PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876606

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876606

Renewable Energy Insurance Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

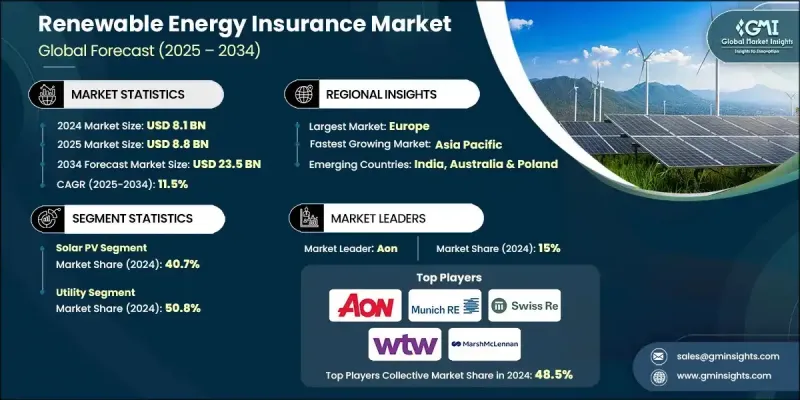

The Global Renewable Energy Insurance Market was valued at USD 8.1 billion in 2024 and is estimated to grow at a CAGR of 11.5% to reach USD 23.5 billion by 2034.

The accelerating investment in renewable energy worldwide is driving the need for specialized insurance coverage designed to protect clean energy assets. Governments, corporations, and investors are allocating substantial capital toward solar farms, wind projects, and energy storage facilities, which require robust protection against risks such as natural catastrophes, mechanical breakdowns, and construction disruptions. Renewable energy insurance plays a vital role in safeguarding these assets, ensuring project continuity, and improving financial confidence among investors and developers. This type of coverage is tailored to mitigate risks across technologies, including wind, solar, hydro, and bioenergy, covering property damage, business interruption, liability, and environmental exposure. As renewable infrastructure expands, insurers are launching innovative solutions and customized services to support industry needs. Moreover, regulatory and policy frameworks are reinforcing the requirement for developers to secure specific insurance policies, ensuring compliance with environmental and safety standards. These measures not only strengthen risk management but also make renewable energy projects more financially sustainable and attractive for global financing and investment opportunities.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.1 Billion |

| Forecast Value | $23.5 Billion |

| CAGR | 11.5% |

The wind technology segment is projected to register an 11.9% CAGR through 2034. The increasing deployment of large and technologically advanced wind installations has heightened the need for specialized insurance due to risks associated with component failures, maintenance delays, and operational downtime. Insurers are responding with targeted policies covering performance guarantees, equipment malfunctions, and business interruptions, providing stability and financial protection for project owners and operators.

The commercial and industrial category is set to witness a CAGR of 12.2% by 2034. Growing renewable installations across commercial and industrial sectors, including solar, wind, and storage systems, are propelling the demand for insurance protection. High-value renewable assets face various operational risks such as equipment failure, weather-related damage, and theft. Tailored insurance solutions ensure business continuity, secure financial investments, and reduce exposure to unforeseen losses, thereby supporting the sector's rapid adoption of clean energy technologies.

Asia Pacific Renewable Energy Insurance Market will grow at 11.9% CAGR by 2034. Increasing renewable capacity expansion across developing economies is fueling the need for insurance that addresses region-specific risks. The surge in solar and wind infrastructure in diverse environmental conditions has prompted insurers to develop coverage for grid interruptions, construction delays, and equipment losses. Expanding policy adoption across the region is enhancing the long-term resilience and viability of renewable projects.

Leading companies operating in the Global Renewable Energy Insurance Market include RSA Insurance, Allianz Global Corporate & Specialty, Axis Capital, Marsh McLennan, Chubb, Aon, Zurich Insurance, Gallagher, kWh Analytics, Descartes Underwriting, Horton Group, Liberty Specialty Markets, Munich Re, Swiss Re, Tokio Marine Kiln, Travelers, and Willis Towers Watson (WTW). Companies within the Global Renewable Energy Insurance Market are pursuing innovation, collaboration, and digital transformation to expand their market presence. Insurers are developing customized policies that address evolving risks related to renewable technologies and climate change. Strategic alliances with project developers, energy investors, and government bodies are enhancing their ability to offer integrated coverage solutions. Many are leveraging data analytics and predictive modeling to assess project performance, manage claims efficiently, and optimize pricing.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 Base estimates and calculations

- 1.1.4 Base year calculation

- 1.1.5 Key trends for market estimates

- 1.2 Forecast model

- 1.3 Primary research & validation

- 1.3.1 Primary sources

- 1.4 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Application trends

- 2.4 Coverage type trends

- 2.5 End Use trends

- 2.6 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Cost structure analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

- 3.7.1 Political factors

- 3.7.2 Economic factors

- 3.7.3 Social factors

- 3.7.4 Technological factors

- 3.7.5 Legal factors

- 3.7.6 Environmental factors

- 3.8 Emerging opportunities & trends

- 3.8.1 Digitalization & IoT integration

- 3.8.2 Emerging market penetration

- 3.9 Investment analysis and future outlook

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Rest of World

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Solar PV

- 5.3 Wind

- 5.4 Hydropower

- 5.5 Others

Chapter 6 Market Size and Forecast, By Coverage Type, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Property insurance

- 6.3 Liability insurance

- 6.4 Business interruption insurance

- 6.5 Equipment breakdown insurance

- 6.6 Others

Chapter 7 Market Size and Forecast, By End Use, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 Utility

- 7.3 Commercial & industrial

- 7.4 Residential

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 Poland

- 8.3.4 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.5 Rest of World

Chapter 9 Company Profiles

- 9.1 Allianz Global Corporate & Specialty

- 9.2 Aon

- 9.3 Axis Capital

- 9.4 Chubb

- 9.5 Descartes Underwriting

- 9.6 Gallagher

- 9.7 Horton Group

- 9.8 kWh Analytics

- 9.9 Liberty Specialty Markets

- 9.10 Marsh McLennan

- 9.11 Munich Re

- 9.12 RSA Insurance

- 9.13 Swiss Re

- 9.14 Tokio Marine Kiln

- 9.15 Travelers

- 9.16 Willis Towers Watson (WTW)

- 9.17 Zurich Insurance