PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871241

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871241

North America Specialty Medical Chairs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

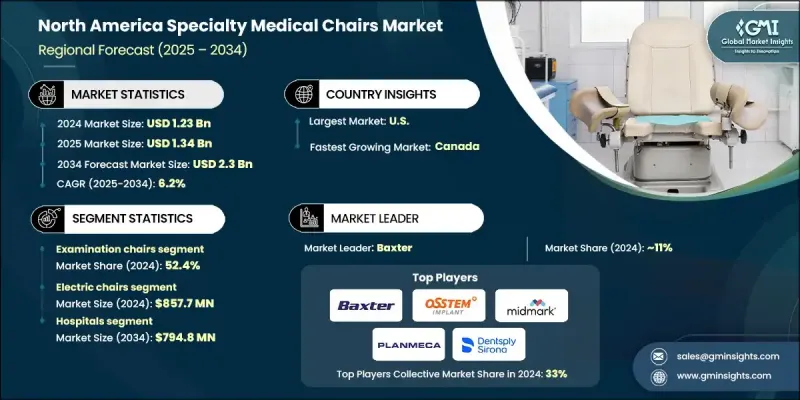

North America Specialty Medical Chairs Market was valued at USD 1.23 Billion in 2024 and is estimated to grow at a CAGR of 6.2% to reach USD 2.3 Billion by 2034.

Growth in this market is fueled by advancements in chair technology, the rising demand for outpatient and in-home care, supportive reimbursement frameworks, and heightened attention to patient safety and comfort. Specialty medical chairs are designed with ergonomic precision, ensuring support and adjustability during diagnostic and therapeutic procedures. These chairs allow for position modifications and customized features tailored to various clinical needs. Innovations, including electronic controls, pressure relief systems, and automated adjustments, have boosted their appeal across healthcare settings. Integration of connected technology, including IoT sensors and real-time feedback mechanisms, enhances compatibility with digital healthcare and telemedicine trends. These smart features allow caregivers to monitor patient posture, vitals, and seating habits more efficiently. Manufacturers are also prioritizing pressure ulcer prevention, postural support, and overall comfort, which is influencing adoption in both hospital and home care environments. Facilities such as hospitals and nursing homes are increasingly outfitting their interiors with ergonomic chairs that feature lumbar support and adjustable armrests to enhance patient care delivery.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.23 Billion |

| Forecast Value | $2.3 Billion |

| CAGR | 6.2% |

The electric specialty chairs segment generated USD 857.7 million in 2024 and is expected to register a CAGR of 6.5% through 2034. These chairs allow for motorized modifications in height, tilt, and reclining angle, improving patient positioning and access during examinations and treatments. Their design reduces physical stress for those with limited mobility or chronic health issues, making them a practical choice across healthcare facilities, outpatient clinics, and long-term care environments.

The hospitals segment held a 36.1% share in 2024 and is anticipated to reach USD 794.8 million by 2034. Hospitals are increasingly opting for modular electric chairs featuring programmable settings and smart capabilities. These features align with evolving clinical workflows by supporting versatile medical procedures and optimizing patient management. Integrated systems allow seamless adaptation to multiple specialties, driving higher operational efficiency.

U.S. Specialty Medical Chairs Market generated USD 1.2 Billion in 2024 and is expected to grow at a CAGR of 6.1% from 2025 to 2034. The growing elderly population, many of whom require rehabilitation, extended care, or regular clinical visits, continues to push demand for medical chairs that prioritize mobility assistance, ergonomic design, and long-term comfort. Healthcare facilities are steadily modernizing their infrastructure to meet the mobility and comfort needs of this aging demographic.

Leading companies in North America Specialty Medical Chairs Market include Lemi MD, Hill Laboratories, A-dec, FRESENIUS MEDICAL CARE, MARCO, ATMOS MedizinTechnik, Dentsply Sirona, TOPCON, OSSTEM, ActiveAid, PLANMECA, CLINTON INDUSTRIES, Champion Healthcare Solutions, Midmark, Baxter, and DENTALEZ. Companies in the North America Specialty Medical Chairs Market are focused on product innovation, smart technology integration, and ergonomic design improvements to gain a competitive edge. Many are investing in R&D to develop chairs that are compatible with digital health systems, offering features such as IoT connectivity, real-time vitals monitoring, and programmable positioning. Partnerships with healthcare facilities and home care providers are also helping expand their distribution reach. Several manufacturers are introducing customizable solutions to address the needs of various specialties, from dental to dialysis.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional

- 1.3.2 Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Type trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing number of specialty clinics, blood banks, and urgent care centers

- 3.2.1.2 Technological advancements and demand for powered chairs

- 3.2.1.3 Growing geriatric population and need for rehab procedures

- 3.2.1.4 Rising ambulatory surgical procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of specialized equipment

- 3.2.2.2 Limited reimbursement policies

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of outpatient and home healthcare

- 3.2.3.2 Medical tourism growth

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Canada

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Pricing analysis, 2024

- 3.7 Industry evolution

- 3.8 Future market trends

- 3.9 Value chain analysis

- 3.10 Customer experience transformation & journey optimization

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

- 3.13 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Examination chairs

- 5.2.1 Dental

- 5.2.2 OB/GYN

- 5.2.3 Dialysis

- 5.2.4 Ophthalmic

- 5.2.5 Dermatology

- 5.2.6 Blood drawing

- 5.2.7 Mammography

- 5.2.8 Other examination chairs

- 5.3 Treatment chairs

- 5.3.1 Dental

- 5.3.2 Ophthalmic

- 5.3.3 ENT

- 5.3.4 Dermatology

- 5.3.5 Other treatment chairs

- 5.4 Rehabilitation chairs

- 5.4.1 Geriatric chairs

- 5.4.2 Pediatric chairs

- 5.4.3 Bariatric chairs

- 5.4.4 Other rehabilitation chairs

Chapter 6 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Electric chairs

- 6.3 Manual chairs

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Clinics

- 7.4 Ambulatory surgical centers (ASCs)

- 7.5 Infusion centers

- 7.6 Urgent care centers

- 7.7 Rehabilitation centers

- 7.8 Medical spas

- 7.9 Home care settings

- 7.10 Other end use

Chapter 8 Market Estimates and Forecast, By Country, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 U.S.

- 8.3 Canada

Chapter 9 Company Profiles

- 9.1 ActiveAid

- 9.2 A-dec

- 9.3 ATMOS MedizinTechnik

- 9.4 Baxter

- 9.5 Champion Healthcare Solutions

- 9.6 CLINTON INDUSTRIES

- 9.7 DENTALEZ

- 9.8 Dentsply Sirona

- 9.9 FRESENIUS MEDICAL CARE

- 9.10 Hill Laboratories

- 9.11 Lemi MD

- 9.12 MARCO

- 9.13 Midmark

- 9.14 OSSTEM

- 9.15 PLANMECA

- 9.16 TOPCON