PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885791

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885791

Solar Thermal Collectors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

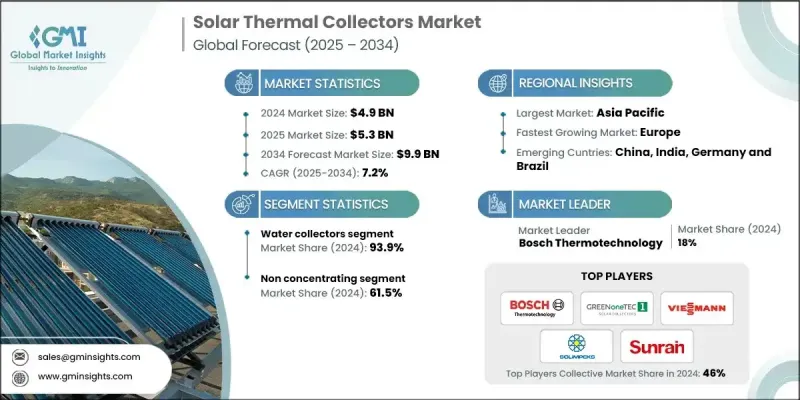

The Global Solar Thermal Collectors Market was valued at USD 4.9 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 9.9 billion by 2034.

Adoption continues to strengthen as decarbonization policies emphasize reducing emissions from heating and as manufacturers introduce advanced collector technologies with improved performance. Solar thermal systems are becoming integral to renewable energy transitions, offering reliable heat generation for residential, commercial, and industrial sectors. Growing investment in hybrid systems, which combine solar thermal collectors with heat pumps and thermal storage, is contributing to broader market acceptance. The increasing use of photovoltaic-thermal systems integrated with ground-source heat pumps is further transforming the landscape by supporting higher renewable energy penetration and lowering reliance on external energy inputs. Technological advancements in selective absorber coatings, including materials delivering absorption above 95% and emittance below 5%, are boosting system efficiency in varying climates. Newly developed high-efficiency evacuated flat-plate collectors are also aiding adoption by providing improved thermal performance. These innovations, paired with supportive policy frameworks and expansion into diverse application areas, continue to shape the upward trajectory of the solar thermal collectors market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.9 Billion |

| Forecast Value | $9.9 Billion |

| CAGR | 7.2% |

The air collectors category is expected to reach USD 1.4 billion by 2034 due to the rising adoption of low-cost renewable heating technologies across applications such as building heating, agricultural drying, and ventilation air preheating. Policy incentives across regions are supporting wider deployment of solar air systems for commercial, agricultural, and institutional buildings.

The non-concentrating segment held a 61.5% share and is projected to grow at a 6.5% CAGR through 2034. This segment includes unglazed, flat-plate, and evacuated tube designs that capture solar energy without the need for tracking equipment. Strong use in domestic hot water systems, space heating, and low-temperature industrial processes is fueling demand. Building regulations promoting renewable-integrated heating, increasing adoption in residential applications, and expanded use in commercial sectors such as hospitals, hotels, and education facilities are driving installations across the country.

United States Solar Thermal Collectors Market is expected to generate USD 140 million by 2024. North America represented 4.8% of the global market in 2024, supported by a wide range of applications from residential hot water systems to commercial and industrial heat solutions and strong manufacturing and research capabilities across the region.

Major companies in the Global Solar Thermal Collectors Market include Ariston Thermo, Archello, Absolicon Solar Collector AB, Himin, Arctic Solar, Ecotherm, GREENoneTEC, Hewalex, Photon Energy Systems, Solhart, Sunrain, Sunmaster, Solarus, Solimpeks, Vela Solaris AG, Viessmann Group, Thermomax Group, TVP Solar, WOLF, and BDR Thermea. Companies competing in the Solar Thermal Collectors Market are investing heavily in technological innovation, emphasizing advanced absorber coatings, improved thermal insulation, and higher-efficiency collector structures to enhance system performance. Many manufacturers are developing hybrid solar-thermal and heat pump solutions to expand application potential and differentiate their offerings. Strategic partnerships with construction firms, renewable energy developers, and HVAC integrators are helping companies broaden distribution channels and increase installation volumes. Firms are also focusing on scaling production capacity to lower costs and meet rising global demand.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 Base estimates and calculations

- 1.1.4 Base year calculation

- 1.1.5 Key trends for market estimates

- 1.2 Forecast model

- 1.3 Primary research & validation

- 1.3.1 Primary sources

- 1.4 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Product Type trends

- 2.4 Type trends

- 2.5 Application trends

- 2.6 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Rest of World

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Product type, 2021 - 2034 (USD Million, Million m2 & MW)

- 5.1 Key trends

- 5.2 Water collectors

- 5.2.1 Flat plate

- 5.2.2 Evacuated Tube

- 5.2.3 Unglazed

- 5.3 Air collectors

- 5.3.1 Glazed

- 5.3.2 Unglazed

Chapter 6 Market Size and Forecast, By Type, 2021 - 2034 (USD Million, Million m2 & MW)

- 6.1 Key trends

- 6.2 Concentrating

- 6.3 Non concentrating

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million, Million m2 & MW)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.4 Industrial

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million, Million m2 & MW)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 Austria

- 8.3.3 Greece

- 8.3.4 Italy

- 8.3.5 Turkey

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.5 Rest of World

Chapter 9 Company Profiles

- 9.1 Absolicon Solar Collector AB

- 9.2 Archello

- 9.3 Arctic Solar

- 9.4 Ariston Thermo

- 9.5 BDR Thermea

- 9.6 Ecotherm

- 9.7 GREENoneTEC

- 9.8 Hewalex

- 9.9 Himin

- 9.10 Photon Energy Systems

- 9.11 Solimpeks

- 9.12 Solarus

- 9.13 Solahart

- 9.14 Sunrain

- 9.15 Sunmaster

- 9.16 TVP Solar

- 9.17 Thermomax Group

- 9.18 Viessmann Group

- 9.19 Vela Solaris AG

- 9.20 WOLF