3 Control valves

- 5.3.1 Globe-style control valves

- 5.3.2 Characterized control valves

- 5.3.3 Pressure reducing valves

- 5.4 Gate valves

- 5.4.1 Flexible wedge gate valves

- 5.4.2 Bellows-sealed gate valves

- 5.4.3 Others

- 5.5 Check valves

- 5.5.1 Spring-loaded check valves

- 5.5.2 Swing check valves

- 5.5.3 Lift check valves

- 5.5.4 Others

- 5.6 Butterfly valves

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Valve size, 2021-2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Less than 1 inch

- 6.3 Between 1.5 to 4 inches

- 6.4 Between 5 to 6 inches

- 6.5 More than 6 inches

Chapter 7 Market Estimates & Forecast, By Gas Type, 2021-2034 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Liquid Nitrogen

- 7.3 Liquid Oxygen

- 7.4 Liquid Argon

- 7.5 Hydrogen

- 7.6 Carbon Dioxide

- 7.7 Others (Helium etc.)

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Isolation valves

- 8.3 Flow control valves

- 8.4 Check/non-return valves

- 8.5 Pressure relief functions

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Healthcare and medical

- 9.3 Electronics and semiconductors

- 9.4 Chemical

- 9.5 Others (metal processing etc.)

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct

- 10.3 Indirect

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Baker Hughes

- 12.2 Bray International

- 12.3 Crane Company

- 12.4 Emerson

- 12.5 Flowserve

- 12.6 Herose

- 12.7 Kitz

- 12.8 Microfinish

- 12.9 Parker Hannifin

- 12.10 PK Valve and Engineering

- 12.11 Powell Valves

- 12.12 Rego

- 12.13 Swagelok

- 12.14 Trimteck

- 12.15 Velan