PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871191

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871191

U.S. Computational Biology Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

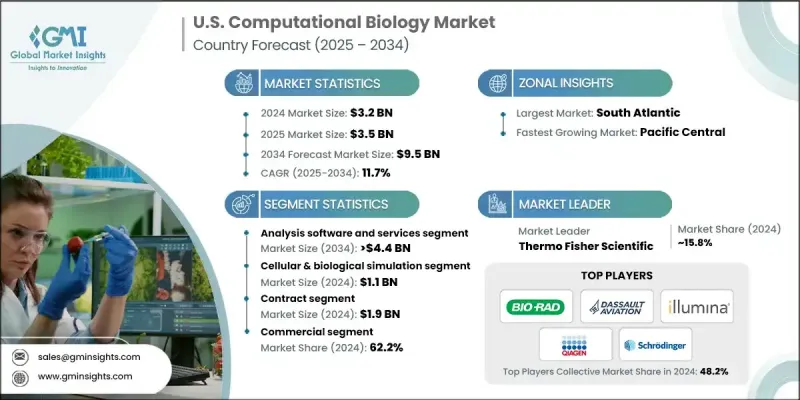

U.S. Computational Biology Market was valued at USD 3.2 Billion in 2024 and is estimated to grow at a CAGR of 11.7% to reach USD 9.5 Billion by 2034.

The strong growth of this market is driven by continuous advancements in artificial intelligence and machine learning applications within healthcare, expanding genomics and proteomics research, increasing focus on drug discovery and development, and the rising adoption of personalized and precision medicine. Computational biology combines computing technologies, mathematical modeling, and statistical methods to interpret complex biological information and generate meaningful insights. It plays an essential role in studying biological systems such as genomes, proteins, and cellular networks, enabling scientists to uncover intricate molecular interactions and biological pathways. The discipline merges biology, computer science, and quantitative analytics to accelerate biomedical innovation and research outcomes. As omics technologies continue to generate vast amounts of biological data, the reliance on computational biology tools and platforms is growing rapidly. Researchers are increasingly using bioinformatics algorithms and analytical frameworks to interpret large-scale datasets, identify disease markers, and accelerate drug target validation. This expanding data complexity is expected to propel sustained market growth in the coming decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.2 Billion |

| Forecast Value | $9.5 Billion |

| CAGR | 11.7% |

The databases segment generated USD 1.1 Billion in 2024 and is projected to grow at a CAGR of 12% from 2025 to 2034. This growth stems from the rapid generation of genomic, proteomic, and multi-omics datasets that require efficient systems for secure storage, integration, and management. The increasing need for centralized, easily accessible, and interoperable repositories is crucial for supporting life science research, enabling smooth data sharing across institutions, and fostering collaborative development among biotechnology and pharmaceutical firms. As a result, the growing focus on standardized and scalable data management systems is strengthening the role of database solutions within computational biology.

The drug discovery and disease modeling segment is forecasted to grow at a CAGR of 12.1% through 2034. The segment's expansion is largely attributed to the use of integrated multi-omics data for identifying new therapeutic targets and understanding the underlying mechanisms of diseases. Incorporating artificial intelligence and machine learning enhances predictive precision, enabling researchers to model disease progression and accelerate the discovery of potential drug candidates more efficiently. This approach supports the broader shift toward data-driven, hypothesis-based research in pharmaceutical innovation.

South Atlantic Computational Biology Market held a 20.8% share in 2024. This region's dominance can be attributed to the strong presence of research universities, advanced hospitals, and biotechnology centers located across states such as Maryland, Georgia, and North Carolina. The concentration of academic research institutions and clinical centers in the area has led to significant demand for computational biology platforms in genomics, proteomics, and drug development. Additionally, the presence of leading biotech and pharmaceutical organizations has contributed to greater investment in computational infrastructure, fostering innovation in biological simulation, predictive modeling, and large-scale data analysis.

Major companies operating in the U.S. Computational Biology Market include Strand, GINKGO, QIAGEN, BIO-RAD, Illumina, Benevolent, DNAnexus, Compugen, Schrodinger, Instem, Thermo Fisher Scientific, Deep Genomics, Genedata (Danaher), Dassault Systemes, and Certara. Leading players in the U.S. Computational Biology Market are strengthening their competitive edge through advanced technology integration, strategic collaborations, and investments in digital infrastructure. Many firms are focusing on AI- and ML-driven platforms to enhance modeling accuracy and predictive analysis in drug discovery. Partnerships with biotechnology firms, academic research institutes, and healthcare organizations enable knowledge exchange and innovation acceleration. Companies are also emphasizing product portfolio diversification by offering scalable bioinformatics tools, cloud-based data management systems, and simulation software tailored for pharmaceutical R&D.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Zone/state

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Zonal trends

- 2.2.2 Tool trends

- 2.2.3 Application trends

- 2.2.4 Services trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Ongoing advancements in bioinformatics and data science

- 3.2.1.2 Increasing clinical trial activities using computational designs

- 3.2.1.3 Rising drug development costs & timeline pressures

- 3.2.1.4 Favorable government policies

- 3.2.1.5 Rising volume of omics data & bioinformatics research

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Disintegration and mismanagement of data

- 3.2.2.2 Data privacy & security compliance

- 3.2.3 Market opportunities

- 3.2.3.1 Regulatory-ready AI validation solutions

- 3.2.3.2 Real-time wearable data integration platforms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Investment landscape

- 3.8 Disruptive technology impact assessment

- 3.9 Deployment model outlook

- 3.10 Workforce development requirements

- 3.11 Risk assessment & mitigation strategies

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

- 3.14 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Tool, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Analysis software and services

- 5.3 Databases

- 5.4 Hardware

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Cellular & biological simulation

- 6.2.1 Computational genomics

- 6.2.2 Computational proteomics

- 6.2.3 Pharmacogenomics

- 6.2.4 Other simulations

- 6.3 Drug discovery & disease modelling

- 6.3.1 Target identification

- 6.3.2 Target validation

- 6.3.3 Lead discovery

- 6.3.4 Lead optimization

- 6.4 Preclinical drug development

- 6.4.1 Pharmacokinetics

- 6.4.2 Pharmacodynamics

- 6.5 Clinical trials

- 6.5.1 Phase I

- 6.5.2 Phase II

- 6.5.3 Phase III

- 6.5.4 Phase IV

- 6.6 Human body simulation software

Chapter 7 Market Estimates and Forecast, By Services, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Contract

- 7.3 In-house

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Commercial

- 8.3 Academics & research

Chapter 9 Market Estimates and Forecast, By Zone, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 East North Central

- 9.3 West South Central

- 9.4 South Atlantic

- 9.5 Northeast

- 9.6 East South Central

- 9.7 West North Centra

- 9.8 Pacific Central

- 9.9 Mountain States

Chapter 10 Company Profiles

- 10.1 Benevolent

- 10.2 BIO-RAD

- 10.3 CERTARA

- 10.4 compugen

- 10.5 DASSAULT SYSTEMES

- 10.6 deep genomics

- 10.7 DNAnexus

- 10.8 Genedata (Danaher)

- 10.9 GINKGO

- 10.10 Illumina

- 10.11 instem

- 10.12 QIAGEN

- 10.13 Schrodinger

- 10.14 strand

- 10.15 Thermo Fisher Scientific