PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885895

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885895

Gallium Nitride (GaN) EV Charger Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

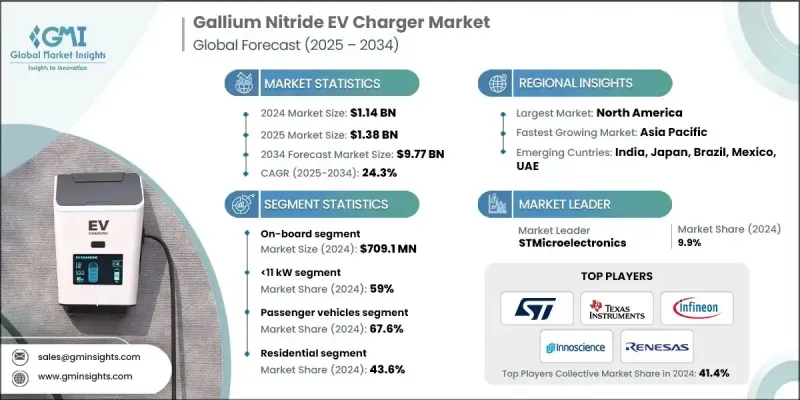

The Global Gallium Nitride (GaN) EV Charger Market was valued at USD 1.14 billion in 2024 and is estimated to grow at a CAGR of 24.3% to reach USD 9.77 billion by 2034.

The market is transitioning from standalone discrete devices to integrated half-bridge stages and modules that combine GaN switches with drivers and protection features. This integration reduces layout sensitivity and EMI while improving thermal performance. Public-private initiatives have accelerated the commercialization of wide-bandgap (WBG) technologies, driving the adoption of integrated GaN solutions for onboard chargers (OBCs) and electric vehicle power systems. Automakers are increasingly integrating multifunctional power domains, which support higher levels of device integration. Demonstrations of OBC converters indicate that GaN can increase power density by 170% and reduce weight by 79% compared to silicon-based systems, achieving peak efficiencies of 99% in a 6.6 kW dual active bridge prototype. GaN devices can switch at higher frequencies with lower conduction losses than silicon, allowing smaller magnetics and cooling systems while reducing losses by 60-80% in advanced EV converters. Design teams are also optimizing switching frequencies to balance converter performance with motor parasitic losses. Research has shown that 1.2 kV GaN MOSFETs using high-HfO2 gate dielectrics achieve very low gate leakage and higher current density. This positions vertical GaN devices to compete with SiC for 1.2 kV applications once substrate and process technologies mature. However, automotive qualification for 800 V+ and 150 kW traction applications remains under development, with readiness expected toward the end of the decade due to cost and reliability considerations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.14 Billion |

| Forecast Value | $9.77 Billion |

| CAGR | 24.3% |

The lateral GaN devices segment held 70% share and is forecasted to grow at a CAGR of 16.1% from 2025 to 2034. Lateral GaN devices dominate EV power electronics for OBCs, DC-DC converters, and auxiliary systems up to 650 V. Their AlGaN/GaN HEMT structure on silicon provides high electron mobility and critical field strength, delivering low on-resistance at high blocking voltages compared to silicon.

The medium voltage segment (100-650 V) accounted for a 67% share in 2024 and is projected to grow at a CAGR of 16% through 2034. Mid-voltage GaN devices are widely deployed because most OBCs (400 V today, rising to 800 V) and many DC-DC converters fall within this range. GaN's high-frequency performance directly boosts efficiency and power density in power factor correction and LLC or resonant converter stages in 6.6-19.2 kW OBC systems.

China Gallium Nitride (GaN) EV Charger Market generated USD 73.4 million in 2024. Accounting for nearly two-thirds of global EV sales, China's scale generates the largest addressable market for GaN devices, as every EV requires onboard chargers, DC-DC converters, and compatible charging infrastructure. This production volume positions China far ahead of other regional markets like Japan, South Korea, and India.

Key players in the Global Gallium Nitride (GaN) EV Charger Market include Transphorm, Navitas, Texas Instruments, GaN Systems, EPC, STMicroelectronics, ROHM Semiconductor, Infineon Technologies, Innoscience, and Power Integrations. Companies are strengthening their position by investing in R&D to improve GaN device performance, efficiency, and reliability. Strategic collaborations with automakers and charger manufacturers accelerate adoption. Expanding product portfolios with medium- and high-voltage solutions, securing automotive qualification certifications, and developing integrated modules enhances market penetration. Firms also focus on reducing costs through substrate innovations, scaling production capacity, and optimizing supply chains.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Product

- 2.2.2 Charging capacity

- 2.2.3 Vehicle

- 2.2.4 Application

- 2.2.5 Distribution channel

- 2.2.6 Regional

- 2.3 TAM Analysis, 2026-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising EV adoption

- 3.2.1.2 Energy efficiency and sustainability

- 3.2.1.3 Electrification of fleets

- 3.2.1.4 Government policies and incentives

- 3.2.1.5 Technological advancements in GaN

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial cost

- 3.2.2.2 Integration challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with renewable energy

- 3.2.3.2 High-power industrial fleet charging

- 3.2.3.3 Expansion of public charging networks

- 3.2.3.4 Smart charging and grid management

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle east and Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technology

- 3.7.2 Emerging technology

- 3.7.3 GaN device architectures & technology variants

- 3.7.3.1 Lateral GaN hemt architecture (300-650v commercial)

- 3.7.3.2 Vertical GaN development roadmap (>1.2 kv target)

- 3.7.3.3 Bidirectional GaN switch (bds) technology

- 3.7.4 Wide-bandgap semiconductor technology landscape

- 3.7.4.1 Silicon (si) baseline performance & limitations

- 3.7.4.2 Gan technology overview & advantages

- 3.7.4.3 Silicon carbide (sic) technology overview

- 3.7.4.4 Gan vs silicon performance comparison

- 3.8 Patent analysis

- 3.9 Price Trends Analysis

- 3.9.1 By component

- 3.9.2 By region

- 3.10 Cost Breakdown Analysis

- 3.11 Production statistics

- 3.11.1 Production hubs

- 3.11.2 Consumption hubs

- 3.11.3 Export and import

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Manufacturing Process & Cost Structure

- 3.13.1 GaN device fabrication process flow

- 3.13.2 Epitaxial growth (MOCVD, MBE)

- 3.13.3 Wafer processing & lithography

- 3.13.4 Dicing & packaging

- 3.13.5 Testing & quality control

- 3.13.6 Manufacturing cost breakdown ($/kW)

- 3.14 Thermal management considerations

- 3.14.1 Heat dissipation challenges at high switching frequency

- 3.14.2 Heatsink design & optimization

- 3.14.3 Liquid cooling vs air cooling

- 3.14.4 Thermal interface materials

- 3.14.5 Junction temperature management

- 3.15 Emi/emc compliance & mitigation

- 3.15.1 High DV/DT & DI/DT challenges

- 3.15.2 Conducted emissions

- 3.15.3 Radiated emissions

- 3.15.4 Emi filter design for GaN chargers

- 3.15.5 Pcb layout best practices

- 3.15.6 Shielding & grounding strategies

- 3.16 Reliability & qualification standards

- 3.16.1 Aec-q101 (automotive discrete semiconductors)

- 3.16.2 Aec-q100 (automotive integrated circuits)

- 3.16.3 Automotive qualification requirements

- 3.16.4 Long-term reliability testing

- 3.16.5 Gate oxide reliability

- 3.16.6 Dynamic on-resistance degradation

- 3.17 Trade analysis & import/export dynamics

- 3.17.1 Global GaN device trade flows

- 3.17.2 Major exporting countries (China, Taiwan, Germany, U.S.)

- 3.17.3 Major importing countries

- 3.17.4 Tariffs & trade barriers

- 3.17.5 Trade policy impact (U.S.-China relations)

- 3.17.6 Reshoring & nearshoring trends

- 3.18 Case Studies & Real-World Implementations

- 3.18.1 ORNL 6.6 kW GaN OBC demonstration

- 3.18.2 Delta electronics GaN charger deployment

- 3.18.3. Infineon 300 mm GaN pilot production

- 3.18.4 Navitas GaNFast IC automotive design wins

- 3.18.5 Chargepoint GaN-enabled dc fast chargers

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key news and initiatives

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 On-Board Chargers

- 5.3 Off-Board Chargers

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Public / High-Power

Chapter 6 Market Estimates & Forecast, By Charging Capacity, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 <11 kW

- 6.3 11-22 kW

- 6.4 >22 kW

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Passenger vehicles

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicles

- 7.3.1 LCV

- 7.3.2 MCV

- 7.3.3 HCV

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.4 Public

- 8.5 Industrial

Chapter 9 Market Estimates & Forecast, By Distribution channel, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Netherlands

- 10.3.8 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 ANZ

- 10.4.5 Singapore

- 10.4.6 Thailand

- 10.4.7 Vietnam

- 10.4.8 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 ABB E-Mobility

- 11.1.2 Infineon Technologies

- 11.1.3 ON Semiconductor

- 11.1.4 Power Integrations

- 11.1.5 Renesas Electronics (Transphorm)

- 11.1.6 ROHM Semiconductor

- 11.1.7 Schneider Electric

- 11.1.8 Siemens eMobility

- 11.1.9 STMicroelectronics

- 11.1.10 Texas Instruments

- 11.2 Regional Players

- 11.2.1 BTC Power

- 11.2.2 ChargePoint

- 11.2.3 EVBox (Engie)

- 11.2.4 GaN Systems

- 11.2.5 Nexperia

- 11.2.6 Panasonic

- 11.2.7 Tritium

- 11.2.8 Wallbox

- 11.2.9 VisIC Technologies

- 11.2.10 Chanan

- 11.3 Emerging players and disruptors

- 11.3.1 Cambridge GaN Devices (CGD)

- 11.3.2 EPC

- 11.3.3 Innoscience Technology

- 11.3.4 Navitas Semiconductor

11.3.5 Odyssey Semiconductor Technologies