PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846194

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846194

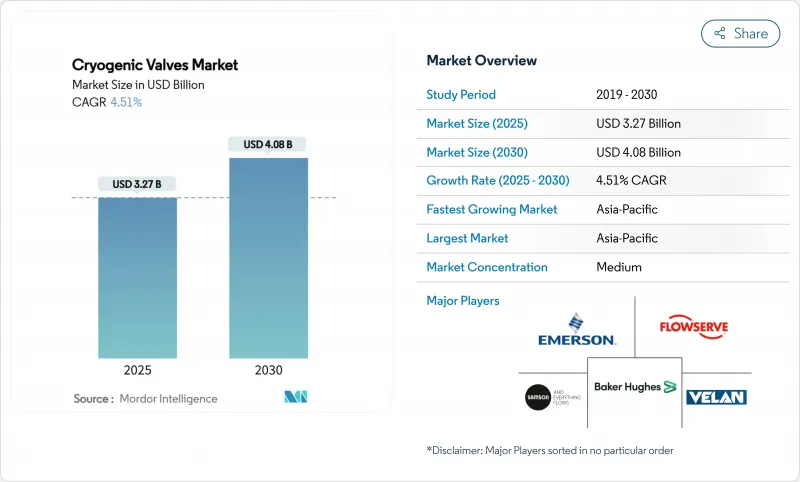

Cryogenic Valves - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Cryogenic Valves Market size is estimated at USD 3.27 billion in 2025, and is expected to reach USD 4.08 billion by 2030, at a CAGR of 4.51% during the forecast period (2025-2030).

Rising investment in liquefied natural gas (LNG) terminals, green-hydrogen projects, and petro-chemical expansions underpins this steady trajectory. Large-scale facilities each require hundreds of valves capable of sealing at temperatures below -150 °C, and owners favour suppliers able to certify products quickly for multiple codes. Asia-Pacific remains the largest regional buyer of equipment, while North America delivers high-value opportunities tied to hydrogen pilot plants. Producers able to combine cryogenic engineering depth with aftermarket services are attracting premium contract awards, as end-users seek long-term reliability and fast turn-round maintenance.

Global Cryogenic Valves Market Trends and Insights

Rising LNG Infrastructure Investments

Expansions slated between 2024-2028 will lift global LNG liquefaction capacity by 40%, with the United States overtaking Qatar as lead exporter while Asia-Pacific purchases the bulk of incremental cargoes. Baker Hughes secured USD 5.6 billion of LNG equipment awards for two Louisiana trains, illustrating contractor appetite for field-proven valve partners able to guarantee ultra-low-leak performance. Marine bunkering demand is forecast to exceed 16 million t annually by 2030, prompting ports to specify automated cryogenic transfer assemblies that integrate emergency shut-off valves. Enterprise Products Partners is expanding Houston Ship Channel refrigeration capacity by 300,000 bbl/d, creating new orders for triple-offset stop-valves rated down to -162 °C. Saudi Aramco's USD 7.7 billion Fadhili upgrade will add 1.3 Bcf/d of sweet-gas processing, each train fitted with redundant cryogenic flow-paths to handle mixed refrigerants.

Growth in Industrial Gas Demand

Air Liquide's four modular air-separation units in Texas will deliver 9,000 t/d of oxygen to ExxonMobil's low-carbon hydrogen complex and generate the continent's largest argon stream, placing long-cycle demand on valve makers able to certify for oxygen service. Healthcare expansion keeps liquid-oxygen consumption rising, and hospitals mandate valve designs that prevent particle shedding in patient circuits. Food processors favour liquid nitrogen tunnels for flash-freezing, with valves that tolerate rapid thermal cycling down to -196 °C while maintaining hygienic finishes. Renewable-powered air-separation plants require fast-response control trim so operators can throttle output to match fluctuating grid tariffs.

Safety & Compliance Complexities

ASME B31.3 mandates impact-tested materials below -425 °F; complying valves use austenitic stainless or aluminium alloys proven by Charpy testing. The 2025 ASME VIII update introduces fresh cryogenic case studies, prompting designers to add thicker bonnets or bellows seals to satisfy the new rules. MSS SP-158-2021 requires high-pressure gas tests that inflate development costs, yet utilities increasingly insist on the certification to reduce outage risk. U.S. Code 49 CFR obliges valves to hold tank test pressure without seepage and to include robust guards against mechanical damage, shaping layout choices on trailers. Five-year recertification cycles for safety valves generate recurring service revenue but raise ownership costs for small operators. Smaller fabricators struggle to keep pace with multi-jurisdiction code work, giving established brands a competitive edge.

Other drivers and restraints analyzed in the detailed report include:

- Hydrogen-Economy Project Pipeline Acceleration

- Capacity Additions in Petro-chem & Specialty Gas Plants

- Stainless-Steel & Nickel Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ball valves held a dominant 34.18% cryogenic valves market share in 2024, owing to proven tight shut-off and straightforward maintenance. Manufacturers supply extended-stem designs that isolate the seat from boiling liquefied gases, cutting ice buildup and seat damage. Emerson's Fisher HP series uses spring-energised PTFE rings to hold Class VI shut-off at -198 °C. Globe valves, though smaller in installed base, are expected to grow at 5.41% CAGR as hydrogen liquefaction projects favour their throttling precision. The cryogenic valves market size for globe valves is anticipated to widen notably in pilot plants producing 8-10 t/h of liquid hydrogen, each calling for variable-flow control to manage ortho-para conversion heat.

Technical enhancements continue across both lines. Ball-valve makers are adding graphite bonnet seals certified to ISO 15848-1 Class A for ultra-low fugitive emissions, an important factor for operators seeking ESG credits. Globe-valve OEMs are deploying contoured plugs that deliver equal-percentage characteristics, enhancing process stability in multi-stage expanders. Gate and check valves retain niche uses: gate valves accommodate full-bore LNG loading lines up to 42 in, while dual-plate cryogenic check valves prevent reverse surge in boil-off gas recirculation loops. Specialty butterfly and plug valves fill gaps such as helium service at ultra-low density where very low torque is essential.

Manual gear and hand-wheel operators represented 59.82% of the cryogenic valves market in 2024, prized for simplicity and intrinsic fail-safe capability during power loss. LNG export terminals rely on manual isolation valves to secure cargo lines during berth-side emergencies. The segment, however, grows slowly as facility owners look to remote operation to cut staffing. Pneumatic actuation will expand at 5.57% CAGR to 2030, leveraging plant air or nitrogen to deliver quick stroke times under fail-closed logic. Hydrogen sites favour pneumatic drives to avoid ignition risks linked to electric motors.

Electric actuators achieve niche uptake where data-rich position feedback is essential, such as in digitally managed nitrogen freezing tunnels that fine-tune flow to maintain product texture. Hybrid solutions that bolt a declutchable gearbox onto a pneumatic drive combine manual override with automated speed, capturing demand in dual-use installations. OEMs increasingly embed smart positioners measuring stem friction and cycle count, feeding plant historians that trigger service work orders before leakage occurs. This predictive-maintenance model strengthens aftermarket ties and lifts lifetime revenue per installed valve.

The Cryogenic Valves Market Report is Segmented by Product Type (Ball Valve, Gate Valve, Globe Valve, Check Valve, Other Product Types), Actuation (Manual, Pneumatic, Electric), Gas (Liquid Nitrogen, Liquid Natural Gas, and More), End-User Industry (Oil and Gas, Energy and Power, Chemicals, and More), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific controlled 26.55% of the cryogenic valves market in 2024 and is projected to expand by a 5.72% CAGR through 2030. China's gas-to-power policy reversal and India's heat-wave-driven demand are reviving import growth, while Japan and South Korea invest in re-loading hubs that reposition cargoes from the United States. Australia's ageing liquefaction trains enter refurbishment cycles, pushing aftermarket valve services. Government hydrogen roadmaps in China, South Korea and Australia create incremental bids for high-pressure globe valves at pilot liquefier sites.

North America benefits from the United States becoming the world's largest LNG exporter and from aggressive federal funding for hydrogen hubs. Gulf Coast brownfield liquefaction projects stipulate North American Valve Manufacturers Association membership, favouring domestic suppliers with local inventories. Air Liquide's Baytown investment plus multiple mid-scale liquid-oxygen build-owns maintain steady industrial-gas valve uptake. Canada's first LNG shipment slated for 2027 from British Columbia will add western-hemisphere demand.

Europe, despite softer LNG imports in 2024, commits heavily to hydrogen. Germany's planned 10 GW of electrolyser capacity links to liquefaction and underground storage schemes, each specifying ultra-low-leak isolation valves. Horizon Europe funds mobile LH2 tank trials between Spain and the Netherlands, generating specialty cargo-handling valve orders. Nordic ports accelerate LNG bunkering roll-outs supporting green-corridor shipping alliances.

The Middle East and Africa witness sizeable greenfield gas processing. Saudi Aramco's Fadhili expansion, Qatar's North Field South and multiple Omani petro-chem complexes need durable cryogenic metallurgy that resists sour-gas compounds. Abu Dhabi is exploring blue-ammonia, which will import design philosophies from LNG trains to valve packages. In Africa, Mozambique's postponed onshore LNG plant, once security stabilises, promises a fresh cycle of valve procurement.

South America remains nascent yet promising. Brazil eyes floating storage and regasification units to manage seasonal gas deficits, requiring compact cryogenic valve skids. Argentina's Vaca Muerta shale may eventually feed LNG export barge projects, though timetable uncertainty tempers near-term demand. Chile's mining sector investigates liquid oxygen for process efficiency, presenting small but high-margin valve prospects.

- BAC Valves

- Baker Hughes

- Bray International

- Burkert India Private Limited

- Cryofab Inc.

- Emerson Electric Co.

- Flowserve Corporation

- Habonim

- HEROSE GmbH

- L&T Valves Limited

- Meca-Inox

- Neway Valve

- OPW, A Dover Company

- Parker Hannifin Corp

- Powell Valves

- Samson AG

- Swagelok Company

- Velan

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising LNG infrastructure investments

- 4.2.2 Growth in industrial gas demand

- 4.2.3 Hydrogen-economy project pipeline acceleration

- 4.2.4 Capacity additions in petro-chem & specialty gas plants

- 4.2.5 Small-scale LNG bunkering at global ports

- 4.3 Market Restraints

- 4.3.1 Safety & compliance complexities

- 4.3.2 Stainless-steel & nickel price volatility

- 4.3.3 Supply-chain gaps in vacuum-brazed components

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Ball Valve

- 5.1.2 Gate Valve

- 5.1.3 Globe Valve

- 5.1.4 Check Valve

- 5.1.5 Other Product Types

- 5.2 By Actuation

- 5.2.1 Manual

- 5.2.2 Pneumatic

- 5.2.3 Electric

- 5.3 By Gas

- 5.3.1 Liquid Nitrogen

- 5.3.2 Liquid Natural Gas

- 5.3.3 Hydrogen

- 5.3.4 Oxygen

- 5.3.5 Other Gases

- 5.4 By End-user Industry

- 5.4.1 Oil and Gas

- 5.4.2 Energy and Power

- 5.4.3 Chemicals

- 5.4.4 Food and Beverage

- 5.4.5 Medical

- 5.4.6 Other End-user Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Italy

- 5.5.3.4 France

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration Analysis

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 BAC Valves

- 6.4.2 Baker Hughes

- 6.4.3 Bray International

- 6.4.4 Burkert India Private Limited

- 6.4.5 Cryofab Inc.

- 6.4.6 Emerson Electric Co.

- 6.4.7 Flowserve Corporation

- 6.4.8 Habonim

- 6.4.9 HEROSE GmbH

- 6.4.10 L&T Valves Limited

- 6.4.11 Meca-Inox

- 6.4.12 Neway Valve

- 6.4.13 OPW, A Dover Company

- 6.4.14 Parker Hannifin Corp

- 6.4.15 Powell Valves

- 6.4.16 Samson AG

- 6.4.17 Swagelok Company

- 6.4.18 Velan

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment