PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885852

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885852

U.S. Advanced Wound Care Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

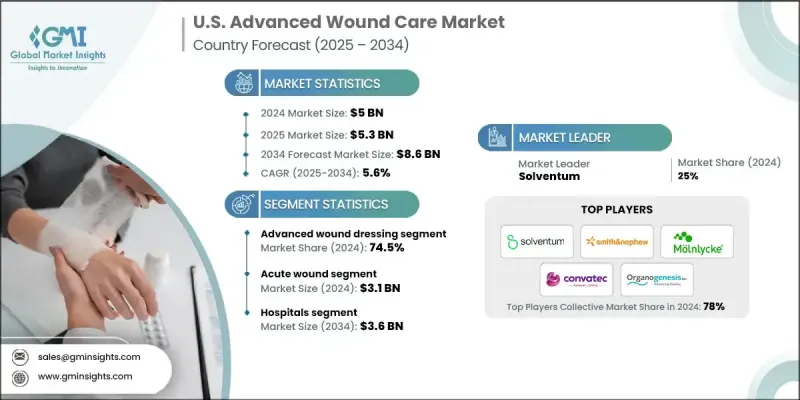

U.S. Advanced Wound Care Market was valued at USD 5 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 8.6 billion by 2034.

Growth continues to accelerate as surgical volumes rise nationwide and chronic wounds become more common due to aging populations and the increasing burden of long-term health conditions. Technological advancements in wound care systems are also elevating demand for solutions that speed healing, reduce complications, and improve the quality of life for patients. Advanced wound care technologies, including negative pressure systems, antimicrobial solutions, and engineered skin materials, play a critical role in supporting more efficient recovery. As more procedures are performed across healthcare settings, the need for sophisticated wound management tools continues to expand. Chronic wounds, including diabetic ulcers, venous injuries, and pressure-related skin breakdowns, often fail to respond to standard techniques, prompting clinicians to adopt specialized products tailored for long-term recovery challenges. With chronic disease rates rising, the number of individuals requiring ongoing wound support is also increasing, further fueling the adoption of advanced wound care therapies across the country.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5 Billion |

| Forecast Value | $8.6 Billion |

| CAGR | 5.6% |

The advanced wound dressings segment held a 74.5% share in 2024. These solutions provide enhanced healing conditions through moisture control, exudate management, and protection against contaminants. Their proven ability to support recovery for both chronic and acute wound types drives widespread usage in clinical settings.

The acute wound segment was valued at USD 3.1 billion in 2024. The category continues to expand due to a higher incidence of injuries, burns, and surgical procedures. Acute wounds typically heal within a predictable timeframe but still require specialized technologies to prevent complications, making advanced solutions essential for optimal outcomes.

The hospitals segment held a 41.3% share in 2024 and is projected to reach USD 3.6 billion by 2034. Hospitals treat large volumes of both short-term and persistent wound cases, supporting consistent demand for advanced solutions across numerous departments. Their central role in managing complex patient needs makes them the dominant end-user segment.

Key companies in the U.S. Advanced Wound Care Market include Accel-Heal Technologies, Coloplast, Solventum, Cardinal Health, DeRoyal Industries, Inc., HARTMANN International, ConvaTec Group, Hollister Incorporated, B. Braun, Lohmann & Rauscher, Medline Industries, Medela AG, Molnlycke Health Care, Integra LifeSciences Corporation, Smith and Nephew, Organogenesis, Talley Group Ltd, Sky Medical Technology, Vomaris Innovations, and WoundEL Health Care. Companies in U.S. Advanced Wound Care Market are strengthening their competitive position by expanding product portfolios, advancing wound healing technologies, and enhancing clinical evidence to support broader adoption. Many firms are investing in next-generation materials that improve moisture balance, reduce infection risk, and accelerate healing across diverse wound types. Strategic partnerships with hospitals and outpatient facilities help expand distribution networks and increase brand visibility. Manufacturers are also focusing on digital health integration, including remote patient monitoring and smart wound care systems, to support more personalized treatment pathways.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product trends

- 2.2.2 Application trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing number of surgical procedures across U.S.

- 3.2.1.2 Increasing incidence of chronic wounds

- 3.2.1.3 Technological advancement in advanced wound care

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Heterogeneous regulatory pathways slow approvals

- 3.2.2.2 High cost of advanced wound-care products

- 3.2.3 Market opportunities

- 3.2.4 Customized and patient-specific solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Pricing analysis, 2024

- 3.8 Patent analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Advanced wound dressing

- 5.2.1 Foam dressings

- 5.2.2 Hydrocolloid dressings

- 5.2.3 Film dressings

- 5.2.4 Alginate dressings

- 5.2.5 Hydrogel dressings

- 5.2.6 Collagen dressings

- 5.2.7 Other advanced dressings

- 5.3 Wound therapy devices

- 5.3.1 Negative pressure wound therapy

- 5.3.2 Oxygen and hyperbaric oxygen equipment

- 5.3.3 Electric stimulation devices

- 5.3.4 Pressure relief devices

- 5.3.5 Other wound therapy devices

- 5.4 Wound care biologics

- 5.4.1 Skin Substitutes

- 5.4.1.1 Biological

- 5.4.1.1.1 Allograft

- 5.4.1.1.2 Xenograft

- 5.4.1.1.3 Other biologicals

- 5.4.1.2 Synthetic

- 5.4.1.1 Biological

- 5.4.2 Topical Agents

- 5.4.1 Skin Substitutes

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Chronic

- 6.2.1 Diabetic ulcer

- 6.2.2 Pressure ulcer

- 6.2.3 Venous leg ulcer

- 6.2.4 Other chronic applications

- 6.3 Acute

- 6.3.1 Surgical Wounds

- 6.3.2 Traumatic wounds

- 6.3.3 Burns

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Specialty clinics

- 7.4 Home care settings

- 7.5 Other end use

Chapter 8 Company Profiles

- 8.1 Solventum

- 8.2 B. Braun

- 8.3 Cardinal Health

- 8.4 Coloplast

- 8.5 ConvaTec Group

- 8.6 DeRoyal Industries, Inc.

- 8.7 HARTMANN International

- 8.8 Hollister Incorporated

- 8.9 Integra LifeSciences Corporation

- 8.10 Lohmann & Rauscher

- 8.11 Medline Industries

- 8.12 Molnlycke Health Care

- 8.13 Organogenesis

- 8.14 Smith and Nephew

- 8.15 Talley Group Ltd

- 8.16 Vomaris Innovations