PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871293

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871293

U.S. Specialty Medical Chairs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

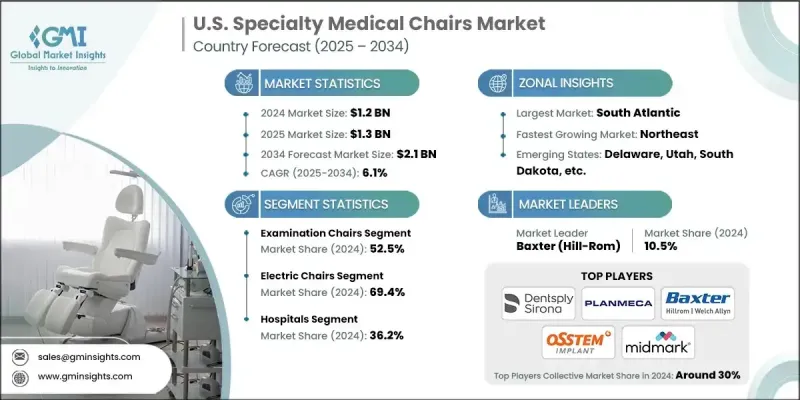

U.S. Specialty Medical Chairs Market was valued at USD 1.2 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 2.1 billion by 2034.

The market is evolving in response to changing healthcare needs, an aging population, and a growing emphasis on patient-centered care. Specialty chairs are engineered for precise clinical applications and are used across a variety of settings such as dialysis units, dental clinics, ophthalmology centers, mammography suites, dermatology clinics, and rehab facilities. These advanced medical seating systems combine ergonomic design with functional features to improve both clinician workflow and patient experience. The demand for technologically equipped, adjustable, and smart medical chairs is also rising with the advancement of outpatient services and remote diagnostics. One of the emerging trends contributing to this growth is the influence of medical tourism. Healthcare providers are upgrading clinical infrastructure to offer high comfort and better outcomes for international patients. This has resulted in greater investments in high-performance chairs in dental, surgical, and diagnostic facilities. In major U.S. hubs that attract medical travelers, providers are focusing on multi-purpose chair systems that support efficiency and enhance care quality during outpatient treatments. Specialty medical chairs are purpose-built seating systems tailored for various clinical requirements. These chairs are crafted with ergonomic precision and integrate features that accommodate the needs of patients undergoing specific therapies or managing health conditions that require specialized support.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $2.1 Billion |

| CAGR | 6.1% |

The dental examination chairs generated USD 239.7 million in 2024. The increasing prioritization of oral health and preventative care is driving the segment's expansion. Public awareness campaigns and school-based programs are motivating clinics to invest in examination chairs that focus on essential comfort, safety, and hygiene without the complexity of advanced treatment features.

The OB/GYN chairs segment generated USD 73.7 million in 2024 and is projected to hit USD 121.5 million by 2034. Higher adoption of women's health services and routine screenings is prompting clinics and hospitals to procure specialized chairs designed for gynecological assessments and procedures. These chairs not only provide enhanced comfort and privacy but also support better clinical efficiency and faster throughput in busy outpatient settings.

South Atlantic Specialty Medical Chairs Market held a 19.6% share in 2024. The growing number of chronic conditions, such as arthritis, cardiovascular disorders, and diabetes, has amplified the need for long-term care solutions, contributing to the rising demand for ergonomically designed, multi-functional medical chairs. Additionally, the recent surge in U.S. healthcare spending, particularly on outpatient and ambulatory surgical services, underlines the increasing focus on patient comfort and efficiency in treatment settings.

Prominent players operating in the U.S. Specialty Medical Chairs Market include TOPCON, FRESENIUS MEDICAL CARE, Dentsply Sirona, Hill Laboratories, MARCO, PLANMECA, ATMOS MedizinTechnik, CLINTON INDUSTRIES, Midmark, Lemi MD, OSSTEM, DENTALEZ, A-dec, Champion Healthcare Solutions, Baxter, and ActiveAid. Companies operating in the U. S Specialty Medical Chairs Market are leveraging innovation, strategic collaborations, and product diversification to strengthen their market presence. Leading manufacturers are focusing on the integration of smart features such as motorized adjustments, patient positioning memory, and digital connectivity for diagnostics. Firms are also aligning product development with ergonomic standards and infection control protocols to meet evolving clinical demands. To expand their reach, several players are entering partnerships with hospitals, ambulatory centers, and dental chains. Customization, modular designs, and patient-centric enhancements remain key strategies, along with investment in R&D to deliver chairs tailored for specific treatments. In parallel, regional expansion and responsive after-sales services are helping companies solidify their position across high-demand zones.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Zonal/states

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Zonal trends

- 2.2.2 Product trends

- 2.2.3 Type trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing number of specialty clinics, blood banks, and urgent care centers

- 3.2.1.2 Technological advancements and demand for powered chairs

- 3.2.1.3 Growing geriatric population and need for rehab procedures

- 3.2.1.4 Rising ambulatory surgical procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of specialized equipment

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of outpatient and home healthcare

- 3.2.3.2 Medical tourism growth

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Future market trends

- 3.5.1 Expansion in home healthcare and outpatient settings

- 3.5.2 Integration of smart and connected technologies

- 3.5.3 Rising demand for ergonomic and adaptive designs

- 3.6 Technology landscape

- 3.6.1 Current technological trends

- 3.6.1.1 Growth of portable and home-based specialty medical chairs

- 3.6.1.2 Digital health platforms enabling remote monitoring

- 3.6.1.3 Patient-friendly adjustable and automated specialty chairs

- 3.6.2 Emerging technologies

- 3.6.2.1 AI-powered usage analytics and predictive maintenance

- 3.6.2.2 Connected and IoT-enabled specialty medical chairs

- 3.6.2.3 Adaptive and smart chairs with personalized configurations

- 3.6.1 Current technological trends

- 3.7 Pricing analysis, 2024

- 3.8 Industry evolution

- 3.9 Value chain analysis

- 3.10 Customer experience transformation & journey optimization

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New service type launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Examination chairs

- 5.2.1 Dental

- 5.2.2 OB/GYN

- 5.2.3 Dialysis

- 5.2.4 Ophthalmic

- 5.2.5 Dermatology

- 5.2.6 Blood drawing

- 5.2.7 Mammography

- 5.2.8 Other examination chairs

- 5.3 Treatment chairs

- 5.3.1 Dental

- 5.3.2 Ophthalmic

- 5.3.3 ENT

- 5.3.4 Dermatology

- 5.3.5 Other treatment chairs

- 5.4 Rehabilitation chairs

- 5.4.1 Geriatric chairs

- 5.4.2 Pediatric chairs

- 5.4.3 Bariatric chairs

- 5.4.4 Other rehabilitation chairs

Chapter 6 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Electric chairs

- 6.3 Manual chairs

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Clinics

- 7.4 Ambulatory surgical centers (ASCs)

- 7.5 Infusion centers

- 7.6 Urgent care centers

- 7.7 Rehabilitation centers

- 7.8 Medical spas

- 7.9 Home care settings

- 7.10 Other end use

Chapter 8 Market Estimates and Forecast, By Zone, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 East North Central

- 8.2.1 Illinois

- 8.2.2 Indiana

- 8.2.3 Michigan

- 8.2.4 Ohio

- 8.2.5 Wisconsin

- 8.3 West South Central

- 8.3.1 Arkansas

- 8.3.2 Louisiana

- 8.3.3 Oklahoma

- 8.3.4 Texas

- 8.4 South Atlantic

- 8.4.1 Delaware

- 8.4.2 Florida

- 8.4.3 Georgia

- 8.4.4 Maryland

- 8.4.5 North Carolina

- 8.4.6 South Carolina

- 8.4.7 Virginia

- 8.4.8 West Virginia

- 8.4.9 Washington, D.C.

- 8.5 Northeast

- 8.5.1 Connecticut

- 8.5.2 Maine

- 8.5.3 Massachusetts

- 8.5.4 New Hampshire

- 8.5.5 Rhode Island

- 8.5.6 Vermont

- 8.5.7 New Jersey

- 8.5.8 New York

- 8.5.9 Pennsylvania

- 8.6 East South Central

- 8.6.1 Alabama

- 8.6.2 Kentucky

- 8.6.3 Mississippi

- 8.6.4 Tennessee

- 8.7 West North Central

- 8.7.1 Iowa

- 8.7.2 Kansas

- 8.7.3 Minnesota

- 8.7.4 Missouri

- 8.7.5 Nebraska

- 8.7.6 North Dakota

- 8.7.7 South Dakota

- 8.8 Pacific Central

- 8.8.1 Alaska

- 8.8.2 California

- 8.8.3 Hawaii

- 8.8.4 Oregon

- 8.8.5 Washington

- 8.9 Mountain States

- 8.9.1 Arizona

- 8.9.2 Colorado

- 8.9.3 Utah

- 8.9.4 Nevada

- 8.9.5 New Mexico

- 8.9.6 Idaho

- 8.9.7 Montana

- 8.9.8 Wyoming

Chapter 9 Company Profiles

- 9.1 ActiveAid

- 9.2 A-dec

- 9.3 ATMOS MedizinTechnik

- 9.4 Baxter

- 9.5 Champion Healthcare Solutions

- 9.6 CLINTON INDUSTRIES

- 9.7 DENTALEZ

- 9.8 Dentsply Sirona

- 9.9 FRESENIUS MEDICAL CARE

- 9.10 Hill Laboratories

- 9.11 Lemi MD

- 9.12 MARCO

- 9.13 Midmark

- 9.14 OSSTEM

- 9.15 PLANMECA

- 9.16 TOPCON