PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876645

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876645

Immunomodulatory Protein Hydrolysates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

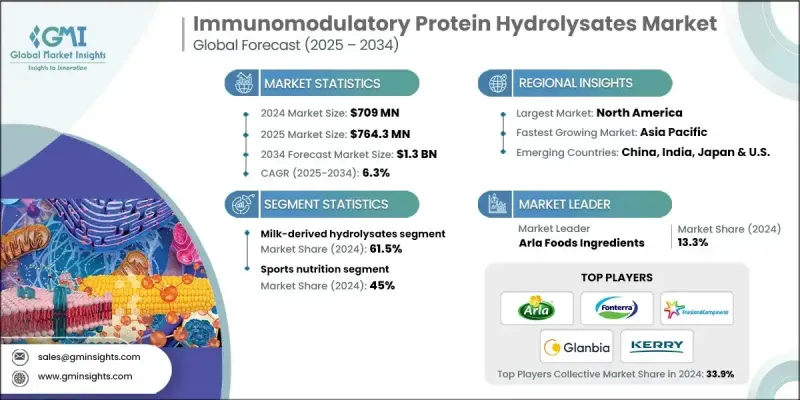

The Global Immunomodulatory Protein Hydrolysates Market was valued at USD 709 million in 2024 and is estimated to grow at a CAGR of 6.3% to reach USD 1.3 billion by 2034.

The industry is experiencing strong momentum as consumers become more aware of immune health and gain a clearer understanding of immune-related conditions. These hydrolysates, created by enzymatically converting proteins into short, bioactive peptides, play an active role in helping regulate immune activity by either supporting defensive responses or moderating inflammation. Their value spans functional foods, dietary supplements, and pharmaceutical formulations because they promote immune resilience, help reduce vulnerability to infections, and contribute to recovery processes. Demand is also shaped by their high bioavailability, safety profile, targeted immune benefits, and minimal side effects. Rising interest in natural and functional ingredients continues to elevate adoption, while the growth of personalized nutrition and preventive wellness adds substantial opportunity. An expanding older population that faces higher immune risks is further contributing to market progression. Research efforts focusing on new peptides with enhanced immunomodulatory potential continue to stimulate product innovation, and manufacturers across food, beverage, and therapeutic categories are incorporating these ingredients into a wide range of formulations, including those explored for immune support in clinical settings.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $709 Million |

| Forecast Value | $1.3 Billion |

| CAGR | 6.3% |

The milk-based hydrolysates segment held 61.5% share in 2024 owing to strong scientific support, established production capabilities, and long-recognized immune modulation functions. Major dairy-linked producers have invested in advanced enzymatic processes to deliver consistent, high-quality hydrolysates with reliable bioactive characteristics.

The clinical and medical nutrition segment held a 21% share in 2024, driven by demand for specialized solutions tailored to individuals with compromised immunity or unique medical requirements. This segment includes nutritionally designed options for people undergoing intensive treatments, older adults with age-related immune decline, and individuals managing autoimmune-related challenges.

North America Immunomodulatory Protein Hydrolysates Market held 42.1% share and is projected to grow at a 6.4% CAGR through 2034, supported by strong consumer acceptance of functional nutrition and a well-developed innovation environment. Companies in the region are devoting substantial resources to research geared toward developing next-generation hydrolysates with enhanced immune-support properties.

Prominent companies participating in the Global Immunomodulatory Protein Hydrolysates Market include Arla Foods Ingredients, Azelis Group, Cargill, Incorporated, DSM-Firmenich, Fonterra (NZMP), FrieslandCampina Ingredients, Glanbia PLC, Hilmar Cheese Company, Inc., Kerry Group, PB Leiner, Roquette, and Tatua. Companies in the Immunomodulatory Protein Hydrolysates Market are pursuing several strategic actions to secure a stronger competitive position. Many are prioritizing large-scale investment in enzymatic technology to improve consistency, purity, and bioactivity. Firms are also expanding collaborative research programs to identify new peptide functionalities and accelerate clinical validation. Product portfolios are widening through the development of tailored hydrolysates designed for specific consumer groups, including aging populations and individuals with targeted immune needs. Businesses are reinforcing supply chains to ensure reliable sourcing and efficient global distribution.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Application

- 2.2.4 Processing method

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product category

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product, 2021-2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Milk-derived protein hydrolysates

- 5.2.1 Whey protein hydrolysates

- 5.2.2 Casein protein hydrolysates

- 5.2.3 Lactoferrin hydrolysates

- 5.3 Plant-derived protein hydrolysates

- 5.3.1 Soy protein hydrolysates

- 5.3.2 Rice protein hydrolysates

- 5.3.3 Pea protein hydrolysates

- 5.3.4 Others

- 5.4 Marine-derived protein hydrolysates

- 5.4.1 Fish protein hydrolysates

- 5.4.2 Algae & microalgae hydrolysates

- 5.4.3 Marine invertebrate hydrolysates

- 5.5 Animal-derived protein hydrolysates

- 5.5.1 Egg protein hydrolysates

- 5.5.2 Meat protein hydrolysates

- 5.5.3 Collagen hydrolysates

- 5.6 Other source hydrolysates

- 5.6.1 Insect protein hydrolysates

- 5.6.2 Microbial protein hydrolysates

- 5.6.3 Single-cell protein hydrolysates

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Sports nutrition applications

- 6.2.1 Pre-workout immune support

- 6.2.2 Post-exercise recovery & anti-inflammatory

- 6.2.3 Endurance sports applications

- 6.3 Clinical/medical nutrition applications

- 6.3.1 Immunocompromised patient support

- 6.3.2 Cancer therapy adjuvants

- 6.3.3 Autoimmune disease management

- 6.3.4 Wound healing & tissue repair

- 6.4 Infant nutrition applications

- 6.4.1 Hypoallergenic formula development

- 6.4.2 Immune system development support

- 6.4.3 Preterm infant specialized nutrition

- 6.5 Functional foods & beverages

- 6.5.1 Immune-boosting beverages

- 6.5.2 Functional dairy products

- 6.5.3 Bakery & snack applications

- 6.6 Pharmaceutical applications

- 6.6.1 Drug delivery systems

- 6.6.2 Immunotherapy combinations

- 6.6.3 Vaccine adjuvants

Chapter 7 Market Estimates and Forecast, By Processing Method, 2021-2034 (USD Million & Kilo Tons)

- 7.1 Key trend

- 7.2 Enzymatic hydrolysis

- 7.3 Acid/alkaline hydrolysis

- 7.4 Fermentation-derived hydrolysates

- 7.5 Advanced processing technologies

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Arla Foods Ingredients

- 9.2 Azelis Group

- 9.3 Cargill

- 9.4 DSM-Firmenich

- 9.5 Fonterra (NZMP)

- 9.6 FrieslandCampina Ingredients

- 9.7 Glanbia PLC

- 9.8 Hilmar Cheese Company, Inc.

- 9.9 Kerry Group

- 9.10 PB Leiner

- 9.11 Roquette

- 9.12 Tatua