PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871157

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871157

U.S. Gaucher Disease Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

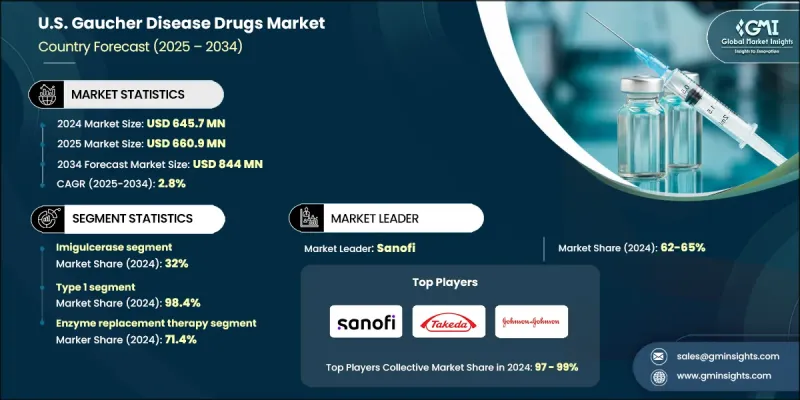

U.S. Gaucher Disease Drugs Market was valued at USD 645.7 million in 2024 and is estimated to grow at a CAGR of 2.8% to reach USD 844 million by 2034.

Market growth is supported by rising awareness of rare genetic disorders, improved diagnostic capabilities, and greater access to both enzyme replacement and substrate reduction therapies. Gaucher disease, a lysosomal storage disorder caused by a deficiency of the enzyme glucocerebrosidase, has seen major therapeutic advancements in recent years. The U.S. market continues to expand as precision treatments address the root enzymatic defect rather than only managing symptoms. Enzyme replacement therapies remain widely adopted for their effectiveness in restoring enzyme function, while oral substrate reduction treatments are increasingly preferred by patients seeking non-infusion alternatives. The broader adoption of patient-specific therapies and ongoing innovation in biologics and small molecules are shaping a more personalized approach to Gaucher disease management. Combined with growing support programs, improved reimbursement pathways, and clinical awareness, these factors are expected to sustain consistent market expansion across the forecast period.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $645.7 Million |

| Forecast Value | $844 Million |

| CAGR | 2.8% |

Gaucher disease treatments are designed to counteract the enzyme deficiency responsible for the condition. They either supplement the missing glucocerebrosidase enzyme or reduce the accumulation of harmful lipids in organs. Enzyme replacement therapies such as imiglucerase, velaglucerase alfa, and taliglucerase alfa restore enzyme functionality to prevent symptom progression, while substrate reduction therapies like miglustat and eliglustat minimize the production of fatty substances contributing to disease complications. Physicians tailor therapy selection based on disease type and severity, aiming to maintain organ function and enhance patient quality of life through long-term symptom management.

The imiglucerase segment held a 32% share in 2024. This recombinant enzyme replacement therapy effectively compensates for the enzyme deficiency in Gaucher disease, allowing for the breakdown of glucocerebroside within cells. The treatment has been proven to alleviate the physical manifestations of the disease, improve hematologic parameters, and reduce organ enlargement, positioning it as one of the most established treatment options for this disorder.

The type 1 Gaucher disease segment held a 98.4% share in 2024. As the most common and commercially significant subtype, Type 1 Gaucher disease involves systemic symptoms such as enlarged liver and spleen, bone complications, and blood abnormalities. Unlike other subtypes, Type 1 does not affect the nervous system, making it more responsive to current therapeutic approaches. Its higher prevalence, especially among genetically predisposed populations, has supported early detection efforts and strong treatment uptake, further reinforcing its dominance within the overall market.

The hospital pharmacy channel segment held 79.1% share in 2024 and is expected to reach USD 674.5 million by 2034. Hospital pharmacies play a critical role in administering Gaucher disease treatments, particularly enzyme replacement therapies that require professional supervision and precise dosing. Their specialized infrastructure ensures the safe preparation and infusion of biologics, supporting adherence and continuity of care. The ongoing expansion of hospital-based infusion centers and specialized pharmacy services is improving patient outcomes and treatment accessibility nationwide.

Major players participating in the U.S. Gaucher Disease Drugs Market include Sanofi, Pfizer Inc., Takeda Pharmaceutical Company Limited, Protalix BioTherapeutics, Prevail Therapeutics, ANI Pharmaceuticals, Navinta LLC, Generium, and Johnson & Johnson. Key companies in the U.S. Gaucher Disease Drugs Market are reinforcing their market position through innovation, partnerships, and expanded patient access initiatives. Firms are prioritizing R&D investments to develop next-generation enzyme replacement and oral substrate reduction therapies with improved efficacy and reduced side effects. Strategic alliances with biotechnology companies and academic institutions are being pursued to accelerate product pipelines and leverage gene therapy technologies. Companies are also focusing on patient assistance programs, flexible pricing strategies, and enhanced distribution networks to increase affordability and adherence. Furthermore, efforts to gain regulatory approvals for novel formulations and explore new indications are strengthening their competitive edge in the growing rare disease treatment landscape.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Drug type trends

- 2.2.2 Disease type trends

- 2.2.3 Therapy type trends

- 2.2.4 Distribution channel trends

- 2.2.5 Country trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising diagnosis rates and disease awareness

- 3.2.1.2 Strong investment in R&D and innovation

- 3.2.1.3 Supportive policy environment for rare diseases

- 3.2.1.4 Advanced healthcare infrastructure and personalized medicine

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of therapies

- 3.2.2.2 Presence of stringent regulatory approval procedures

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging market expansion and local manufacturing

- 3.2.3.2 Substrate reduction therapy adoption

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.1.1 Improved clinical biomarkers

- 3.5.1.2 Gene therapy approaches

- 3.5.1.3 AI-guided drug discovery platforms

- 3.5.2 Emerging technologies

- 3.5.2.1 Multi-omics integration for personalized therapy

- 3.5.2.2 Quantum computing for drug design optimization

- 3.5.1 Current technological trends

- 3.6 Patent analysis

- 3.7 Future market trends

- 3.8 Pipeline analysis

- 3.9 Pricing analysis, 2024

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Drug Type, 2021 - 2034 ($ Mn & Units)

- 5.1 Key trends

- 5.2 Imiglucerase

- 5.3 Velaglucerase alfa

- 5.4 Taliglucerase alfa

- 5.5 Eliglustat

- 5.6 Miglustat

Chapter 6 Market Estimates and Forecast, By Disease Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Type 1

- 6.3 Type 3

Chapter 7 Market Estimates and Forecast, By Therapy Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Enzyme replacement therapy

- 7.3 Substrate replacement therapy

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacy

- 8.3 Retail pharmacy

- 8.4 Online pharmacy

Chapter 9 Company Profiles

- 9.1 ANI Pharmaceuticals, Inc.

- 9.2 Generium

- 9.3 Johnson & Johnson

- 9.4 Navinta, LLC

- 9.5 Pfizer Inc.

- 9.6 Prevail Therapeutics

- 9.7 Protalix BioTherapeutics, Inc.

- 9.8 Sanofi

- 9.9 Takeda Pharmaceutical Company Limited