PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885874

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885874

Mycelium-Based Protein Ingredients Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

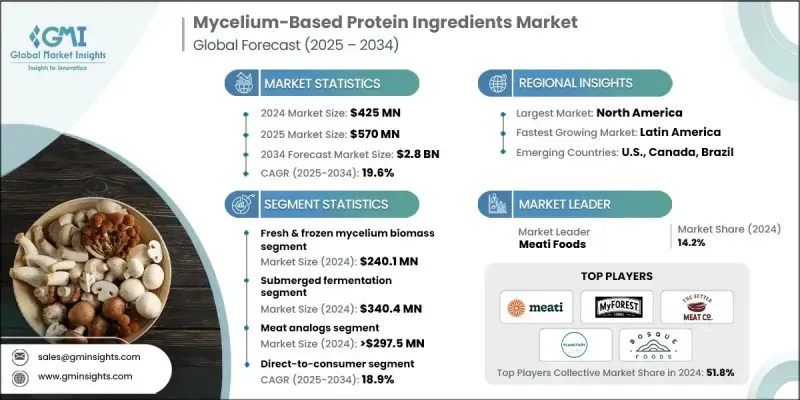

The Global Mycelium-Based Protein Ingredients Market was valued at USD 425 million in 2024 and is estimated to grow at a CAGR of 19.6% to reach USD 2.8 billion by 2034.

Rising consumer demand for environmentally conscious protein sources continues to help in this expansion, as more individuals seek nutrient-dense, sustainable alternatives. This growing interest has encouraged retailers and foodservice companies to introduce a wider range of fungi-derived offerings, prompting faster product development and broader manufacturing capabilities across the alternative-protein landscape. Advancements in fermentation science and bioprocess engineering are pushing production toward large-scale capabilities, supported by industrial bioreactors designed to deliver greater control, higher yields, and consistent quality. The shift from pilot operations to commercial-scale facilities is reinforced by increased funding activities and significant investments in new production sites, boosting the availability of mycelium ingredients for food manufacturers. Financial support from both private and public sectors is accelerating the construction of factories and driving rapid expansion across the supply chain. This surge in capital flow shortens commercialization timelines, reduces costs through scale efficiencies, and expands overall market capacity as documented by producers and purchasers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $425 Million |

| Forecast Value | $2.8 Billion |

| CAGR | 19.6% |

The fresh and frozen mycelium biomass segment reached USD 240.1 million in 2024, driven by alignment with whole-food applications and clean-label preferences. Its natural texture and fiber-rich profile allow producers to create whole-cut alternatives, patties, or ready-made meals without heavy processing. This format is ideal for brands looking for shorter ingredient lists, reduced production steps, scalable volume, and quicker entry into retail and foodservice channels.

The submerged fermentation segment was valued at USD 340.4 million in 2024 and continues to serve as the primary production method due to its efficiency and scalability. This technique leverages large industrial bioreactors that allow precise monitoring of temperature, oxygen, nutrient flow, and pH, supporting continuous biomass growth and more predictable output. Improved process control results in higher productivity, while cost efficiencies make it suitable for companies supplying large food manufacturers and quick-service businesses.

North America Mycelium-Based Protein Ingredients Market held a 36.4% share in 2024, led by strong activity in the United States. The region benefits from established fermentation facilities, experienced infrastructure, and early investments in companies developing fungal proteins. Substantial venture funding accelerates capacity growth and supports rapid commercialization in both retail and foodservice sectors. Rising consumer interest in high-protein, clean-label, and environmentally friendly options strengthens the demand for mycelium-based products as retailers seek to diversify their product offerings.

Major companies active in the Mycelium-Based Protein Ingredients Market include Maia Farms, My Forest Foods, Meati Foods, Bosque Foods, Optimized Foods, Cargill, Planetary, Better Meat Co., and Esencia Foods. Companies in the Mycelium-Based Protein Ingredients Market use multiple strategies to enhance their competitive position. Many focus on expanding fermentation capacity and optimizing bioprocesses to increase output while lowering production costs. Investments in R&D help firms improve texture, flavor, and nutritional profiles to meet the expectations of food manufacturers and consumers. Strategic partnerships with retailers, ingredient suppliers, and foodservice operators expand distribution networks and support quicker market integration. Brands also emphasize clean-label positioning and sustainability messaging to strengthen consumer trust.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product Form

- 2.2.3 Production Technology

- 2.2.4 Application

- 2.2.5 Distribution Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising consumer demand for sustainable protein sources

- 3.2.1.2 Environmental benefits over animal agriculture

- 3.2.1.3 Technological advancements in fermentation

- 3.2.1.4 Increasing investment in alternative proteins

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs compared to plant proteins

- 3.2.2.2 Limited consumer awareness & acceptance

- 3.2.3 Market opportunities

- 3.2.3.1 Development of clinical nutrition applications

- 3.2.3.2 Integration with food waste valorization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 Product

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Form, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Fresh & frozen mycelium biomass

- 5.3 Dried mycelium

- 5.4 Mycelium powder & flour

- 5.5 Protein isolates & concentrates

- 5.6 Whole-cut formats

Chapter 6 Market Estimates and Forecast, By Production Technology, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Submerged fermentation

- 6.3 Solid-state fermentation

- 6.4 Continuous aerobic fermentation

- 6.5 Batch & fed-batch fermentation

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Meat analogs

- 7.2.1 Burgers & ground meat

- 7.2.2 Whole-cut steaks & cutlets

- 7.2.3 Bacon & sausages

- 7.2.4 Nuggets & processed meats

- 7.3 Dairy analogs

- 7.3.1 Milk & cream alternatives

- 7.3.2 Yogurt & fermented products

- 7.3.3 Cheese alternatives

- 7.3.4 Ice cream & frozen desserts

- 7.4 Baked goods

- 7.5 Beverages

- 7.6 Snacks & processed foods

- 7.7 Sports nutrition & supplements

- 7.8 Clinical nutrition

- 7.9 Animal feed

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD million) (Kilo Tons)

- 8.1 Key trends

- 8.2 B2B ingredient suppliers

- 8.3 Direct-to-consumer

- 8.4 Retail (modern trade)

- 8.4.1 Supermarkets & hypermarkets

- 8.4.2 Convenience stores

- 8.4.3 Specialty health food stores

- 8.5 Online & e-commerce

- 8.6 Traditional markets & street vendors

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Bosque Foods

- 10.2 Maia Farms

- 10.3 Planetary

- 10.4 Meati Foods

- 10.5 Cargill

- 10.6 My Forest Foods

- 10.7 Optimized Foods

- 10.8 Esencia Foods

- 10.9 Better Meat Co