PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885869

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885869

Silicon Nanowire Battery Technology Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

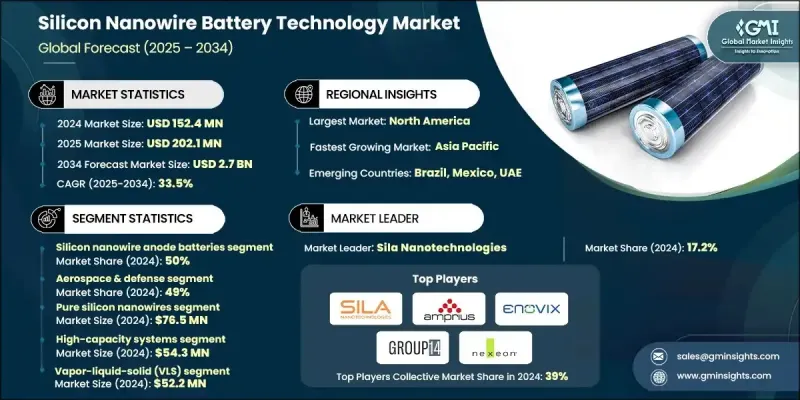

The Global Silicon Nanowire Battery Technology Market was valued at USD 152.4 million in 2024 and is estimated to grow at a CAGR of 33.5% to reach USD 2.7 billion by 2034.

Strong momentum comes from the shift toward high-energy-density storage systems, surging electric mobility, and broader use of advanced battery chemistries across major sectors such as consumer electronics, automotive, and stationary energy storage. As energy storage requirements evolve to demand higher durability, faster charging, and longer life cycles, manufacturers are increasingly focusing on breakthroughs in material science, scalable fabrication techniques, and digitally enhanced development pathways. These efforts are aimed at ensuring safety, real-world performance, and readiness for commercial deployment. The market's progress is also reinforced by greater integration of sophisticated engineering tools that streamline development and reduce prototyping timelines, enabling companies to push next-generation batteries toward mainstream adoption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $152.4 Million |

| Forecast Value | $2.7 Billion |

| CAGR | 33.5% |

Growing reliance on AI-driven material research, IoT-linked monitoring platforms, and cloud-based battery management systems is transforming how nanomaterial battery technologies evolve. These solutions give developers continuous insight into electrochemical activity, allow early prediction of degradation trends, and support synchronized workflow management across research units, pilot facilities, and integration partners. The use of digital twins, machine-learning simulations, and automated testing platforms helps accelerate validation cycles, enhance energy retention, and cut down development expenditures, supporting the transition toward intelligent battery ecosystems.

The silicon nanowire anode batteries segment captured a 50% share in 2024 and is estimated to grow at a CAGR of 32.9% between 2025 and 2034. These anode systems are engineered to deliver substantial improvements in energy density, conductivity, and durability. Their structure enables greater lithium-ion intake while addressing limitations found in conventional graphite. Rising demand for extended battery life in transportation, electronics, and aerospace applications continues to strengthen the adoption of pure silicon nanowire anodes as industries pursue more reliable and high-output storage technologies.

The aerospace and defense segment held a 49% share in 2024 and is expected to grow at a CAGR of 33.1% through 2034. Its dominance is driven by the need for lightweight, high-capacity, and high-performance power solutions capable of functioning in harsh operating environments. Silicon nanowire anode systems offer high power-to-weight ratios, rapid charging, and strong operational endurance, which support the sector's advanced equipment needs. Continuous investments in nanostructured materials, advanced thermal-control systems, and AI-based modeling tools strengthen the segment's leadership as demand for resilient energy systems grows.

United States Silicon Nanowire Battery Technology Market held an 88% share in 2024, generating approximately USD 49.6 million. This position is supported by a well-established EV and battery production landscape, strong R&D infrastructure, and significant involvement from leading nanomaterials innovators. Adoption of high-capacity silicon nanowire batteries has accelerated across electric transportation, consumer devices, and grid-level storage. Companies across the U.S. are deploying AI-enabled diagnostics, IoT-connected monitoring solutions, and cloud-supported management software to increase battery safety, improve efficiency, and enhance operational intelligence.

Key companies active in the Silicon Nanowire Battery Technology Market include Amprius Technologies, BTR New Material, Enevate, ENOVIX, Group14 Technologies, Nexeon, OneD Battery Sciences, ShinEtsu Chemical, Sila Nanotechnologies, and XG Sciences. Companies involved in the Silicon Nanowire Battery Technology Market are focusing on several strategic approaches to strengthen their competitive standing. Many firms are expanding their manufacturing capacities to support commercialization and ensure a consistent supply. Heavy emphasis is placed on R&D programs that enhance energy density, improve cycle stability, and optimize nanowire structures. Collaborations with EV makers, electronics brands, and defense contractors help accelerate real-world adoption. Businesses are also integrating AI-based analytics, digital twins, and automated testing systems to shorten development cycles and reduce costs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Fabrication Method

- 2.2.4 Performance Category

- 2.2.5 Material Composition

- 2.2.6 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for high-energy-density batteries

- 3.2.1.2 Advancements in nanomaterial engineering and ai-based material optimization

- 3.2.1.3 Growth of fast-charging infrastructure and high-power applications

- 3.2.1.4 Increasing investments from automotive OEMs and battery manufacturers

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs and scalability challenges

- 3.2.2.2 Mechanical instability and degradation risks

- 3.2.3 Market opportunities

- 3.2.3.1 High EV adoption and fleet electrification

- 3.2.3.2 Expansion of stationary energy storage

- 3.2.3.3 Expansion into grid-scale and renewable energy storage systems

- 3.2.3.4 Development of circular-economy-aligned recycling technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Nanomaterial regulations & TSCA compliance

- 3.4.2 Occupational safety requirements & NIOSH guidelines

- 3.4.3 Environmental impact regulations & EPA standards

- 3.4.4 International standards & harmonization efforts

- 3.4.5 Product safety & testing requirements

- 3.4.6 Certification processes & quality assurance

- 3.4.7 Regulatory timeline & future policy changes

- 3.4.8 Compliance cost analysis & implementation strategies

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 Technology evolution timeline & milestones

- 3.7.2 Performance improvement projections by technology

- 3.7.3 Cost reduction roadmap & economic targets

- 3.7.4 Manufacturing scale-up timeline & capacity planning

- 3.7.5 Emerging technology integration & convergence

- 3.7.6 Market penetration scenarios & adoption curves

- 3.7.7 Disruptive technology threats & market impact

- 3.7.8 Long-term market opportunities & strategic vision

- 3.7.9 Technology transfer & commercialization pathways

- 3.7.10 Innovation ecosystem & collaboration networks

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Best case scenarios

- 3.14 Manufacturing Scalability & Commercialization Roadmap

- 3.15 Performance Comparison Matrix vs. Alternative Technologies

- 3.16 Capital Expenditure & Funding Landscape

- 3.17 Performance Degradation & Cycle Life Analysis

- 3.18 Electrolyte & Separator Innovation Trends

- 3.19 Battery Pack Integration & System-Level Design

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($ Mn, Units)

- 5.1 Key trends

- 5.2 Silicon nanowire anode batteries

- 5.3 Silicon nanowire composite batteries

- 5.4 Hybrid nanostructure batteries

Chapter 6 Market Estimates & Forecast, By Fabrication Method, 2021 - 2034 ($ Mn, Units)

- 6.1 Key trends

- 6.2 Vapor-liquid-solid (VLS) growth

- 6.3 Metal-assisted chemical etching (MACE)

- 6.4 Chemical vapor deposition (CVD)

- 6.5 Solution-based growth methods

- 6.6 Electrochemical deposition

Chapter 7 Market Estimates & Forecast, By Performance Category, 2021 - 2034 ($ Mn, Units)

- 7.1 Key trends

- 7.2 High-capacity systems

- 7.3 Fast charging systems

- 7.4 Long-cycle life systems

- 7.5 Cost-optimized systems

Chapter 8 Market Estimates & Forecast, By Material Composition, 2021 - 2034 ($ Mn, Units)

- 8.1 Key trends

- 8.2 Pure silicon nanowires

- 8.3 Silicon-carbon composites

- 8.4 Silicon-oxide composites

- 8.5 Silicon alloy nanowires

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($ Mn, Units)

- 9.1 Key trends

- 9.2 Aerospace & defense

- 9.3 Automotive

- 9.4 Consumer electronics

- 9.5 Stationary energy storage

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($ Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Belgium

- 10.3.7 Netherlands

- 10.3.8 Sweden

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 Singapore

- 10.4.6 South Korea

- 10.4.7 Vietnam

- 10.4.8 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Global Player

- 11.1.1 Amprius Technologies

- 11.1.2 BTR New Material

- 11.1.3 Group14 Technologies

- 11.1.4 LG Energy Solution

- 11.1.5 Nexeon

- 11.1.6 OneD Material

- 11.1.7 Panasonic Energy

- 11.1.8 Samsung SDI

- 11.1.9 Shanshan Technology

- 11.1.10 Sila Nanotechnologies

- 11.2 Regional Player

- 11.2.1 DAEJOO Electronic Materials

- 11.2.2 Enevate

- 11.2.3 Gotion High-tech

- 11.2.4 GUIBAO Science & Technology

- 11.2.5 IOPSILION

- 11.2.6 KINGi New Materials

- 11.2.7 LeydenJar Technologies

- 11.2.8 NanoGraf

- 11.2.9 NEO Battery Materials

- 11.2.10 StoreDot

- 11.3 Emerging Players

11.3.1. DBattery

- 11.3.2 Advano

- 11.3.3 HKG Energy

- 11.3.4 Nanoramic Laboratories

- 11.3.5 Solid Power