PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876648

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876648

Infant Formula Protein Hydrolysates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

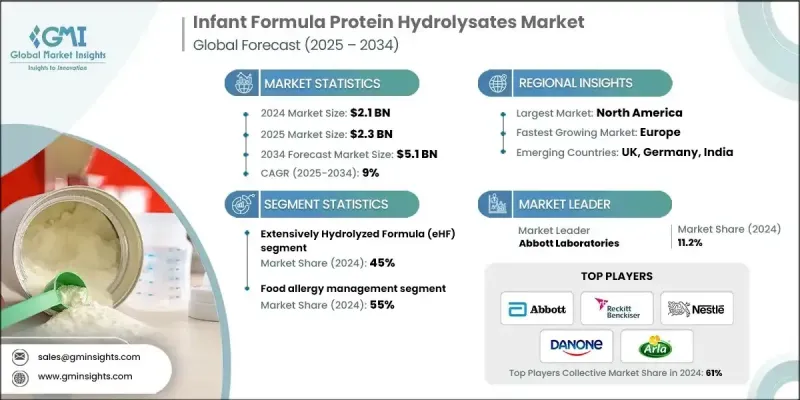

The Global Infant Formula Protein Hydrolysates Market was valued at USD 2.1 billion in 2024 and is estimated to grow at a CAGR of 9% to reach USD 5.1 billion by 2034.

The steady increase highlights the fast-growing demand for hydrolyzed protein formulas, which are becoming a preferred option for infants who require specialized nutrition due to allergies or dietary sensitivities. The expansion of this market is closely linked to the rising number of infants experiencing food-related intolerances, encouraging consistent adoption of formulas with modified proteins. Long-term assessments indicate that the market will continue advancing as product innovation accelerates and manufacturers tailor solutions to emerging clinical needs and shifting consumer expectations. Premium pricing remains a defining characteristic of this category because producing hydrolyzed proteins involves complex processing steps, rigorous safety evaluations, and strict adherence to regulatory standards across global markets. Advanced hydrolysis technologies, including enzymatic and thermal techniques, help create proteins that are easier for infants to digest and less likely to trigger reactions. Clinical guidance supports the use of extensively hydrolyzed formulas as an effective nutritional option for infants who do not tolerate standard cow's milk proteins.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 Billion |

| Forecast Value | $5.1 Billion |

| CAGR | 9% |

The extensively hydrolyzed formula products held a 45% share in 2024, underscoring their strong role in addressing cow's milk protein sensitivity. These formulas use deeply broken-down proteins with peptide sizes below 3 kDa to help lower the chance of triggering reactions while still meeting key nutritional needs.

In 2024, the food allergy management segment represented a 55% share. This large share reflects the clinical relevance of hydrolyzed proteins in addressing conditions linked to adverse food responses and ongoing nutritional concerns. Their ability to support feeding tolerance while lowering reaction risk continues to shape healthcare recommendations, contributing to rising demand across medical and retail channels.

United States Infant Formula Protein Hydrolysates Market generated USD 589.3 million in 2024. The increase in food allergy cases among children has influenced growth, with supportive clinical guidance and insurance recognition helping strengthen adoption. The region's readiness to invest in specialized nutrition also supports strong market momentum.

Key brands active in the Infant Formula Protein Hydrolysates Market include Perrigo Company, ByHeart, Danone, Abbott Laboratories, Arla Foods Ingredients, Else Nutrition, Morinaga Milk Industry, HiPP, Nestle, Bellamy's Organic, Reckitt Benckiser, Kendamil, and Biostime International. Companies in the Infant Formula Protein Hydrolysates Market focus on several core strategies to reinforce their competitive position. Many invest heavily in research to create formulas with improved digestibility and enhanced protein breakdown profiles. Firms also emphasize clinical validation to build trust among healthcare professionals and caregivers. Expanding production capabilities and optimizing supply chains help support consistent product availability, while collaborations with pediatric experts enhance credibility. Leading brands pursue targeted marketing to highlight the benefits of hydrolyzed proteins and widen consumer awareness.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product type

- 2.2.2 Application

- 2.2.3 End Use Industry

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Size and Forecast, By Product Type, 2021-2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Extensively hydrolyzed formula (eHF)

- 5.2.1 Casein-based eHF

- 5.2.2 Whey-based eHF

- 5.3 Partially hydrolyzed formula (pHF)

- 5.3.1 Casein-based pHF

- 5.3.2 Whey-based pHF

- 5.4 Amino acid-based formula (AAF)

- 5.5 Rice protein hydrolysate formula

- 5.6 Others

Chapter 6 Market Size and Forecast, By Application, 2021-2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Food allergy management

- 6.2.1 Cow's milk protein allergy (CMPA)

- 6.2.2 Multiple food protein intolerance (MFPI)

- 6.2.3 Food protein-induced enterocolitis syndrome (FPIES)

- 6.2.4 Eosinophilic gastrointestinal disorders

- 6.3 Gastrointestinal disorders

- 6.3.1 Functional gastrointestinal disorders

- 6.3.2 Malabsorption syndromes

- 6.3.3 Inflammatory bowel conditions

- 6.3.4 Structural gastrointestinal disorders

- 6.4 Growth & nutritional support

- 6.4.1 Failure to thrive

- 6.4.2 Metabolic disorders

- 6.4.3 Pancreatic insufficiency

- 6.5 Critical care & hospital applications

- 6.5.1 Neonatal intensive care unit (NICU)

- 6.5.2 Pediatric intensive care unit (PICU)

- 6.5.3 Emergency department applications

- 6.6 Others

- 6.6.1 Immunodeficiency disorders

- 6.6.2 Neurological conditions

- 6.6.3 Genetic syndromes

- 6.6.4 Oncological applications

Chapter 7 Market Size and Forecast, By End Use Industry, 2021-2034 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Hospital & healthcare systems

- 7.3 Government & public programs

- 7.4 Others

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 Reckitt Benckiser

- 9.3 Nestle

- 9.4 Danone

- 9.5 Arla Foods Ingredients

- 9.6 Morinaga Milk Industry

- 9.7 Biostime International

- 9.8 Bellamy's Organic

- 9.9 HiPP GmbH

- 9.10 ByHeart

- 9.11 Else Nutrition

- 9.12 Perrigo Company

- 9.13 Kendamil