PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913476

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913476

Protein Ingredients Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

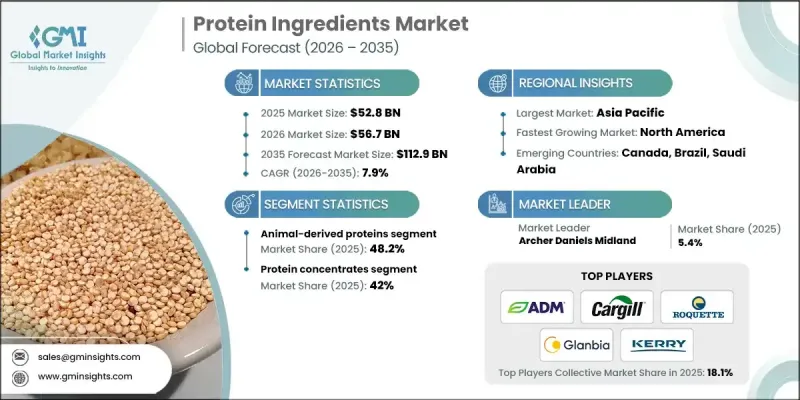

The Global Protein Ingredients Market was valued at USD 52.8 billion in 2025 and is estimated to grow at a CAGR of 7.9% to reach USD 112.9 billion by 2035.

Protein ingredients are derived from plant-based, animal-based, and microbial sources and are widely used across food, beverage, nutritional, and agricultural applications. Growing consumer focus on health, wellness, and balanced nutrition is reshaping dietary choices and accelerating demand for high-quality and functional protein solutions. Expanding populations, rising disposable incomes, and a rapidly growing middle-income group with stronger nutritional awareness have positioned Asia-Pacific as the leading regional market. At the same time, North America is witnessing the fastest growth due to advanced manufacturing capabilities, continuous innovation in alternative protein technologies, and a large consumer base focused on health-driven products. The increasing prevalence of lifestyle-related health conditions has amplified awareness of adequate protein consumption, supporting sustained market expansion. Additional momentum is coming from the expanding sports nutrition and fitness ecosystem, where protein intake is increasingly recognized as essential for physical performance, recovery, and overall well-being.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $52.8 Billion |

| Forecast Value | $112.9 Billion |

| CAGR | 7.9% |

The animal-based protein ingredients segment accounted for 48.2% share in 2025 and is expected to grow at a CAGR of 7.9% through 2035. This segment maintains a strong position due to its functional performance, high bioavailability, and widespread acceptance across the food and nutrition industries.

The protein concentrates segment held a 42% share in 2025. Their leadership is supported by cost efficiency, broad formulation flexibility, and suitability across a wide range of applications. Ease of processing and availability from multiple raw material categories continue to reinforce their demand.

North America Protein Ingredients Market is anticipated to grow at a CAGR of 8% between 2026 and 2035. Rising demand for clean-label and plant-forward protein solutions is accelerating growth, while innovations in extraction and processing technologies are improving sustainability and reducing environmental impact. Increasing consumer emphasis on health and environmental responsibility is prompting companies to intensify research and development activities focused on next-generation protein ingredients.

Key companies operating in the Global Protein Ingredients Market include Cargill, Incorporated, Archer Daniels Midland, Roquette Freres, Kerry Group, Ingredion Incorporated, Fonterra Co-operative Group, Glanbia Nutritionals, Darling Ingredients, International Flavors & Fragrances, Perfect Day, Inc., MGP Ingredients, Inc., Kewpie Corporation, and CropEnergies AG. Companies in the Global Protein Ingredients Market are strengthening their competitive positions through strategic investments in innovation, sustainability, and capacity expansion. Market participants are prioritizing research and development to improve the functionality, nutritional performance, and environmental efficiency of protein solutions. Many players are expanding production facilities and optimizing supply chains to ensure consistent quality and scalability. Strategic partnerships, mergers, and acquisitions are being used to access new technologies and regional markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Source

- 2.2.3 Type

- 2.2.4 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising health & wellness consciousness

- 3.2.1.2 Growing sports nutrition & fitness industry

- 3.2.1.3 Increasing demand for plant-based alternatives

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of alternative protein production

- 3.2.2.2 Consumer acceptance barriers for insect & cultured proteins

- 3.2.3 Market opportunities

- 3.2.3.1 Precision fermentation & recombinant protein technology

- 3.2.3.2 Collagen & marine protein applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By source

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)( Note: The trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Source, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Animal-derived proteins

- 5.2.1 Dairy proteins

- 5.2.2 Egg proteins

- 5.2.3 Meat-based proteins

- 5.2.4 Marine proteins

- 5.2.5 Collagen & gelatin

- 5.3 Plant-derived proteins

- 5.3.1 Legume proteins

- 5.3.2 Cereal proteins

- 5.3.3 Oilseed proteins

- 5.3.4 Others

- 5.4 Alternative proteins

Chapter 6 Market Estimates and Forecast, By Type, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Protein concentrates

- 6.3 Protein isolates

- 6.4 Protein hydrolysates

- 6.5 Textured proteins

Chapter 7 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food applications

- 7.2.1 Bakery products

- 7.2.2 Beverages

- 7.2.3 Meat & seafood alternatives

- 7.2.4 Dairy alternatives

- 7.2.5 Snacks & bars

- 7.2.6 Pasta & noodles

- 7.2.7 Soups, sauces & gravies

- 7.2.8 Confectionery

- 7.2.9 Others

- 7.3 Nutritional applications

- 7.3.1 Sports nutrition

- 7.3.2 Clinical & medical nutrition

- 7.3.3 Infant & child nutrition

- 7.3.4 Dietary supplements

- 7.3.5 Meal replacements

- 7.3.6 Others

- 7.4 Non-food applications

- 7.4.1 Personal care & cosmetics

- 7.4.2 Pharmaceutical applications

- 7.4.3 Animal feed

- 7.4.4 Others

Chapter 8 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Archer Daniels Midland

- 9.2 Cargill, Incorporated

- 9.3 CropEnergies AG

- 9.4 Darling Ingredients

- 9.5 Fonterra Co-operative Group

- 9.6 Glanbia Nutritionals

- 9.7 Ingredion Incorporated

- 9.8 International Flavors & Fragrances

- 9.9 Kerry Group

- 9.10 Kewpie Corporation

- 9.11 MGP Ingredients, Inc

- 9.12 Perfect Day, Inc.

- 9.13 Roquette Freres