PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876583

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876583

North America Circular Connector Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

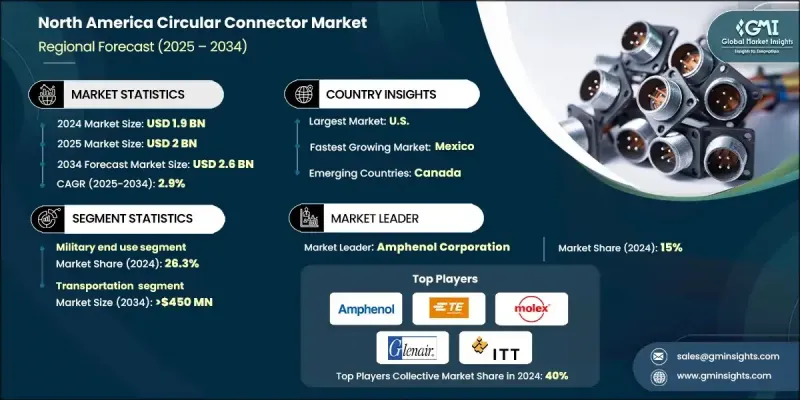

North America Circular Connector Market was valued at USD 1.9 billion in 2024 and is estimated to grow at a CAGR of 2.9% to reach USD 2.6 billion by 2034.

The region's industrial environment is rapidly evolving with the expansion of smart manufacturing and Industry 4.0 technologies. Circular connectors are at the center of this transformation, enabling efficient, secure, and high-speed power and data transmission across automated and connected systems. As digitalization advances, the need for connectors that offer superior reliability, modularity, and support for real-time communication continues to expand. This growing shift toward automation is creating significant opportunities for manufacturers to innovate in compact design, improved signal performance, and enhanced resistance to harsh environmental conditions. Additionally, the automotive sector is increasingly incorporating sophisticated electronic systems, particularly in electric and autonomous vehicles. Circular connectors are gaining traction due to their durability, high current handling, and ability to function in extreme temperature and vibration conditions. The increasing collaboration between manufacturers and original equipment producers through partnerships, acquisitions, and product innovation is shaping the competitive landscape, allowing companies to diversify their portfolios and strengthen their presence across the region's supply chain network.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $2.6 Billion |

| CAGR | 2.9% |

In 2024, the military segment held a 26.3% share and is anticipated to grow at a CAGR of 2.7% through 2034. The ongoing modernization of defense equipment, combined with the growing use of compact and electronics-intensive systems such as unmanned vehicles and advanced communication devices, is boosting the need for high-performance circular connectors. The defense industry's focus on network-enabled capabilities and rugged equipment design is driving the adoption of connectors that can endure demanding operational environments while maintaining consistent data and power transfer.

United States Circular Connector Market held an 82% share in 2024, generating USD 1.63 billion. This dominance is attributed to the country's strong industrial foundation and commitment to technological advancement. Expanding smart factory initiatives and the widespread implementation of the Industrial Internet of Things (IIoT) are fueling demand for durable, efficient, and high-speed circular connectors. Moreover, the growing presence of advanced manufacturing, defense projects, and next-generation vehicle technologies continues to propel market growth. The increasing adoption of electric mobility solutions and intelligent infrastructure also supports the demand for robust connectivity components that ensure reliable performance in critical applications.

Key players operating in the North America Circular Connector Market include Aptiv, ITT Inc., Yazaki, TE Connectivity, Fischer Connectors, Rosenberger, Molex, AMETEK, Inc., Glenair, LAPP Group, Phoenix Contact, Smiths Interconnect, Luxshare Precision Industry Co., Ltd., Japan Aviation Electronics, Mencom Corporation, 3M, Foxconn, Hirose Electric Co., Ltd., GTK, and Amphenol Corporation. To strengthen their foothold, companies in the North America circular connector industry are actively pursuing strategies such as research and development investments, product innovation, and strategic collaborations with major OEMs. Many firms are focusing on expanding production facilities and developing advanced connector solutions tailored for high-speed data, power efficiency, and miniaturization. Mergers, acquisitions, and partnerships are being leveraged to enhance global distribution networks and technological capabilities.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.1.1 Business trends

- 2.1.2 End Use trends

- 2.1.3 Country trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technology factors

- 3.6.5 environmental factors

- 3.6.6 Legal factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digitalization and IoT integration

- 3.7.2 Emerging market penetration

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By End Use, 2021 - 2034 (USD Million, Million Units)

- 5.1 Key trends

- 5.2 Telecom

- 5.3 Transportation

- 5.4 Automotive

- 5.5 Industrial

- 5.6 Computer & peripherals

- 5.7 Military

- 5.8 Others

Chapter 6 Market Size and Forecast, By Country, 2021 - 2034 (USD Million, Million Units)

- 6.1 Key trends

- 6.2 U.S.

- 6.3 Canada

- 6.4 Mexico

Chapter 7 Company Profiles

- 7.1 3M

- 7.2 AMETEK, Inc.

- 7.3 Amphenol Corporation

- 7.4 Aptiv

- 7.5 Fischer Connectors

- 7.6 Foxconn

- 7.7 Glenair

- 7.8 GTK

- 7.9 Hirose Electric Co., Ltd.

- 7.10 ITT Inc.

- 7.11 Japan Aviation Electronics

- 7.12 LAPP Group

- 7.13 Luxshare Precision Industry Co., Ltd.

- 7.14 Mencom Corporation

- 7.15 Molex

- 7.16 Phoenix Contact

- 7.17 Rosenberger

- 7.18 Smiths Interconnect

- 7.19 TE Connectivity

- 7.20 Yazaki