PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876653

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876653

Halal-Certified Protein Hydrolysates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

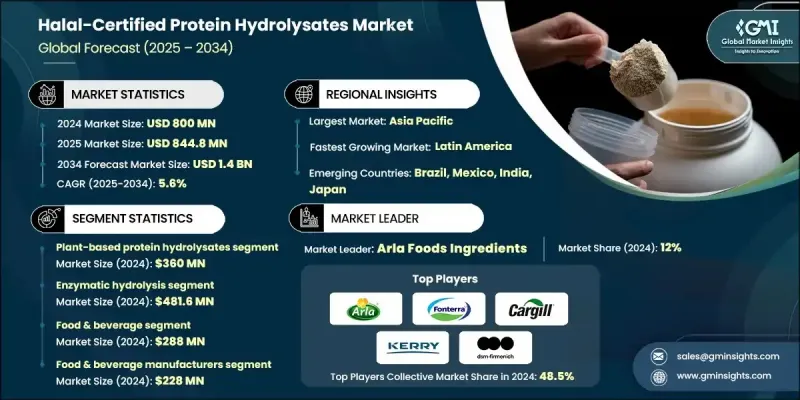

The Global Halal-Certified Protein Hydrolysates Market was valued at USD 800 million in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 1.4 billion by 2034.

The market is witnessing expansion due to rising health awareness and the increasing demand for clean-label, functional ingredients. Consumers are becoming more conscious of protein digestibility, muscle recovery, and gut health, which is fueling growth across sports nutrition, dietary supplements, and clinical nutrition sectors. Advances in enzymatic hydrolysis are reshaping the market by enhancing process efficiency and product quality. Modern enzyme-based systems allow controlled peptide breakdown, producing hydrolysates with higher bioavailability and reduced off-flavors. Global food ingredient manufacturers are adapting their enzymatic hydrolysis processes to meet halal compliance, enabling precision nutrition and cleaner production. The growing use of halal-certified hydrolysates in infant and clinical nutrition, where they reduce allergenicity and improve nutrient absorption, is also driving market adoption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $800 Million |

| Forecast Value | $1.4 Billion |

| CAGR | 5.6% |

The plant-based protein hydrolysates accounted for USD 360 million in 2024, owing to rising consumer preference for sustainable, ethical, and allergen-free protein sources. Lactose intolerance, veganism, and environmental awareness have encouraged manufacturers to replace animal-derived proteins with soy, pea, and rice hydrolysates. Their ease of halal certification, availability of raw materials, and simplified production processes make plant-based hydrolysates ideal for beverages, functional foods, and sports nutrition applications.

The enzymatic hydrolysis segment reached USD 481.6 million in 2024, attributed to its specificity and ability to produce high-quality, bioactive protein hydrolysates without compromising nutritional integrity. This method allows manufacturers to control peptide chain length and composition, improving digestibility and functionality for dietary supplements, clinical foods, and sports nutrition. Additionally, enzymatic hydrolysis aligns with halal standards since it avoids chemical catalysts, making it suitable for halal-certified production lines.

North America Halal-Certified Protein Hydrolysates Market captured USD 120 million in 2024, representing 15% share. The U.S. contributed USD 100.8 million due to its mature food processing industry, high consumer demand for functional and clean-label ingredients, and growing Muslim population. Increasing awareness of halal-certified nutritional supplements among fitness-focused consumers is also driving market growth in the region.

Key players in the Global Halal-Certified Protein Hydrolysates Market include Arla Foods Ingredients, ADM (Archer Daniels Midland), Cargill Incorporated, Actus Nutrition, Fonterra Co-operative Group, Glanbia PLC, FrieslandCampina, Abbott Laboratories, Roquette Freres, DSM-Firmenich, Kerry Group, and Agropur Cooperative. To strengthen their presence, companies in the halal-certified protein hydrolysates sector are focusing on research and development to improve enzymatic hydrolysis efficiency, peptide bioavailability, and clean-label formulations. Strategic collaborations with food manufacturers, nutrition brands, and clinical nutrition providers help expand distribution networks. Firms are also investing in halal certification processes, regional production facilities, and raw material sourcing to ensure compliance and scalability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Source type

- 2.2.3 Processing Technology

- 2.2.4 Application

- 2.2.5 End Use Industry

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising health consciousness & clean label demand

- 3.2.1.2 Technological advancements in enzymatic hydrolysis

- 3.2.1.3 Expanding applications in infant & clinical nutrition

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Higher production costs & price premiums

- 3.2.2.2 Limited availability of halal-certified raw materials

- 3.2.3 Market opportunities

- 3.2.3.1 Plant-based protein hydrolysates growth potential

- 3.2.3.2 Digital traceability & blockchain integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 Product

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Source Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Plant-based protein hydrolysates

- 5.2.1 Pea protein hydrolysates

- 5.2.2 Soy protein hydrolysates

- 5.2.3 Rice protein hydrolysates

- 5.2.4 Hemp protein hydrolysates

- 5.2.5 Other plant sources

- 5.3 Animal-based protein hydrolysates

- 5.3.1 Whey protein hydrolysates

- 5.3.2 Casein hydrolysates

- 5.3.3 Bovine protein hydrolysates

- 5.3.4 Poultry protein hydrolysates

- 5.4 Marine protein hydrolysates

- 5.4.1 Fish protein hydrolysates

- 5.4.2 Shrimp & crustacean hydrolysates

- 5.4.3 Other marine sources

- 5.5 Microbial protein hydrolysates

Chapter 6 Market Estimates and Forecast, By Processing Technology, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Enzymatic hydrolysis

- 6.2.1 Microbial enzyme systems

- 6.2.2 Plant-derived enzyme systems

- 6.2.3 Immobilized enzyme technology

- 6.3 Acid hydrolysis

- 6.4 Alkaline hydrolysis

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Infant nutrition

- 7.2.1 Extensively hydrolyzed formulas

- 7.2.2 Partially hydrolyzed formulas

- 7.2.3 Hypoallergenic products

- 7.3 Sports nutrition

- 7.3.1 Pre-workout supplements

- 7.3.2 Post-workout recovery products

- 7.3.3 Protein powders & shakes

- 7.4 Clinical/medical nutrition

- 7.4.1 Enteral nutrition products

- 7.4.2 Medical foods

- 7.4.3 Specialized dietary management

- 7.5 Dietary supplements & nutraceuticals

- 7.5.1 Capsules & tablets

- 7.5.2 Powder supplements

- 7.5.3 Functional foods

- 7.6 Food & beverage ingredients

- 7.6.1 Flavor enhancers

- 7.6.2 Protein fortification

- 7.6.3 Emulsifiers & stabilizers

- 7.7 Cosmetics & personal care

- 7.7.1 Anti-aging products

- 7.7.2 Hair care products

- 7.7.3 Skin care applications

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Food & beverage manufacturers

- 8.3 Pharmaceuticals

- 8.4 Nutraceuticals & Dietary supplement producers

- 8.5 Cosmetics & personal care

- 8.6 Animal feed & pet food

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Arla Foods Ingredients

- 10.2 Fonterra Co-operative Group

- 10.3 Cargill Incorporated

- 10.4 Kerry Group

- 10.5 DSM-Firmenich

- 10.6 ADM (Archer Daniels Midland)

- 10.7 Actus Nutrition

- 10.8 FrieslandCampina

- 10.9 Agropur Cooperative

- 10.10 Roquette Freres

- 10.11 Abbott Laboratories

- 10.12 Glanbia PLC