PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871115

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871115

China Specialty Medical Chairs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

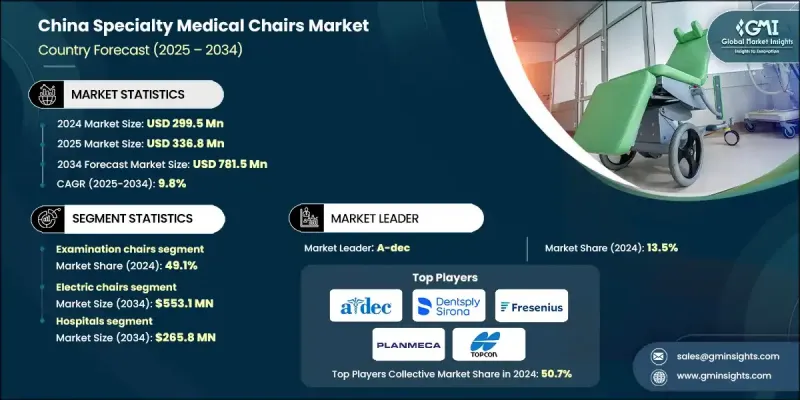

China Specialty Medical Chairs Market was valued at USD 299.5 million in 2024 and is estimated to grow at a CAGR of 9.8% to reach USD 781.5 million by 2034.

The growth of this market is closely tied to evolving healthcare demands and the push for greater clinical efficiency. Specialty medical chairs, including those used in dialysis and dental procedures, are widely used across hospitals, outpatient surgical centers, and specialized clinics. Increasing demand is being driven by the country's aging population, a rising incidence of chronic illnesses, and the growing need for rehabilitation and specialized treatment options. These conditions require high-performance, ergonomic seating solutions that support both patient comfort and procedural accuracy. The shift toward minimally invasive procedures and outpatient care is further pushing the need for versatile, multifunctional chairs. Simultaneously, China's investment in modernizing healthcare facilities and expanding hospital infrastructure is increasing the procurement of high-quality medical furniture. Government-backed initiatives and a focus on improving healthcare access in urban and semi-urban areas are further enhancing growth. Patient awareness regarding hygiene, posture, and treatment efficiency is also influencing healthcare providers to adopt advanced solutions that meet modern clinical standards.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $299.5 Million |

| Forecast Value | $781.5 Million |

| CAGR | 9.8% |

In 2024, the examination chairs segment held a 49.1% share. Their dominance is largely attributed to a growing number of diagnostic centers and specialty care facilities across both developed and developing regions. These chairs are available in various configurations, such as OB/GYN, dental, ophthalmic, dermatology, mammography, blood drawing, and dialysis chairs, among others. The demand for adjustable and ergonomically designed examination chairs is climbing as healthcare centers aim to improve patient positioning, workflow efficiency, and comfort during medical procedures.

The electric chairs segment held a 68.6% share in 2024 and is projected to reach USD 553.1 million by 2034. This segment continues to grow as electric models offer advanced functionality such as height adjustability, backrest tilting, and automated recline features. These features help clinicians ensure patient safety, achieve precise positioning, and streamline procedures. Widely used in rehab, dental, and dialysis units, electric chairs are favored for their precision, comfort, and convenience. Technological enhancements like programmable memory settings, remote-control operation, and integration with clinical systems are supporting their rising popularity among healthcare professionals.

The hospitals segment held a 35.4% share in 2024 and is anticipated to reach USD 265.8 million by 2034. Hospitals are increasingly investing in powered, ergonomic chairs due to growing patient volumes, complex treatment protocols, and chronic care demands. Modern hospital setups are now integrating advanced chair systems with smart features to enhance clinical output and patient care. Support from national healthcare reform and investments aimed at improving infrastructure across metro and semi-metro locations are further pushing adoption rates in this segment.

Prominent players in the China Specialty Medical Chairs Market include Dentsply Sirona, A-dec, Baxter, Tronwind Medical Chairs, PLANMECA, Zhangjiagang Medi Medical Equipment, OSSTEM, Fresenius Medical Care, TOPCON, and ATMOS MedizinTechnik. Companies competing in the China Specialty Medical Chairs Market are leveraging innovation, product customization, and strategic partnerships to expand their market footprint. Many are developing chairs with enhanced ergonomic features, automated adjustments, and digital integration to meet clinical performance demands and patient expectations. Key players are also focusing on expanding their product lines to address different specialties, including rehabilitation, dialysis, dental, and diagnostic care. Localized manufacturing and collaborations with healthcare providers are helping brands offer cost-effective solutions without compromising quality.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product trends

- 2.2.2 Type trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising specialty clinics number

- 3.2.1.2 Growing powered chairs adoption

- 3.2.1.3 Increasing geriatric patient base

- 3.2.1.4 Expanding ambulatory surgeries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High equipment costs

- 3.2.2.2 Limited insurance reimbursements

- 3.2.3 Market opportunities

- 3.2.3.1 Outpatient healthcare expansion

- 3.2.3.2 Homecare services growth

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Future market trends

- 3.5.1 Expansion in home healthcare and outpatient settings

- 3.5.2 Integration of smart and connected technologies

- 3.5.3 Rising demand for ergonomic and adaptive designs

- 3.6 Technology landscape

- 3.6.1 Current technological trends

- 3.6.1.1 Growth of portable and home-based specialty medical chairs

- 3.6.1.2 Digital health platforms enabling remote monitoring

- 3.6.1.3 Patient-friendly adjustable and automated specialty chairs

- 3.6.2 Emerging technologies

- 3.6.2.1 AI-powered usage analytics and predictive maintenance

- 3.6.2.2 Connected and IoT-enabled specialty medical chairs

- 3.6.2.3 Adaptive and smart chairs with personalized configurations

- 3.6.1 Current technological trends

- 3.7 Pricing analysis, 2024

- 3.8 Industry evolution

- 3.9 Value chain analysis

- 3.10 Customer experience transformation & journey optimization

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New service type launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Examination chairs

- 5.2.1 Dental

- 5.2.2 OB/GYN

- 5.2.3 Dialysis

- 5.2.4 Ophthalmic

- 5.2.5 Dermatology

- 5.2.6 Blood drawing

- 5.2.7 Mammography

- 5.2.8 Other examination chairs

- 5.3 Treatment chairs

- 5.3.1 Dental

- 5.3.2 Ophthalmic

- 5.3.3 ENT

- 5.3.4 Dermatology

- 5.3.5 Other treatment chairs

- 5.4 Rehabilitation chairs

- 5.4.1 Geriatric chairs

- 5.4.2 Pediatric chairs

- 5.4.3 Bariatric chairs

- 5.4.4 Other rehabilitation chairs

Chapter 6 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Electric chairs

- 6.3 Manual chairs

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Clinics

- 7.4 Ambulatory surgical centers (ASCs)

- 7.5 Infusion centers

- 7.6 Urgent care centers

- 7.7 Rehabilitation centers

- 7.8 Medical spas

- 7.9 Home care settings

- 7.10 Other end use

Chapter 8 Company Profiles

- 8.1 A-dec

- 8.2 ATMOSMedizinTechnik

- 8.3 Baxter

- 8.4 Dentsply Sirona

- 8.5 Fresenius Medical Care

- 8.6 OSSTEM

- 8.7 PLANMECA

- 8.8 TOPCON

- 8.9 Tronwind Medical Chairs

- 8.10 Zhangjiagang Medi Medical Equipment