PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871220

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871220

Computational Biology Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

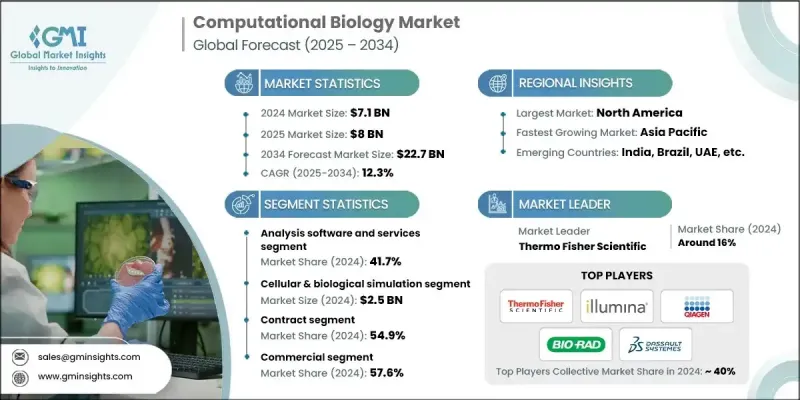

The Global Computational Biology Market was valued at USD 7.1 Billion in 2024 and is estimated to grow at a CAGR of 12.3% to reach USD 22.7 Billion by 2034.

The growing integration of computational models in clinical research, the rising cost and complexity of drug development, and ongoing advancements in bioinformatics and artificial intelligence are fueling this growth. Increasing omics data volume, supportive government policies, and expanding applications of AI-driven analytics are accelerating the adoption of computational biology solutions. Traditional drug discovery remains time-intensive and costly, often taking over a decade, which has pushed pharmaceutical companies to embrace computational tools that streamline R&D, reduce experimental failures, and identify promising therapeutic candidates early in the process. These technologies support biological simulations, drug-target interaction modeling, and data-driven insights from omics research, significantly cutting down laboratory time and improving clinical trial outcomes. The mounting pressure on the pharmaceutical industry to develop effective therapies faster and at a lower cost continues to propel the computational biology landscape forward. Moreover, its growing influence on clinical trial design, patient stratification, and biomarker discovery is transforming the way therapies are developed and validated.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.1 Billion |

| Forecast Value | $22.7 Billion |

| CAGR | 12.3% |

The analysis software and services segment held a 41.7% share in 2024. The demand for these solutions is surging due to the rapid expansion of omics data, the growing necessity for complex modeling platforms, and the increasing dependence on AI-enabled insights across drug discovery and precision medicine. With the continuous rise in omics-based research, the adoption of advanced analytical and modeling tools is accelerating, enabling faster and more precise biological interpretations that are vital for pharmaceutical R&D, clinical testing, and tailored treatment development.

The preclinical drug development segment was valued at USD 1.1 Billion in 2024 and is witnessing consistent utilization of computational biology to simulate pharmacokinetic, pharmacodynamic, and toxicity characteristics of drug candidates before human testing. These tools can anticipate a drug's behavior in biological systems, helping minimize the use of animal models in preclinical studies and improving the likelihood of progressing to clinical trials successfully.

United States Computational Biology Market reached USD 3.2 Billion in 2024. The country's strong focus on accelerating drug development through the adoption of cutting-edge computational methods continues to drive market expansion. The U.S. remains a dominant force due to its robust biotechnology ecosystem, advanced research capabilities, and strong collaboration between government, academia, and the private sector. Major technology and pharmaceutical players are heavily investing in AI-led drug discovery, genomics, and precision medicine.

Leading companies operating within the Global Computational Biology Market include BIO-RAD, Schrodinger, Thermo Fisher SCIENTIFIC, DNAnexus, Illumina, Dassault SYSTEMES, Compugen, QIAGEN, GINKGO, Instem, FIos GENOMICS, Strand, Aganitha, BenevolentAI, Deep Genomics, Certara, Cadence, BIODIGITAL, Atomwise, and Genedata (Danaher). To strengthen their foothold, companies in the Computational Biology Market are focusing on product innovation, AI integration, and strategic partnerships. Many are investing in R&D to enhance simulation accuracy, expand omics data analytics capabilities, and improve the interoperability of bioinformatics platforms. Collaborations between biotech firms, academic institutions, and software developers are fostering the development of robust computational models tailored for drug discovery and personalized medicine. Firms are also pursuing mergers and acquisitions to broaden their technology portfolios and geographic presence.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Tool trends

- 2.2.3 Application trends

- 2.2.4 Services trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Ongoing advancements in bioinformatics and data science

- 3.2.1.2 Increasing clinical trial activities using computational designs

- 3.2.1.3 Rising drug development costs & timeline pressures

- 3.2.1.4 Favorable government policies

- 3.2.1.5 Rising volume of omics data & bioinformatics research

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Disintegration and mismanagement of data

- 3.2.2.2 Data privacy & security compliance

- 3.2.2.3 Lack of skilled professional

- 3.2.3 Opportunities

- 3.2.3.1 Regulatory-ready AI validation solutions

- 3.2.3.2 Real-time wearable data integration platforms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Investment landscape

- 3.7 Disruptive technology impact assessment

- 3.8 Deployment model outlook

- 3.9 Workforce development requirements

- 3.10 Risk assessment & mitigation strategies

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

- 3.13 Gap analysis

- 3.14 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Key developments

- 4.7.1 Mergers & acquisitions

- 4.7.2 Partnerships & collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Tool, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Analysis software and services

- 5.3 Databases

- 5.4 Hardware

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Cellular & biological simulation

- 6.2.1 Computational genomics

- 6.2.2 Computational proteomics

- 6.2.3 Pharmacogenomics

- 6.2.4 Other simulations

- 6.3 Drug discovery & disease modelling

- 6.3.1 Target identification

- 6.3.2 Target validation

- 6.3.3 Lead discovery

- 6.3.4 Lead optimization

- 6.4 Preclinical drug development

- 6.4.1 Pharmacokinetics

- 6.4.2 Pharmacodynamics

- 6.5 Clinical trials

- 6.5.1 Phase I

- 6.5.2 Phase II

- 6.5.3 Phase III

- 6.5.4 Phase IV

- 6.6 Human body simulation software

Chapter 7 Market Estimates and Forecast, By Services, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Contract

- 7.3 In-house

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Commercial

- 8.3 Academics & research

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 aganitha

- 10.2 Atomwise

- 10.3 Benevolent AI

- 10.4 BIODIGITAL

- 10.5 BIO-RAD

- 10.6 cadence

- 10.7 CERTARA

- 10.8 compugen

- 10.9 DASSAULT SYSTEMES

- 10.10 deep genomics

- 10.11 DNAnexus

- 10.12 fios GENOMICS

- 10.13 Genedata (Danaher)

- 10.14 GINKGO

- 10.15 Illumina

- 10.16 instem

- 10.17 QIAGEN

- 10.18 Schrodinger

- 10.19 strand

- 10.20 Thermo Fisher SCIENTIFIC