PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871185

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871185

Enzymatic Food Processing Solutions Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

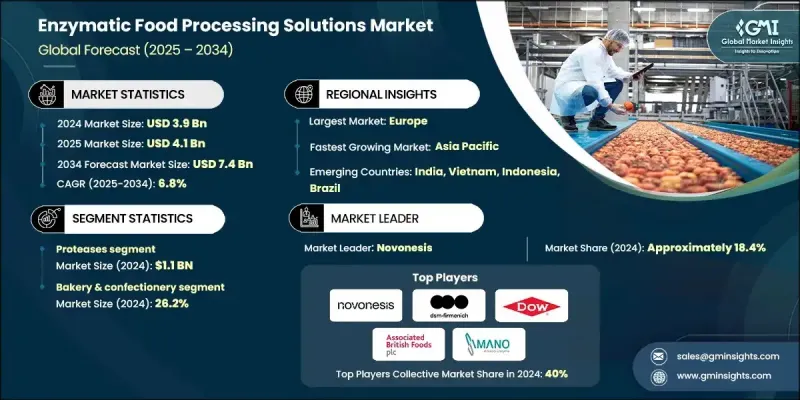

The Global Enzymatic Food Processing Solutions Market was valued at USD 3.9 Billion in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 7.4 Billion by 2034.

The market is experiencing robust growth as enzymes play an increasingly central role in enhancing processing efficiency, product quality, and sustainability across multiple food categories, including dairy, starch and sweeteners, bakery, beverages, plant-based proteins, and oils and fats. These solutions have evolved from serving basic functional roles to becoming integrated platforms that align with digital processing environments. Growth is further supported by rising consumer demand for clean-label products, favorable regulatory frameworks promoting natural processing aids, and the expanding use of precision fermentation technologies. Manufacturers are also leveraging enzyme systems for cost reduction, shelf life extension, and process optimization, making these solutions a key differentiator across industrial food lines.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.9 Billion |

| Forecast Value | $7.4 Billion |

| CAGR | 6.8% |

Growth in this sector is fueled by the commercialization of both standardized enzyme concentrates and high-value, customized blends that deliver targeted performance benefits. These include ingredients like proteases designed to improve texture in plant protein applications and baking amylases used for large-scale production. Advanced formulations, often supported by enzyme activity optimization and thermostability, allow producers to achieve higher yields and product consistency. Suppliers are particularly focused on markets with price-sensitive buyers by offering multi-functional blends that replace synthetic additives without increasing input costs. Regulatory positioning of enzymes as processing aids enables seamless reformulation in clean-label foods, especially within tightly regulated markets.

The niche categories, such as transglutaminases, catalases, and glucose oxidases, collectively held a 15.3% share in 2024 and will grow at a CAGR of 7.2% through 2034. These specialized enzymes deliver customized solutions for complex processes and are increasingly co-developed with clients to achieve optimal dosing precision, reduced batch variability, and enhanced operational control. These blends offer premium value due to their specialized functionality and formulation versatility.

The beverages segment held 14.1% share in 2024, driven by demand for pectinase-based solutions that improve yield, product clarity, and processing time across categories like fruit juices, brewing, and wine production. In parallel, the growing segment of plant-based proteins continues to adopt proteases and carbohydrases to overcome common texture and solubility issues, ultimately creating more appealing end products. Despite low overall input cost, enzymatic solutions consistently deliver measurable efficiency gains and product enhancements in high-volume manufacturing, making them increasingly indispensable.

US Enzymatic Food Processing Solutions Market generated USD 948.7 million in 2024 and is projected to grow at a CAGR of 6.7%, hitting USD 1.8 Billion by 2034. Growth in the US is supported by strong clean label trends, advanced research and development capabilities, and widespread automation across food sectors like bakery, dairy, and beverages. The market is witnessing increased adoption of complex enzyme systems, particularly multi-enzyme blends, to improve product consistency, softness, and shelf stability. AI-driven formulation techniques are also gaining ground across starch and bakery operations, enhancing precision and performance predictability.

Key companies shaping the Enzymatic Food Processing Solutions Market include Codexis Inc., Biocatalysts Ltd, and Chr. Hansen Holding A/S, Kerry Group PLC, DSM-Firmenich, Novonesis, Dow, Amano Enzyme Inc., Deerland Probiotics & Enzymes, and Advanced Enzyme Technologies Ltd. Companies in the enzymatic food processing solutions market are focusing on custom enzyme formulation, advanced fermentation techniques, and digital process integration to enhance product performance. Leaders are strengthening R&D investments to develop thermostable and multi-functional enzymes suitable for modern processing environments. Strategic partnerships with food manufacturers help tailor enzyme solutions to meet exact production needs. Firms are also leveraging AI-driven modeling to optimize dosage, reduce processing variability, and boost yield efficiency.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 enzyme type

- 2.2.3 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By enzyme type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries Note: the trade statistics will be provided for key countries only)

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Enzyme Type, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Proteases

- 5.2.1 Serine proteases (subtilisin, chymotrypsin)

- 5.2.2 Aspartic proteases (pepsin, rennet/chymosin)

- 5.2.3 Cysteine proteases (papain, bromelain, ficin)

- 5.2.4 Metalloproteases (neutral proteases)

- 5.3 Amylases

- 5.3.1 Α-amylases (endo-acting, liquefaction)

- 5.3.2 Β-amylases (exo-acting, saccharification)

- 5.3.3 Glucoamylases (glucose production)

- 5.3.4 Pullulanases (debranching enzymes)

- 5.4 Lipases

- 5.4.1 Animal lipases

- 5.4.2 Microbial lipases

- 5.4.3 Phospholipases

- 5.5 Carbohydrases

- 5.5.1 Pectinases

- 5.5.2 Cellulases & hemicellulases

- 5.5.3 Lactases (β-galactosidase)

- 5.6 Specialized enzymes

- 5.6.1 Transglutaminases

- 5.6.2 Glucose isomerases

- 5.6.3 Catalases & glucose oxidases

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Bakery & confectionery

- 6.2.1 Dough conditioning applications

- 6.2.2 Anti-staling solutions

- 6.2.3 Gluten modification technologies

- 6.3 Dairy processing

- 6.3.1 Cheese production applications

- 6.3.2 Lactose reduction technologies

- 6.3.3 Protein modification solutions

- 6.4 Beverage production

- 6.4.1 Brewing applications

- 6.4.2 Juice processing solutions

- 6.4.3 Wine making technologies

- 6.5 Meat & seafood processing

- 6.5.1 Tenderization applications

- 6.5.2 Protein binding solutions

- 6.5.3 Yield enhancement technologies

- 6.6 Starch & sweetener production

- 6.6.1 Starch liquefaction processes

- 6.6.2 Saccharification technologies

- 6.6.3 Isomerization applications

- 6.7 Plant-based & alternative proteins

- 6.7.1 Protein functionality enhancement

- 6.7.2 Texture modification solutions

- 6.7.3 Digestibility improvement technologies

- 6.8 Oil & fat processing

- 6.8.1 Interesterification applications

- 6.8.2 Degumming processes

- 6.8.3 Flavor development solutions

- 6.9 Others

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.5.4 Rest of Latin America

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

- 7.6.4 Rest of Middle East and Africa

Chapter 8 Company Profiles

- 8.1 Advanced Enzyme Technologies Ltd

- 8.2 Amano Enzyme Inc.

- 8.3 Aralez Bio

- 8.4 Associated British Foods Plc

- 8.5 Biocatalysts Ltd

- 8.6 Cascade Biocatalysts Inc.

- 8.7 Chr. Hansen Holding A/S

- 8.8 Codexis Inc.

- 8.9 Creative Enzymes

- 8.10 Deerland Probiotics & Enzymes

- 8.11 DSM-Firmenich

- 8.12 Dow

- 8.13 Dyadic International Inc.

- 8.14 Enzyme Development Corporation

- 8.15 Enzyme Research Laboratories Inc.

- 8.16 Jiangsu Boli Bioproducts Co., Ltd

- 8.17 Kerry Group PLC

- 8.18 Novonesis

- 8.19 Solugen Inc.

- 8.20 Specialty Enzymes & Probiotics