PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871215

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871215

Oncology Biopharmaceuticals Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

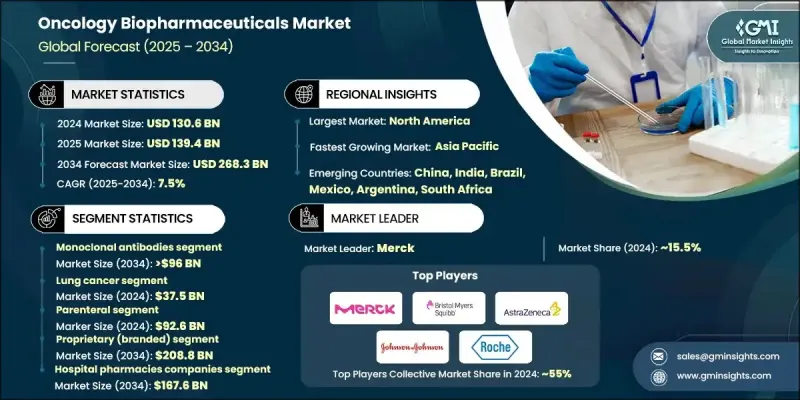

The Global Oncology Biopharmaceuticals Market was valued at USD 130.6 Billion in 2024 and is estimated to grow at a CAGR of 7.5% to reach USD 268.3 Billion by 2034.

The market is witnessing a transformative phase driven by the growing worldwide incidence of cancer and the rising need for personalized and targeted treatment solutions. Continuous breakthroughs in next-generation sequencing, immunotherapy, and AI-powered drug development are reshaping how cancer is treated and detected. Over the past year, new treatment innovations and improved access to advanced biologics have redefined therapeutic standards for both hematologic and solid tumors. Precision oncology technologies are enhancing early diagnosis and individualizing treatments to improve patient survival. Market expansion is supported by favorable government programs, higher healthcare investments, and evolving regulatory pathways. The oncology biopharmaceuticals sector continues to lead the shift toward precision medicine by customizing therapies according to each patient's molecular profile. The industry's growth is further supported by advancements in biologics, immunotherapies, and the increasing adoption of precision-based medical practices to address the urgent need for more effective cancer management worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $130.6 Billion |

| Forecast Value | $268.3 Billion |

| CAGR | 7.5% |

The monoclonal antibodies segment held a 37.6% share in 2024 and is anticipated to reach USD 96 Billion by 2034, growing at a CAGR of 7%. Monoclonal antibodies remain a cornerstone of contemporary oncology, as they are highly specific biologic agents that bind to unique antigens expressed on cancer cells. These targeted therapies work by directly attacking tumor cells, interrupting tumor growth signaling, and stimulating immune activity to eliminate cancerous tissues. Compared to conventional chemotherapy, monoclonal antibodies offer a more favorable safety profile, minimizing off-target effects and enhancing treatment precision.

The lung cancer application segment generated USD 37.5 Billion in 2024. Lung cancer remains the most fatal cancer type globally, with non-small cell lung cancer (NSCLC) accounting for nearly 85% of all cases. The market has experienced a major transformation due to the growing availability of precision-based and immuno-oncology treatments. Modern therapeutic advancements focused on specific genetic and molecular targets have significantly improved patient outcomes and treatment success rates.

U.S. Oncology Biopharmaceuticals Market reached USD 51.9 Billion in 2024. Technological progress in artificial intelligence is revolutionizing cancer diagnostics and accelerating the development of next-generation oncology drugs. However, unequal access to these advanced treatments remains a persistent challenge, particularly among underrepresented groups. The U.S. continues to make strides in advancing biosimilars and personalized therapies, with strong investments aimed at improving affordability and enhancing patient access to cell-based and immune therapies.

Key participants in the Oncology Biopharmaceuticals Market include AbbVie, Amgen, AstraZeneca, Bayer, Biogen, Bristol-Myers Squibb, Eli Lilly, F. Hoffmann-La Roche, GlaxoSmithKline, Johnson & Johnson, Merck, Novartis, Pfizer, Sanofi, Takeda Pharmaceutical, Sandoz, Biocon, Celltrion, Adaptimmune, Legend Biotech, and Arcellx. To reinforce their position in the Global Oncology Biopharmaceuticals Market, major companies are focusing on strategic collaborations, mergers, and acquisitions to broaden their oncology pipelines and accelerate drug development. Firms are expanding their research partnerships with biotech innovators to co-develop targeted biologics and immunotherapies. Investment in advanced technologies such as AI, genomics, and molecular profiling is being prioritized to strengthen precision medicine capabilities. Companies are also working toward regulatory alignment to speed up product approvals and expand geographic reach.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Cancer type trends

- 2.2.4 Route of administration trends

- 2.2.5 Drug type trends

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global cancer incidence and aging population

- 3.2.1.2 Advancements in immunotherapy and targeted biologics

- 3.2.1.3 Expansion of biomarker-driven and precision oncology

- 3.2.1.4 Increasing regulatory support for accelerated approvals

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of biologics and limited affordability in low-income regions

- 3.2.2.2 Complex manufacturing and supply chain logistics

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of tumor-agnostic and pan-cancer therapies

- 3.2.3.2 Increased adoption of digital health and remote monitoring tools

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pipeline analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Bn)

- 5.1 Key trends

- 5.2 Monoclonal antibodies

- 5.3 Immune checkpoint inhibitors

- 5.4 Cell and gene therapies

- 5.5 Antibody-drug conjugates (ADCs)

- 5.6 Cancer vaccines

- 5.7 Other product types

Chapter 6 Market Estimates and Forecast, By Cancer Type, 2021 - 2034 ($ Bn)

- 6.1 Key trends

- 6.2 Lung cancer

- 6.3 Breast cancer

- 6.4 Colorectal cancer

- 6.5 Prostate cancer

- 6.6 Leukemia and lymphoma

- 6.7 Melanoma

- 6.8 Ovarian and cervical cancer

- 6.9 Other cancer types

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Bn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Parenteral

- 7.4 Other route of administration

Chapter 8 Market Estimates and Forecast, By Drug Type, 2021 - 2034 ($ Bn)

- 8.1 Key trends

- 8.2 Proprietary (Branded)

- 8.3 Biosimilars

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Bn)

- 9.1 Key trends

- 9.2 Hospital pharmacies

- 9.3 Drug stores and retail pharmacies

- 9.4 Online pharmacies

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 AbbVie

- 11.2 Amgen

- 11.3 AstraZeneca

- 11.4 Bayer

- 11.5 Biogen

- 11.6 Bristol-Myers Squibb

- 11.7 Eli Lilly

- 11.8 F. Hoffmann-La Roche

- 11.9 GlaxoSmithKline

- 11.10 Johnson & Johnson

- 11.11 Merck

- 11.12 Novartis

- 11.13 Pfizer

- 11.14 Sanofi

- 11.15 Takeda Pharmaceutical

- 11.16 Sandoz

- 11.17 Biocon

- 11.18 Celltrion

- 11.19 Adaptimmune

- 11.20 Legend Biotech

- 11.21 Arcellx