PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871165

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871165

Germany Computational Biology Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

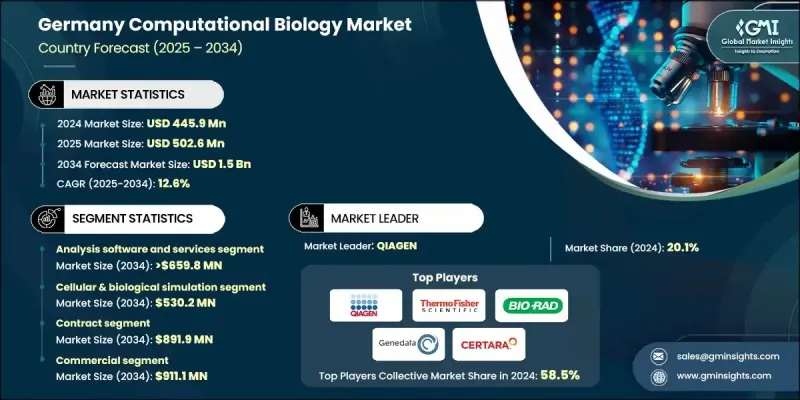

Germany Computational Biology Market was valued at USD 445.9 million in 2024 and is estimated to grow at a CAGR of 12.6% to reach USD 1.5 Billion by 2034.

Market growth reflects the rising demand for advanced computational tools across the healthcare and life sciences sectors. Increasing implementation of artificial intelligence in drug development, along with advancements in genomics and precision medicine, continues to drive demand. The market is evolving rapidly, providing cutting-edge platforms that help pharmaceutical firms, payers, technology providers, and healthcare institutions streamline regulatory processes, boost patient outcomes, and enhance research operations. Sophisticated data analysis tools, bioinformatics software, predictive modeling applications, and cloud-based computing are widely adopted to support data-driven decision-making, personalized healthcare, and optimized R&D workflows. The growing burden of chronic illnesses, genetic diseases, and cancer has amplified the demand for computational biology solutions in Germany. These technologies are pivotal in early diagnosis, biomarker identification, and novel therapeutic development. Ongoing government initiatives and funding for innovative healthcare tech and genomics research also add momentum, while cloud integration and digital transformation help healthcare providers improve compliance, scalability, and efficiency across research and clinical operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $445.9 Million |

| Forecast Value | $1.5 Billion |

| CAGR | 12.6% |

The analysis software and services segment held a 43.4% share in 2024, propelled by strong demand for predictive modeling, bioinformatics, and AI-powered platforms. These tools are becoming essential in genomics and proteomics as they provide researchers and clinicians with the ability to process and interpret large-scale biological data in real time. With the rising emphasis on customized therapies and precision healthcare, platforms capable of visualizing and analyzing complex data are being rapidly adopted. This segment's growth is further supported by the integration of machine learning algorithms that enhance the accuracy and reliability of scientific outputs, thereby reducing trial timelines and boosting innovation in clinical and laboratory settings.

In 2024, the cellular and biological simulation segment accounted for a 35.8% share and is projected to generate USD 530.2 million through 2034. Growing interest in simulating molecular and cellular interactions has led to wider adoption of modeling software that can accurately predict biological responses. These tools enable researchers to simulate genetic interactions, metabolic pathways, and intricate cellular behaviors, which reduces the dependency on costly laboratory experiments and accelerates scientific discoveries. The use of AI, multi-scale modeling, and high-performance computing has significantly elevated the accuracy and usability of these simulations, making them indispensable tools for drug developers and biologists aiming to optimize experimental outcomes.

The commercial segment held a 61% share in 2024 and is forecasted to reach USD 911.1 million by 2034. Companies within the pharmaceutical, biotechnology, and healthcare technology industries are increasingly investing in computational platforms to speed up drug development, reduce R&D expenses, and meet stringent regulatory standards. Demand for intelligent data processing, AI-enabled drug screening, and streamlined clinical trial operations is accelerating commercial adoption. By incorporating predictive analytics and machine learning models into their workflows, these organizations are enhancing operational efficiency, achieving faster time-to-market, and delivering innovative therapies more cost-effectively.

Key players shaping the Germany Computational Biology Market include Thermo Fisher Scientific, Schrodinger, BIO-RAD, QIAGEN, Certara, Dassault Systemes, Genedata (Danaher), and Cadence. To solidify their positioning, companies in Germany's computational biology sector are actively pursuing several core strategies. Many are focusing on integrating AI and machine learning into their existing platforms to improve data interpretation and streamline drug discovery workflows. Partnerships and collaborations with biotech firms and academic institutions are also expanding, enabling technology sharing and research advancement. Strategic acquisitions have become common as firms seek to broaden their solution portfolios and tap into niche markets.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Tool trends

- 2.2.2 Application trends

- 2.2.3 Services trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Adoption of AI and machine learning

- 3.2.1.2 Rising demand for personalized medicine

- 3.2.1.3 Expansion of genomics research

- 3.2.1.4 Increasing clinical trial activities using computational designs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of computational biology tools

- 3.2.2.2 Lack of skilled professional

- 3.2.3 Market opportunities

- 3.2.3.1 Growth of precision medicine initiatives

- 3.2.3.2 Real-time wearable data integration platforms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.1.1 AI-driven drug discovery and predictive modeling platforms

- 3.5.1.2 High-throughput sequencing and multi-omics analysis

- 3.5.1.3 Cloud-based bioinformatics and data storage solutions

- 3.5.2 Emerging technologies

- 3.5.2.1 Machine learning algorithms for personalized medicine and biomarker discovery

- 3.5.2.2 Real-time wearable data integration for clinical research

- 3.5.2.3 Quantum computing applications in computational biology simulations

- 3.5.1 Current technological trends

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New service type launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Tool, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Analysis software and services

- 5.3 Databases

- 5.4 Hardware

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Cellular & biological simulation

- 6.2.1 Computational genomics

- 6.2.2 Computational proteomics

- 6.2.3 Pharmacogenomics

- 6.2.4 Other simulations

- 6.3 Drug discovery & disease modelling

- 6.3.1 Target identification

- 6.3.2 Target validation

- 6.3.3 Lead discovery

- 6.3.4 Lead optimization

- 6.4 Preclinical drug development

- 6.4.1 Pharmacokinetics

- 6.4.2 Pharmacodynamics

- 6.5 Clinical trials

- 6.5.1 Phase I

- 6.5.2 Phase II

- 6.5.3 Phase III

- 6.5.4 Phase IV

- 6.6 Human body simulation software

Chapter 7 Market Estimates and Forecast, By Services, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Contract

- 7.3 In-house

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Commercial

- 8.3 Academics & research

Chapter 9 Company Profiles

- 9.1 BIO-RAD

- 9.2 cadence

- 9.3 Certara

- 9.4 Dassault Systemes

- 9.5 Genedata (Danaher)

- 9.6 QIAGEN

- 9.7 Schrodinger

- 9.8 Thermo Fisher Scientific