PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871234

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1871234

Self-healing Adhesives Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

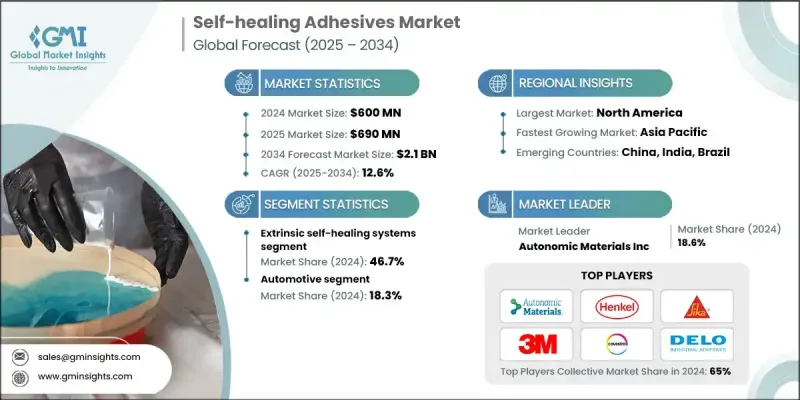

The Global Self-healing Adhesives Market was valued at USD 600 million in 2024 and is estimated to grow at a CAGR of 12.6% to reach USD 2.1 Billion by 2034.

Rising demand for high-performance and durable bonding solutions across the construction, automotive, and electronics sectors is driving strong market growth. The growing focus on reducing maintenance expenses while extending product lifespan is further encouraging adoption. Self-healing adhesives contribute nearly 7% to overall market expansion, as industries increasingly seek materials capable of automatic damage repair and structural recovery. The technology is particularly critical in aerospace applications where maintaining structural integrity and composite repair efficiency is essential. However, concerns surrounding long-term performance reliability and limited field data have hindered broader adoption. Technical challenges such as restricted healing agent capacity and irreversible repair processes under mechanical stress have also slowed commercialization. Ongoing research innovations have started to address these barriers by improving healing kinetics, mechanical recovery, and repeatability. The integration of advanced nanomaterials has enabled rapid strength recovery within minutes, marking a significant leap in the performance of next-generation self-healing adhesives.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $600 Million |

| Forecast Value | $2.1 Billion |

| CAGR | 12.6% |

The intrinsic self-healing systems segment held 31.7% share in 2024 and is forecast to grow at a CAGR of 13.9%. The growing preference for reversible chemistry-based technologies that utilize dynamic covalent and supramolecular bonding mechanisms is reshaping product development. These systems eliminate the need for external healing agents and enable continuous, repeatable repair cycles without compromising material integrity. The advancement in molecular design and chemistry has significantly expanded operating temperature ranges and enhanced overall healing performance. Manufacturers are increasingly adopting this approach due to its manufacturing simplicity and suitability for various industrial applications requiring consistent mechanical recovery.

The construction and infrastructure applications segment held 18% share in 2024 and is expected to grow at a 9.3% CAGR through 2034. This segment reflects a mature adoption trend driven by self-healing materials for weatherproofing, structural reinforcement, and crack mitigation. Ongoing infrastructure modernization, combined with rising awareness about lifecycle cost efficiency, continues to strengthen market demand. The growing application of self-healing concrete additives and bonding agents in critical infrastructure such as bridges and tunnels underscores the technology's long-term value in maintaining structural safety and resilience.

U.S. Self-healing Adhesives Market was valued at USD 187.2 million in 2024 and is estimated to reach USD 667.4 million by 2034. The United States dominates the North American landscape, supported by substantial demand from aerospace manufacturers that require advanced composite repair technologies. Automotive OEMs are also major contributors, with strong adoption of self-healing adhesives for battery assembly and thermal management in electric vehicles. The expanding EV ecosystem, alongside the electrification efforts of leading carmakers, continues to drive innovation. Additionally, the electronics sector is witnessing rising use of flexible and wearable device adhesives from major technology brands, reflecting strong domestic consumption and R&D activity.

Prominent companies operating in the Global Self-healing Adhesives Market include Sika, 3M Company, Henkel AG & Co. KGaA, Covestro AG, Autonomic Materials Inc., and DELO Industrial Adhesives. Leading participants in the Global Self-healing Adhesives Market are pursuing strategic initiatives to enhance competitiveness and strengthen their global footprint. Companies are heavily investing in R&D to develop formulations with improved healing efficiency, repeatability, and environmental resistance. Strategic collaborations with research institutions and material science firms are enabling advancements in polymer chemistry and nanotechnology integration. Manufacturers are also focusing on expanding production capacities and diversifying application portfolios across construction, aerospace, and electronics.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Healing Mechanism

- 2.2.2 Application

- 2.2.3 Material Base

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Size and Forecast, By Healing Mechanism, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Intrinsic self-healing systems

- 5.3 Extrinsic self-healing systems

- 5.4 Hybrid self-healing systems

Chapter 6 Market Size and Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Aerospace & defense

- 6.2.1 Composite repair systems

- 6.2.2 Protective coatings

- 6.3 Automotive

- 6.3.1 EV battery sealing & thermal management

- 6.3.2 Structural bonding & body assembly

- 6.3.3 Electronic component protection

- 6.4 Electronics & semiconductors

- 6.4.1 Device assembly & encapsulation

- 6.4.2 Thermal interface materials

- 6.4.3 Flexible electronics & wearables

- 6.5 Construction & infrastructure

- 6.5.1 Structural repair systems

- 6.5.2 Weatherproofing & sealing

- 6.5.3 Maintenance & renovation

- 6.6 Medical devices

- 6.7 Marine & offshore

- 6.8 Others

Chapter 7 Market Size and Forecast, By Material Base, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Epoxy-based systems

- 7.3 Polyurethane-based systems

- 7.4 Silicone-based systems

- 7.5 Acrylic-based systems

- 7.6 Bio-based systems

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 Autonomic Materials

- 9.2 Henkel AG

- 9.3 3M Company

- 9.4 DowDuPont

- 9.5 Arkema Group

- 9.6 Covestro AG

- 9.7 DELO Industrial Adhesives

- 9.8 Fraunhofer

- 9.9 H.B. Fuller Company

- 9.10 Lohmann-koester GmbH

- 9.11 Sika

- 9.12 WACKER Chemie

- 9.13 WEICON GmbH