PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871317

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871317

Gaucher Disease Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

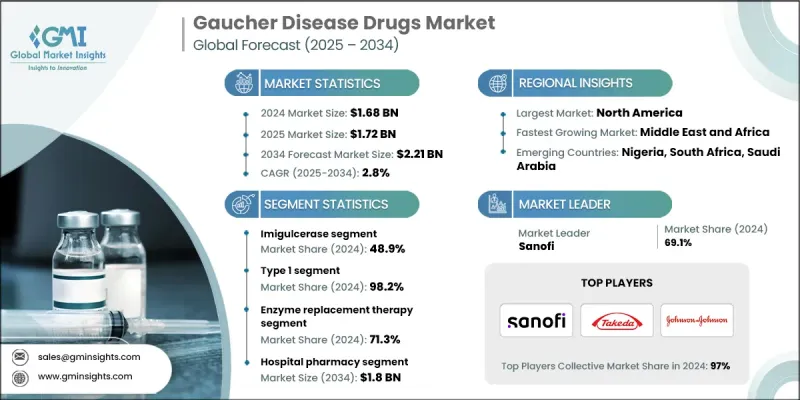

The Gaucher Disease Drugs Market was valued at USD 1.68 billion in 2024 and is estimated to grow at a CAGR of 2.8% to reach USD 2.21 billion by 2034.

The market is steadily expanding as awareness of rare genetic disorders rises, diagnostic techniques improve, and access to enzyme replacement and substrate reduction therapies broadens. Gaucher disease, a lysosomal storage disorder caused by glucocerebrosidase deficiency, has seen significant therapeutic breakthroughs over the past decade. Targeted treatments are reshaping patient care by addressing the underlying enzyme deficiency, improving quality of life, and managing disease symptoms. Leading pharmaceutical companies such as Takeda Pharmaceutical Company Limited, Johnson & Johnson, and Sanofi are driving innovation through continuous research and development, strategic collaborations, and rare disease-focused platforms. Regional variations influence treatment focus, with certain subtypes more prevalent in Asia Pacific, while North America and Europe are dominated by Type 1 cases, highlighting the importance of region-specific therapy availability and access to both enzyme replacement therapies (ERTs) and substrate reduction therapies (SRTs).

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.68 Billion |

| Forecast Value | $2.21 Billion |

| CAGR | 2.8% |

The Imiglucerase segment held a share of 48.9% in 2024. This recombinant enzyme replacement therapy compensates for glucocerebrosidase deficiency, aiding the breakdown of accumulated glucocerebroside and alleviating disease manifestations. Its widespread adoption is supported by strong clinical efficacy, proven long-term safety, and broad regulatory approval, establishing it as a trusted treatment among healthcare providers and patients.

Type 1 Gaucher disease (GD1) segment held a 98.2% share in 2024. GD1, the most common subtype, is characterized by systemic symptoms without neurological involvement, making it more responsive to existing therapies and a central focus for drug development and commercialization efforts globally.

U.S. Gaucher Disease Drugs Market was valued at USD 645.7 million in 2024. The country's advanced healthcare infrastructure, widespread clinical adoption, and emphasis on personalized medicine support early diagnosis and long-term management of Gaucher disease. Enzyme replacement therapies like imiglucerase and velaglucerase alfa, along with increasing use of oral substrate reduction therapies such as eliglustat, dominate treatment practices in the region.

Key players in the Global Gaucher Disease Drugs Market include ANI Pharmaceuticals, Inc., Pfizer Inc., Takeda Pharmaceutical Company Limited, Johnson & Johnson, Protalix BioTherapeutics, Inc., Navinta, LLC, Dipharma SA, Prevail Therapeutics, ISU ABXIS, Generium, and Sanofi. Companies in the Gaucher Disease Drugs Market are strengthening their presence by investing heavily in R&D for next-generation therapies and rare disease platforms. They pursue strategic partnerships and collaborations to expand global access and regulatory approvals. Market leaders focus on patient-centric approaches, including tailored therapies for different subtypes and regions. They also enhance visibility through education programs for healthcare providers and patient communities. Continuous innovation, targeted marketing strategies, and expansion into emerging markets help companies maintain a competitive edge, while regulatory compliance and intellectual property protections further consolidate their market foothold.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Drug type trends

- 2.2.3 Disease type trends

- 2.2.4 Therapy type trends

- 2.2.5 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of Gaucher disease

- 3.2.1.2 Growing investments for developing Gaucher disease therapies

- 3.2.1.3 Increasing awareness towards timely diagnosis and treatment

- 3.2.1.4 Rising government support for rare disease therapies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of therapies

- 3.2.2.2 Presence of stringent regulatory approval procedures

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging market expansion and local manufacturing

- 3.2.3.2 Substrate reduction therapy adoption

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.1.1 Improved clinical biomarkers

- 3.5.1.2 Gene therapy approaches

- 3.5.1.3 AI- guided drug discovery platforms

- 3.5.2 Emerging technologies

- 3.5.2.1 Multi-omics integration for personalized therapy

- 3.5.2.2 Quantum computing for drug design optimization

- 3.5.1 Current technological trends

- 3.6 Patent analysis

- 3.7 Future market trends

- 3.8 Pipeline analysis

- 3.9 Pricing analysis, 2024

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Drug Type, 2021 - 2034 ($ Mn & Units)

- 5.1 Key trends

- 5.2 Imiglucerase

- 5.3 Velaglucerase alfa

- 5.4 Taliglucerase alfa

- 5.5 Eliglustat

- 5.6 Miglustat

Chapter 6 Market Estimates and Forecast, By Disease Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Type 1

- 6.3 Type 3

Chapter 7 Market Estimates and Forecast, By Therapy Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Enzyme replacement therapy

- 7.3 Substrate replacement therapy

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacy

- 8.3 Retail pharmacy

- 8.4 Online pharmacy

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Chile

- 9.5.5 Colombia

- 9.5.6 Peru

- 9.5.7 Ecuador

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Egypt

- 9.6.5 Nigeria

- 9.6.6 Israel

- 9.6.7 Iran

Chapter 10 Company Profiles

- 10.1 ANI Pharmaceuticals, Inc.

- 10.2 Dipharma SA

- 10.3 Generium

- 10.4 ISU ABXIS

- 10.5 Johnson & Johnson

- 10.6 Navinta, LLC

- 10.7 Pfizer Inc.

- 10.8 Prevail Therapeutics

- 10.9 Protalix BioTherapeutics, Inc.

- 10.10 Sanofi

- 10.11 Takeda Pharmaceutical Company Limited