PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876638

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876638

Extreme Ultraviolet (EUV) Lithography Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

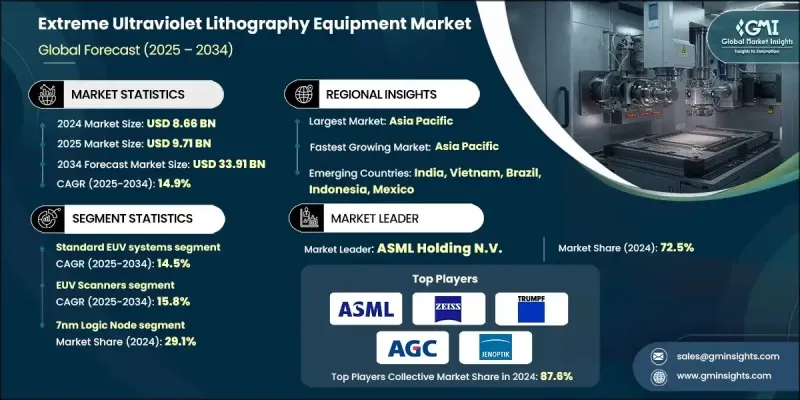

The Global Extreme Ultraviolet (EUV) Lithography Equipment Market was valued at USD 8.66 billion in 2024 and is estimated to grow at a CAGR of 14.9% to reach USD 33.91 billion by 2034.

The market is expanding steadily as the semiconductor industry transitions to advanced process nodes and the complexity of modern electronics continues to rise. Despite the high system costs of USD 200-400 million, EUV technology offers significant efficiency advantages by enabling advanced nodes without the costly multi-patterning steps required by older techniques. Market valuation accounts not only for EUV scanners but also for the complete ecosystem, including light sources, masks, optics, metrology, service contracts, consumables, and system upgrades.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.66 billion |

| Forecast Value | $33.91 billion |

| CAGR | 14.9% |

The high-NA EUV systems segment will grow at a CAGR of 17.6% through 2034. The next-generation lithography platforms feature a higher numerical aperture of 0.55 NA, capable of printing features as small as 8nm for sub-2nm nodes. These systems, which commanded USD 370-400 million in cost in 2024, are transitioning from R&D into early production. Their higher upfront expense is offset by reduced complexity and fewer additional patterning steps, offering long-term production efficiency.

EUV optical systems, contributing 15% share and growing at a CAGR of 14.3% through 2034, include precision mirrors, collectors, and optical components critical for system performance. Leading optical suppliers have exclusive agreements to meet the demanding accuracy requirements of EUV systems, often down to the picometer scale.

U.S. Extreme Ultraviolet (EUV) Lithography Equipment Market was valued at USD 2 billion in 2024 and is expected to grow at a CAGR of 15% through 2034. Government initiatives, including a USD 825 million allocation under the CHIPS Act for EUV accelerator programs, are strengthening domestic semiconductor manufacturing capabilities. These incentives are encouraging private sector investment in EUV technologies and boosting the development of local production capacity.

Prominent players in the Extreme Ultraviolet (EUV) Lithography Equipment Market include Lam Research Corporation, Nikon Corporation, ASML Holding N.V., Canon Inc., KLA Corporation, Coherent Corporation, Applied Materials, Inc., Gigaphoton Inc., NuFlare Technology, Inc., Lasertec Corporation, Trumpf SE + Co. KG, Jenoptik AG, SUSS MicroTec SE, EV Group E. Thallner GmbH, SET Corporation, Veeco Instruments Inc., Plasma-Therm LLC, and Oxford Instruments plc. Companies operating in the Extreme Ultraviolet (EUV) Lithography Equipment Market focus on strategies such as investing heavily in research and development to advance system performance, precision, and throughput. Many pursue strategic partnerships and collaborations to enhance technology integration across the semiconductor ecosystem. Firms also expand global manufacturing capacity, optimize supply chains, and establish service networks to ensure high system uptime.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Technology type trends

- 2.2.2 Equipment type trends

- 2.2.3 Technology node application trends

- 2.2.4 End use type trends

- 2.2.5 End use industry trends

- 2.2.6 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical Success Factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for advanced semiconductor nodes

- 3.2.1.2 Growing adoption of EUV in high-volume manufacturing by leading foundries

- 3.2.1.3 Rising complexity of semiconductor devices requiring precise lithography

- 3.2.1.4 Expansion of EUV applications beyond logic to advanced memory production

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Extremely high capital expenditure and operational costs

- 3.2.2.2 Limited EUV source power and throughput constraints

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging Business Models

- 3.9 Compliance Requirements

- 3.10 Sustainability Measures

- 3.11 Consumer Sentiment Analysis

- 3.12 Patent and IP analysis

- 3.13 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive Benchmarking of key Players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ Startup Competitors Landscape

Chapter 5 Market Estimates & Forecast, By Technology Type, 2021-2034 (USD Billion & Units)

- 5.1 Key trends

- 5.2 Standard EUV Systems (NA 0.33)

- 5.2.1 NXE:3400C systems

- 5.2.2 NXE:3600D systems

- 5.2.3 NXE:3800E systems

- 5.3 High-NA EUV Systems (NA 0.55)

- 5.3.1 EXE:5000 systems

- 5.3.2 EXE:5200B systems

- 5.3.3 Next-Generation High-NA systems

Chapter 6 Market Estimates & Forecast, By Equipment Type, 2021-2034 (USD Billion & Units)

- 6.1 Key trends

- 6.2 EUV scanners

- 6.3 EUV optical systems

- 6.3.1 Illumination systems

- 6.3.2 Projection optics

- 6.3.3 mirror systems & multilayer coatings

- 6.4 EUV light sources

- 6.4.1 co2 laser systems

- 6.4.2 Plasma generation equipment

- 6.4.3 Power conditioning systems

- 6.5 EUV masks & blanks

- 6.5.1 Mask substrate blanks

- 6.5.2 Pellicle systems

- 6.5.3 Mask manufacturing equipment

- 6.6 EUV metrology & inspection equipment

- 6.6.1 Defect inspection systems

- 6.6.2 Overlay metrology systems

- 6.6.3 Critical dimension measurement systems

- 6.7 EUV support systems

- 6.7.1 Vacuum systems

- 6.7.2 Abatement equipment

- 6.7.3 Environmental control systems

- 6.8 EUV software & computational systems

- 6.8.1 Computational lithography software

- 6.8.2 Process control software

- 6.8.3 Mask design software

Chapter 7 Market Estimates & Forecast, By Technology Node Application, 2021-2034 (USD Billion & Units)

- 7.1 Key trends

- 7.2 7nm Logic Node

- 7.3 5nm Logic Node

- 7.4 3nm Logic Node

- 7.5 2nm Logic Node

- 7.6 Sub-2nm Logic Nodes

- 7.7 Advanced DRAM (10nm-class & below)

- 7.8 Advanced NAND Flash

Chapter 8 Market Estimates & Forecast, By End Use Type, 2021-2034 (USD Billion & Units)

- 8.1 Key trends

- 8.2 Pure-play foundries

- 8.3 Integrated device manufacturers (IDMS)

- 8.4 Memory manufacturers

Chapter 9 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion & Units)

- 9.1 Key trends

- 9.2 Mobile & consumer electronics

- 9.3 Automotive semiconductors

- 9.4 Artificial intelligence & machine learning

- 9.5 Data center & high-performance computing

- 9.6 5G & telecommunications infrastructure

- 9.7 Industrial & IoT applications

- 9.8 Aerospace & defense

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion & Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Key Players

- 11.1.1 ASML Holding N.V.

- 11.1.2 Applied Materials, Inc.

- 11.1.3 KLA Corporation

- 11.1.4 Lam Research Corporation

- 11.1.5 Nikon Corporation

- 11.2 Regional Key Players

- 11.2.1 North America

- 11.2.1.1 Coherent Corporation

- 11.2.1.2 Veeco Instruments Inc.

- 11.2.1.3 Plasma-Therm LLC

- 11.2.2 Europe

- 11.2.2.1 Trumpf SE + Co. KG

- 11.2.2.2 Jenoptik AG

- 11.2.2.3 SUSS MicroTec SE

- 11.2.2.4 EV Group E. Thallner GmbH

- 11.2.2.5 Oxford Instruments plc

- 11.2.3 Asia-Pacific

- 11.2.3.1 Canon Inc.

- 11.2.3.2 Gigaphoton Inc.

- 11.2.3.3 NuFlare Technology, Inc.

- 11.2.3.4 Lasertec Corporation

- 11.2.1 North America

- 11.3 Disruptors / Niche Players

- 11.3.1 SET Corporation

- 11.3.2 SUSS MicroTec SE