PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871131

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871131

Cryogenic Valve for Pharmaceutical Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

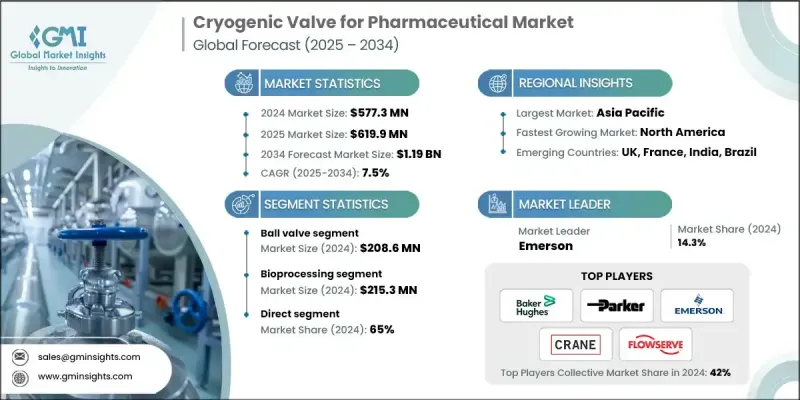

The Global Cryogenic Valve for Pharmaceutical Market was valued at USD 577.3 million in 2024 and is estimated to grow at a CAGR of 7.5% to reach USD 1.19 Billion by 2034.

Increasing demand for specialty gases such as liquid nitrogen, argon, and oxygen across pharmaceutical and biotechnology applications is driving market growth. These gases are essential in areas such as drug preservation, vaccine storage, and laboratory research, all of which require ultra-low temperature environments. Cryogenic valves are critical components that ensure precise control and secure transfer of these gases under sterile and high-pressure conditions. Their use supports compliance with international standards for leak prevention, material purity, and hygiene in pharmaceutical operations. As pharmaceutical companies increase the use of cryogenic systems to support biopharmaceutical manufacturing and cold-chain storage, demand for advanced cryogenic valves continues to expand. The rising production of temperature-sensitive medicines and biologics is creating new opportunities for valve manufacturers offering specialized solutions that meet strict safety and performance criteria. Overall, the integration of cryogenic technology into modern pharmaceutical operations is reinforcing the importance of efficient and high-quality cryogenic valves worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $577.3 Million |

| Forecast Value | $1.19 Billion |

| CAGR | 7.5% |

The diaphragm valves segment held 26.1% share in 2024, owing to their compact design, cost-effectiveness, and capability to withstand high-pressure and high-temperature applications. Their role has become even more significant as investment in water infrastructure has increased across the pharmaceutical sector, supporting processes such as water purification, treatment, and sterile system management. The growing application of diaphragm valves in such systems underscores their essential function in maintaining clean, controlled, and reliable operations within pharmaceutical production facilities.

The direct sales channel segment held a 65% share in 2024. Direct engagement between manufacturers and pharmaceutical companies ensures high-quality product supply and fosters stronger business relationships. By minimizing intermediaries, companies reduce overall procurement costs and provide efficient after-sales services, a key advantage in industries where equipment reliability and temperature control precision are vital. The direct approach also allows manufacturers to tailor solutions to client specifications, improving responsiveness to the growing needs of pharmaceutical applications that demand stringent performance and traceability.

United States Cryogenic Valve for Pharmaceutical Market held a 78.8% share in 2024, reflecting its strong pharmaceutical production base and substantial investments in research and development. Federal spending on pharmaceutical R&D exceeding USD 70 Billion has significantly contributed to technological advancement and innovation in cryogenic systems. The increasing requirement for reliable storage and transport of temperature-sensitive drugs has fueled the adoption of cryogenic valves across manufacturing and logistics networks. Furthermore, the Food and Drug Administration's continued emphasis on quality assurance and modernized biopharmaceutical infrastructure supports the widespread implementation of advanced cryogenic handling systems, positioning the U.S. as a major market hub.

Leading players in the Global Cryogenic Valve for Pharmaceutical Market include Flowserve, Baker Hughes, Velan, Parker Hannifin, Kitz, Swagelok, Herose, Powell Valves, Trimteck, Rego, PK Valve and Engineering, Crane Company, Bray International, Microfinish, and Emerson. Key strategies employed by companies in the Cryogenic Valve For Pharmaceutical Market focus on enhancing technological innovation, strategic collaborations, and global expansion. Major firms are prioritizing R&D investments to develop valves with improved sealing performance, sterilization compatibility, and durability under extreme temperatures. Many companies are forming partnerships with pharmaceutical manufacturers to co-develop customized cryogenic solutions that meet industry-specific standards. Expanding manufacturing capacities and strengthening local distribution networks in emerging markets are also vital steps to improve accessibility.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Valve type

- 2.2.3 Valve size

- 2.2.4 Application

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for specialty pharmaceuticals

- 3.2.1.2 Expansion of air separation units (ASUs)

- 3.2.1.3 Focus on operational safety and efficiency

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost of compliance and certification

- 3.2.2.2 Material compatibility issues

- 3.2.3 Opportunities

- 3.2.3.1 Emerging markets and biotech hubs

- 3.2.3.2 Automation and smart valve technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By Region

- 3.6.2 By Valve type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS code- 84818090)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Gap analysis

- 3.10 Risk assessment and mitigation

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Valve type, 2021-2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Ball valve

- 5.3 Diaphragm valves

- 5.4 Globe valve

- 5.5 Check valve

- 5.6 Others (relief, safety, solenoid valve etc.)

Chapter 6 Market Estimates & Forecast, By Valve size, 2021-2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Less than 1 inch

- 6.3 Between 1 to 4 inches

- 6.4 Between 4 to 8 inches

- 6.5 More than 8 inches

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Bioprocessing and biopharmaceutical

- 7.3 Vaccine storage and cold chain

- 7.4 Cell and gene therapy

- 7.5 Freeze drying

- 7.6 Others (medical gas, cryopreservation etc.)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct

- 8.3 Indirect

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Baker Hughes

- 10.2 Bray International

- 10.3 C.P. Valves (Hammer brand)

- 10.4 Crane Company

- 10.5 Cryofab, Inc.

- 10.6 Emerson

- 10.7 Flowserve

- 10.8 Herose

- 10.9 Kitz

- 10.10 Microfinish

- 10.11 Parker Hannifin

- 10.12 PK Valve and Engineering

- 10.13 Steriflow Valve

- 10.14 Swagelok

- 10.15 Velan