PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885801

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885801

Meat by-product Protein Hydrolysates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

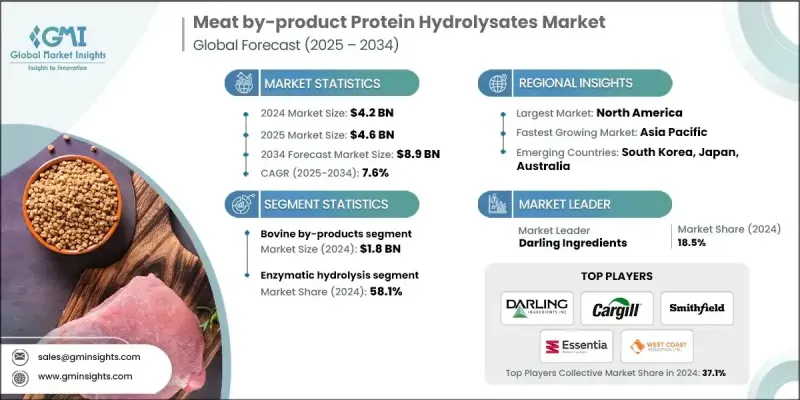

The Global Meat by-product Protein Hydrolysates Market was valued at USD 4.2 billion in 2024 and is estimated to grow at a CAGR of 7.6% to reach USD 8.9 billion by 2034.

These hydrolysates are bioactive peptides derived from the enzymatic breakdown of animal by-products such as bones, feathers, and offal. Their exceptional digestibility, high bioavailability, and functional benefits in animal nutrition are driving their adoption as an alternative to traditional protein sources. Rising demand for sustainable protein solutions is further boosting the market, as governments worldwide promote waste reduction and resource efficiency. Transforming meat by-products into protein hydrolysates not only reduces waste but also offers a cost-effective, high-quality feed additive, aligning with global sustainability goals. Regulatory incentives, particularly in regions like Europe, are focused on optimizing waste usage, directly supporting market expansion. Increasing attention to animal health and nutrition in the growing pet food and livestock feed sectors continues to fuel demand. North America currently dominates the market due to advanced manufacturing infrastructure, robust regulatory support, and high adoption rates, while the Asia-Pacific region is the fastest-growing market, driven by rising meat consumption, urbanization, and a growing focus on sustainable animal nutrition.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.2 Billion |

| Forecast Value | $8.9 Billion |

| CAGR | 7.6% |

In 2024, the bovine by-products generated USD 1.8 billion, maintaining a dominant position in the market. These sources are abundant and protein-rich, offering a cost-effective and reliable raw material for producing meat by-product protein hydrolysates. Their nutritional profile supports growth and immune health, making them popular in animal feed and aquaculture applications. Advances in extraction and hydrolysis techniques have simplified processing from bovine sources, further strengthening their market position.

The enzymatic hydrolysis segment accounted for a 58.1% share in 2024. This method is preferred because it produces high-quality, bioavailable protein hydrolysates with targeted functional properties. Enzymes selectively break down proteins into fractions with enhanced digestibility and bioactivity while minimizing chemical residues, making the process safer and more environmentally friendly. As a result, enzymatic hydrolysis is highly valued in formulating natural and organic animal feed products.

North America Meat by-product Protein Hydrolysates Market is expected to grow at a CAGR of 7.7% between 2025 and 2034. Demand is rising for feed ingredients that promote environmental conservation and sustainable farming practices. Awareness among consumers is increasing, and industry players are emphasizing responsible animal husbandry. Natural, biodegradable, and sustainable protein hydrolysates are gaining popularity. Technological innovations, including enzymatic hydrolysis, fermentation, and biotechnology advancements, are enhancing product quality and safety while reducing production costs.

Key players in the Global Meat by-product Protein Hydrolysates Market include Titan Biotech, West Coast Reduction Ltd, Cargill, Hormel Foods Corporation, Essentia Protein Solutions, Smithfield Foods Inc, Novonesis, National Beef Packing Company, Sanimax, and Darling Ingredients. Companies in the Meat by-product Protein Hydrolysates Market are adopting strategies to strengthen their market presence through technological innovation, expanding production capacities, and investing in R&D to improve hydrolysate quality. Strategic partnerships and mergers allow them to extend distribution networks and reach emerging markets. Focused efforts on sustainability, such as utilizing waste products and developing environmentally friendly processing methods, enhance brand credibility.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Source trends

- 2.2.2 Process trends

- 2.2.3 Application trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for sustainable protein sources

- 3.2.1.2 Circular economy implementation in food processing

- 3.2.1.3 Growing pet food & animal feed industries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Quality standardization challenges

- 3.2.2.2 Supply chain disruption vulnerabilities

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with alternative protein value chains

- 3.2.3.2 Emerging bioactive peptide applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By source

- 3.9 Future market trends

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Source, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Bovine by-products

- 5.3 Porcine by-products

- 5.4 Poultry by-products

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Process, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Enzymatic hydrolysis

- 6.3 Chemical hydrolysis

- 6.4 Microbial fermentation

Chapter 7 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food & beverage

- 7.2.1 Flavor enhancers

- 7.2.2 Protein fortifiers

- 7.2.3 Others

- 7.3 Animal feed

- 7.3.1 Pet food

- 7.3.2 Livestock feed

- 7.3.3 Others

- 7.4 Clinical nutrition

- 7.5 Sports nutrition

- 7.6 Infant nutrition

- 7.7 Dietary supplements

- 7.8 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Cargill

- 9.2 Darling Ingredients

- 9.3 Essentia Protein Solutions

- 9.4 Hormel Foods Corporation

- 9.5 National Beef Packing Company

- 9.6 Novonesis

- 9.7 Sanimax

- 9.8 Smithfield Foods Inc

- 9.9 Titan Biotech

- 9.10 West Coast Reduction Ltd