PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871138

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871138

Ultrasonic Food Processing Technology Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

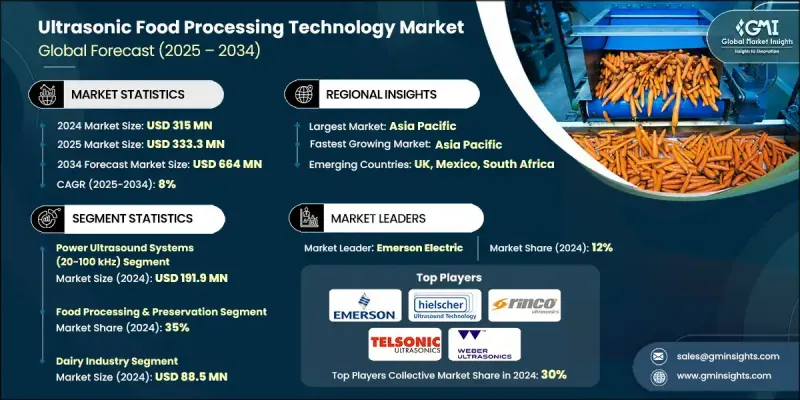

The Global Ultrasonic Food Processing Technology Market was valued at USD 315 million in 2024 and is estimated to grow at a CAGR of 8% to reach USD 664 million by 2034.

The growing popularity of non-thermal processing methods is reshaping food manufacturing trends, as consumers prioritize food safety, nutrition, and shelf life without compromising on quality. Technologies such as ultrasonic processing, high-pressure treatment, and pulsed electric fields are becoming more widely accepted due to their ability to maintain sensory and nutritional properties while meeting regulatory safety standards. With rising consumer concerns over contamination and the demand for traceable and hygienically processed food, manufacturers are investing in innovative processing systems that meet strict global safety guidelines. In response to evolving export standards and consumer expectations, producers are increasingly turning to ultrasonic technology to improve productivity and ensure compliance. These systems help meet the industry's growing need for clean-label products, enhanced processing efficiency, and sustainable production practices. The integration of ultrasonic equipment into broader food tech ecosystems is also streamlining operations across production lines, especially in regions with advanced food manufacturing infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $315 Million |

| Forecast Value | $664 Million |

| CAGR | 8% |

The power ultrasound systems operating within the 20-100 kHz range segment generated USD 191.9 million in 2024. These systems play a critical role in boosting mass transfer operations such as emulsification, homogenization, and extraction. By leveraging cavitation effects, ultrasonic systems facilitate the release of valuable bioactive compounds, nutrients, and flavors, making them highly effective in processing plant- and animal-based materials. Their benefits are especially notable in producing high-yield emulsified products, where consistency and quality are key.

The food processing and preservation segment held 35% share in 2024. This segment is expanding rapidly as manufacturers prioritize techniques that preserve nutritional integrity and maintain desirable sensory attributes in food products. As consumer demand shifts toward minimally processed, functionally rich foods, methods like ultrasonic treatment, freeze-drying, and vacuum packaging are gaining ground. These techniques are instrumental in extending shelf life while retaining the functional value of ingredients.

U.S. Ultrasonic Food Processing Technology Market held 75.6% share and generated USD 83.8 million in 2024. This leadership position stems from a strong emphasis on food innovation, digital transformation, and compliance with food safety mandates. As North America continues to embrace automation and digitized tracking solutions, demand for advanced processing technologies is rising across both large-scale and mid-tier food production facilities. The region's focus on clean-label product development and longer shelf stability is pushing manufacturers toward non-thermal methods for enhanced competitiveness.

Key players operating in the Global Ultrasonic Food Processing Technology Market include Dukane, Telsonic, FoodTools, Cavitus, Emerson Electric, Herrmann Ultrasonics, Weber Ultrasonics, Hielscher Ultrasonics, AERZEN, Marchant Schmidt, Ultrasonic Power, MS Ultrasonic Technology Group, Innovative Ultrasonics, RINCO ULTRASONICS, Sonimat, and Sonics & Materials. To strengthen their position in the Ultrasonic Food Processing Technology Market, leading companies are focusing on developing application-specific ultrasonic systems tailored to different food product categories. Many are expanding global distribution networks, net manufacturers and strategic partnerships with OEMs and food manufacturers and investing in automation integration for seamless plant operations. Emphasis is also placed on advancing cavitation control and power efficiency to maximize yield and consistency.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology type

- 2.2.3 Application

- 2.2.4 End use industry

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for non-thermal processing

- 3.2.1.2 Food safety & hygiene requirements

- 3.2.1.3 Growth in plant-based & functional foods

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Scalability issues

- 3.2.3 Opportunities

- 3.2.3.1 Integration with automation & smart manufacturing

- 3.2.3.2 Expansion into plant-based and functional foods

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By technology type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Technology Type, 2021 - 2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Power ultrasound systems (20-100 khz)

- 5.3 Sonochemistry systems (100 khz-1 mhz)

- 5.4 Diagnostic ultrasound systems (1-10 mhz)

- 5.5 Hybrid ultrasonic systems

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Food processing & preservation

- 6.3 Extraction & separation

- 6.4 Homogenization & emulsification

- 6.5 Cutting & sealing

- 6.6 Cleaning & sanitization

- 6.7 Quality control & analysis

Chapter 7 Market Estimates and Forecast, By End use Industry, 2021 - 2034 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Dairy industry

- 7.3 Meat & seafood processing

- 7.4 Beverage industry

- 7.5 Bakery & confectionery

- 7.6 Packaging industry

- 7.7 Food ingredients & additives

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Cavitus

- 9.2 Dukane

- 9.3 Emerson Electric

- 9.4 FoodTools

- 9.5 Herrmann Ultrasonics

- 9.6 Hielscher Ultrasonics

- 9.7 Innovative Ultrasonics

- 9.8 Marchant Schmidt

- 9.9 MS Ultrasonic Technology Group

- 9.10 RINCO ULTRASONICS

- 9.11 Sonics & Materials

- 9.12 Sonimat

- 9.13 Telsonic

- 9.14 Ultrasonic Power

- 9.15 Weber Ultrasonics