PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876804

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876804

Advanced Wound Care Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

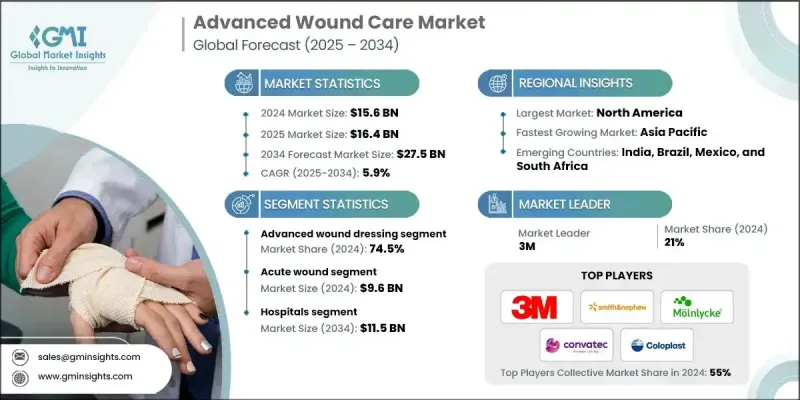

The Global Advanced Wound Care Market was valued at USD 15.6 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 27.5 billion by 2034.

Market growth is driven by the expanding geriatric population worldwide, the rising prevalence of chronic diseases, advancements in wound care technologies in developed regions, and increasing surgical procedures. The U.S. remains a leading contributor, reflecting high numbers of both emergency and elective surgeries. The rise in surgical volumes, from trauma-related cases to aesthetic procedures, has significantly heightened the demand for advanced wound care solutions. These technologies are increasingly critical in modern healthcare, facilitating faster recovery, minimizing post-surgical complications, and enhancing patient outcomes. With healthcare systems emphasizing reduced hospital stays and improved efficiency, advanced wound care solutions are emerging as essential components of post-surgical treatment pathways and chronic wound management.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.6 billion |

| Forecast Value | $27.5 billion |

| CAGR | 5.9% |

The increasing incidence of chronic diseases further fuels market demand. Conditions such as diabetes, cardiovascular disorders, and obesity often result in wounds that are slow to heal and require specialized interventions. Advanced wound care products, including hydrocolloids and alginates, are preferred over traditional dressings because they provide optimized wound management, maintain a moist environment, reduce infection risk, and accelerate healing. Hospitals and clinics are progressively adopting these solutions to ensure quicker recovery and better patient outcomes, driving the market forward.

The advanced wound dressings segment held a 74.5% share in 2024. Unlike conventional gauze, these dressings integrate innovative technologies such as hydrocolloids, foams, alginates, and antimicrobial layers. They are specifically designed to maintain optimal wound conditions, enhance healing, and prevent infections, making them indispensable in the management of chronic wounds, surgical incisions, and burns.

U.S. Advanced Wound Care Market reached USD 5 billion in 2024. The growth is primarily fueled by the increasing prevalence of chronic wounds, particularly those associated with diabetes. Diabetic foot ulcers and other slow-healing wounds often require advanced solutions, including specialized dressings and negative pressure wound therapy (NPWT), contributing to sustained market expansion in the country.

Key players in the Global Advanced Wound Care Market include Integra LifeSciences Corporation, Medela AG, Smith and Nephew, B. Braun, WoundEL Health Care, Coloplast, Molnlycke Health Care, Talley Group Ltd, Hollister Incorporated, 3M, Medline Industries, Organogenesis, HARTMANN International, Accel-Heal Technologies, Cardinal Health, DeRoyal Industries, Inc., ConvaTec Group, Lohmann & Rauscher, and Sky Medical Technology. Companies in the Global Advanced Wound Care Market employ a variety of strategies to strengthen their market foothold. They focus on continuous product innovation by developing next-generation dressings, NPWT systems, and biologics to address complex wounds. Strategic partnerships with hospitals, clinics, and research institutions expand their distribution networks and enhance credibility. Geographic expansion into emerging markets allows companies to tap into growing demand, while mergers and acquisitions consolidate resources and technology portfolios.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Production trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing geriatric population worldwide

- 3.2.1.2 Increasing incidence of chronic diseases

- 3.2.1.3 Technological advancement in wound care industry in developed region

- 3.2.1.4 Increasing number of surgical procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High Cost of Advanced Devices

- 3.2.2.2 Lack of skilled healthcare Professionals

- 3.2.3 Market opportunities

- 3.2.4 Development of smart wound care technologies

- 3.2.5 Customized and patient-specific solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Asia Pacific

- 3.4.3 Europe

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Key developments

- 4.7.1 Mergers and acquisitions

- 4.7.2 Partnerships and collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Advanced wound dressing

- 5.2.1 Foam dressings

- 5.2.2 Hydrocolloid dressings

- 5.2.3 Film dressings

- 5.2.4 Alginate dressings

- 5.2.5 Hydrogel dressings

- 5.2.6 Collagen dressings

- 5.2.7 Other advanced dressings

- 5.3 Wound therapy devices

- 5.3.1 Negative pressure wound therapy

- 5.3.2 Oxygen and hyperbaric oxygen equipment

- 5.3.3 Electric stimulation devices

- 5.3.4 Pressure relief devices

- 5.3.5 Other wound therapy devices

- 5.4 Wound care biologics

- 5.4.1 Skin Substitutes

- 5.4.1.1 Biological

- 5.4.1.1.1 Allograft

- 5.4.1.1.2 Xenograft

- 5.4.1.1.3 Other biologicals

- 5.4.1.2 Synthetic

- 5.4.1.1 Biological

- 5.4.2 Topical Agents

- 5.4.1 Skin Substitutes

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Chronic

- 6.2.1 Diabetic ulcer

- 6.2.2 Pressure ulcer

- 6.2.3 Venous legs ulcer

- 6.2.4 Other chronic applications

- 6.3 Acute

- 6.3.1 Surgical Wounds

- 6.3.2 Traumatic wounds

- 6.3.3 Burns

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Specialty clinics

- 7.4 Home care settings

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 1.1.1 U.S.

- 1.1.2 Canada

- 8.3 Europe

- 1.1.3 Germany

- 1.1.4 UK

- 1.1.5 France

- 1.1.6 Spain

- 1.1.7 Italy

- 1.1.8 Netherlands

- 8.4 Asia Pacific

- 1.1.9 China

- 1.1.10 Japan

- 1.1.11 India

- 1.1.12 Australia

- 1.1.13 South Korea

- 8.5 Latin America

- 1.1.14 Brazil

- 1.1.15 Mexico

- 1.1.16 Argentina

- 8.6 Middle East and Africa

- 1.1.17 South Africa

- 1.1.18 Saudi Arabia

- 1.1.19 UAE

Chapter 9 Company Profiles

- 9.1 3M

- 9.2 Accel-Heal Technologies

- 9.3 B. Braun

- 9.4 Cardinal Health

- 9.5 Coloplast

- 9.6 ConvaTec Group

- 9.7 DeRoyal Industries, Inc.

- 9.8 HARTMANN International

- 9.9 Hollister Incorporated

- 9.10 Integra LifeSciences Corporation

- 9.11 Lohmann & Rauscher

- 9.12 Medela AG

- 9.13 Medline Industries

- 9.14 Molnlycke Health Care

- 9.15 Organogenesis

- 9.16 Sky Medical Technology

- 9.17 Smith and Nephew

- 9.18 Talley Group Ltd

- 9.19 Vomaris Innovations

- 9.20 WoundEL Health Care