PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876642

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876642

Food Packaging Recycling Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

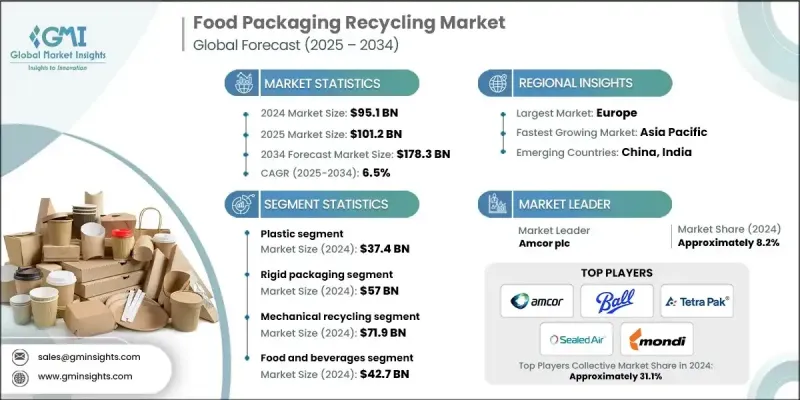

The Global Food Packaging Recycling Market was valued at USD 95.1 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 178.3 billion by 2034.

Market expansion is fueled by rising regulatory pressure and the implementation of Extended Producer Responsibility programs, which are prompting manufacturers to increase the use of recycled content in their packaging. Companies are pursuing ambitious sustainability commitments, leading to higher investments in collection infrastructure, sorting capabilities, and advanced recycling technologies. At the same time, public awareness of environmental concerns has strengthened participation in recycling efforts, reinforcing demand for recyclable food packaging formats and improved processing systems. Innovations in mechanical and chemical recycling are accelerating progress, enabling previously difficult packaging materials-such as multilayer structures and flexible films-to be recycled more effectively. Efforts to simplify and harmonize packaging designs are also supporting higher recovery rates. As a result, the market is experiencing steady momentum driven by technology adoption, stronger stakeholder collaboration, and a clear shift toward circularity in the food packaging ecosystem.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $95.1 Billion |

| Forecast Value | $178.3 Billion |

| CAGR | 6.5% |

The plastic segment reached USD 37.4 billion in 2024 and is expected to grow at a 10.9% CAGR from 2025 to 2034. Growth is supported by the rising recovery of plastics, paper, glass, and metal as industries and regulators work toward minimizing waste. Plastics remain a primary focus due to their widespread use and the complexities of disposal. Investments in both chemical and mechanical recycling are improving the ability to process PET and polyolefins into food-grade materials. Paper and paperboard continue to gain market share, supported by strong recycling networks and increasing adoption of fiber-based alternatives.

The rigid packaging segment was valued at USD 57 billion in 2024 and is anticipated to grow at a 6.5% CAGR through 2034. Rigid formats benefit from well-established recycling streams for glass jars, metal cans, PET bottles, and HDPE containers. Food and beverage producers are incorporating more recycled inputs into rigid packaging to meet sustainability standards, supported by enhanced washing, pelletizing, and decontamination systems that improve material quality.

North America Food Packaging Recycling Market generated USD 28.2 billion in 2024 and is positioned for strong growth over the forecast period. The region is strengthening its recycling landscape through supportive regulations, corporate responsibility initiatives, and established waste management networks. Expanding mechanical and chemical recycling capacity and improved design-for-recyclability practices are advancing closed-loop systems across packaging categories, especially in rigid formats.

Key participants in the Global Food Packaging Recycling Market include Amcor plc, Mondi Group, Ball Corporation, Tetra Pak, and Sealed Air Corporation. Companies in the food packaging recycling market are implementing several strategies to reinforce their competitive advantage. Many firms are scaling investments in next-generation recycling technologies, including advanced mechanical and chemical systems that enable higher-quality output and better processing of complex materials. Organizations are also partnering with waste management providers and consumer goods brands to build closed-loop supply chains that enhance material recovery. Expansion of recycling infrastructure, such as improved sorting automation and upgraded collection networks, is another key priority. Businesses are redesigning packaging to improve recyclability while aligning with regulatory requirements and sustainability goals.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material Type

- 2.2.3 Packaging Format

- 2.2.4 Recycling Process

- 2.2.5 End Use Industry

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing implementation of Extended Producer Responsibility (EPR) policies

- 3.2.1.2 Strong corporate sustainability and recycled-content commitments

- 3.2.1.3 Rising consumer awareness of environmental impacts

- 3.2.1.4 Expansion of recycling infrastructure and capacity

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Contamination of food packaging waste streams

- 3.2.2.2 Complexity of multilayer and mixed-material packaging

- 3.2.2.3 Insufficient segregation, collection, and sorting systems

- 3.2.3 Market opportunities

- 3.2.3.1 Scaling chemical recycling to process difficult packaging types

- 3.2.3.2 Developing robust supply chains for food-grade rPET and recycled polyolefins

- 3.2.3.3 Offering design-for-recycling advisory and certification services

- 3.2.3.4 Investment and M&A in regional recycling infrastructure

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Material Type, 2021 - 2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Plastic

- 5.2.1 PET (Polyethylene Terephthalate)

- 5.2.2 HDPE (High-Density Polyethylene)

- 5.2.3 LDPE (Low-Density Polyethylene)

- 5.2.4 PP (Polypropylene)

- 5.2.5 Polystyrene

- 5.2.6 Multi-layer plastics

- 5.3 Paper & Paperboard

- 5.3.1 Corrugated board

- 5.3.2 Boxboard

- 5.3.3 Kraft paper

- 5.4 Metal

- 5.4.1 Aluminum

- 5.4.2 Steel

- 5.5 Glass

- 5.6 Biodegradable/Bio-based Materials

- 5.6.1 PLA (Polylactic Acid)

- 5.6.2 Starch-based plastics

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Packaging Format, 2021 - 2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Rigid Packaging

- 6.2.1 Bottles & Jars

- 6.2.2 Trays

- 6.2.3 Cans

- 6.2.4 Boxes

- 6.3 Flexible Packaging

- 6.3.1 Pouches

- 6.3.2 Wraps

- 6.3.3 Films

- 6.3.4 Sachets

- 6.4 Others

Chapter 7 Market Estimates and Forecast, By Recycling Process, 2021 - 2034 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Mechanical Recycling

- 7.3 Chemical Recycling

- 7.3.1 Pyrolysis

- 7.3.2 Depolymerization

- 7.4 Biological Recycling

- 7.4.1 Composting (for biodegradable packaging)

- 7.5 Energy Recovery

- 7.5.1 Incineration with energy capture

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 Food & Beverage

- 8.2.1 Dairy

- 8.2.2 Bakery & Confectionery

- 8.2.3 Meat, Poultry & Seafood

- 8.2.4 Ready-to-Eat Meals

- 8.2.5 Fruits & Vegetables

- 8.2.6 Beverages (non-alcoholic and alcoholic)

- 8.3 Foodservice

- 8.3.1 Quick Service Restaurants (QSRs)

- 8.3.2 Cafeterias

- 8.3.3 Catering Services

- 8.4 Retail & E-commerce

- 8.5 Institutional Use

- 8.5.1 Hospitals

- 8.5.2 Schools

- 8.5.3 Government Facilities

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion, Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East & Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 Amcor plc

- 10.2 Mondi Group

- 10.3 Tetra Pak

- 10.4 Sealed Air Corporation

- 10.5 Ball Corporation

- 10.6 Constantia Flexibles

- 10.7 MULTIVAC Group

- 10.8 Clear Path Recycling

- 10.9 Clean Tech Incorporated

- 10.10 CarbonLite Industries

- 10.11 BioPak

- 10.12 EcoEnclose

- 10.13 Elevate Packaging

- 10.14 TC Transcontinental Packaging

- 10.15 International Paper Company