PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885902

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885902

Rich Communication Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

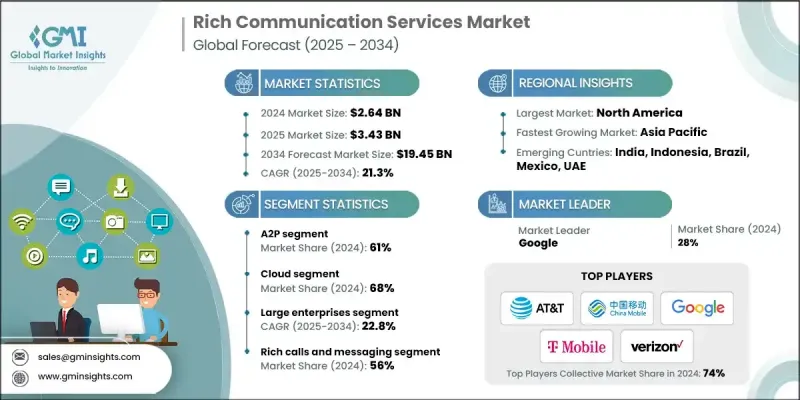

The Global Rich Communication Services Market was valued at USD 2.64 billion in 2024 and is estimated to grow at a CAGR of 21.3% to reach USD 19.45 billion by 2034.

The surge in smartphone adoption worldwide is a key driver for RCS, enabling these advanced messaging systems to reach a broader audience. As consumers transition from basic phones to smartphones with enhanced connectivity and operating systems, the pace of RCS adoption accelerates. This growth is fueled by RCS's ability to support multimedia content, interactive features, and app-like messaging experiences. The increasing variety of connected devices motivates telecom operators to implement RCS, expanding business outreach and accelerating commercialization in both mature and emerging markets. The deployment of 5G networks offers the speed, bandwidth, and low-latency environment necessary for more reliable and efficient RCS messaging. With improved connectivity, features such as high-resolution media sharing, real-time notifications, interactive chatbots, and branded messaging perform more seamlessly. As carriers upgrade to 5G, enterprises gain opportunities to enhance customer interactions, boosting adoption rates and driving revenue growth globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.64 Billion |

| Forecast Value | $19.45 Billion |

| CAGR | 21.3% |

The A2P segment held a 61% share in 2024 and is expected to grow at a CAGR of 19% through 2034. A2P RCS is widely used across sectors for interactive campaigns, secure alerts, and personalized customer engagement. Its recognition as a legitimate communication channel further strengthens its adoption, while CPaaS providers have simplified integration for enterprises. The ability to combine visuals and interactivity makes A2P the most commercially advanced segment of the Rich Communication Services Market.

The cloud-based RCS solutions segment was valued at USD 1.79 billion in 2024. These platforms provide scalable, low-latency messaging infrastructure, support for A2P campaigns, and elastic capacity to manage fluctuating demand while offering automatic updates. CPaaS providers have turned RCS into a service via accessible APIs, streamlining enterprise adoption and making it easier to deploy across industries.

United States Rich Communication Services Market reached USD 891.6 million in 2024. Strong smartphone penetration, the gradual rollout of 5G, and adoption across retail, banking, and telecom sectors support market growth. The increasing use of AI-enabled chatbots, A2P messaging, and brand-verified messaging enhances RCS-based customer engagement, accelerating its acceptance among major enterprises.

Key players in the Global Rich Communication Services Market include AT&T, China Mobile, Deutsche Telekom, Google, Huawei Technologies, KDDI, NTT DOCOMO, T-Mobile US, Verizon Communications, and Vodafone. Companies in the Rich Communication Services Market focus on strategies such as expanding cloud-based offerings, integrating AI and interactive features, and forming strategic partnerships with telecom operators. They emphasize A2P solutions to increase enterprise adoption, invest in scalable APIs for easier integration, and leverage 5G networks to enhance service reliability. Many firms also prioritize expanding global reach, improving customer experience through rich messaging features, and enhancing brand visibility to strengthen their market position and capture new revenue streams.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Communication type

- 2.2.3 Deployment model

- 2.2.4 Organization size

- 2.2.5 Application

- 2.2.6 Industry vertical

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook

- 2.6 Strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Smartphone penetration

- 3.2.1.2 5G network expansion

- 3.2.1.3 Enterprise adoption of A2P messaging

- 3.2.1.4 Shift from SMS to rich messaging

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Interoperability challenges

- 3.2.2.2 User privacy concerns

- 3.2.3 Market opportunities

- 3.2.3.1 E-commerce & retail engagement

- 3.2.3.2 Banking & financial services

- 3.2.3.3 Travel & hospitality services

- 3.2.3.4 Regional market expansion (MEA & APAC)

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Global

- 3.4.1.1 FCC Classification as Information Services

- 3.4.1.2 ITU Security Requirements (ITU-T X.1817)

- 3.4.1.3 GDPR & Data Privacy Implications

- 3.4.1.4 HIPAA Compliance for Healthcare Applications

- 3.4.2 North America

- 3.4.3 Europe

- 3.4.4 Asia Pacific

- 3.4.5 Latin America

- 3.4.6 Middle East & Africa

- 3.4.1 Global

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.7.3 Technology readiness & maturity assessment

- 3.8 Pricing analysis

- 3.8.1 Operator pricing strategies (per-message vs subscription)

- 3.8.2 CPaaS pricing models (pay-as-you-go vs enterprise plans)

- 3.8.3 RCS vs SMS cost comparison

- 3.8.4 A2P messaging rate cards by region

- 3.8.5 Emerging monetization models

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.10.1 GSMA patent landscape

- 3.10.2 Key patent holders & licensing models

- 3.10.3 Standards-Essential Patents (SEPs)

- 3.10.4 Litigation & Dispute Trends

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.11.5 Carbon footprint considerations

- 3.12 Use cases

- 3.12.1 Advanced conversational AI applications

- 3.12.2 Augmented Reality (AR) messaging

- 3.12.3. IoT & M2 M messaging

- 3.12.4 Metaverse & immersive experiences

- 3.13 Best case scenario

- 3.14 Investment & funding analysis

- 3.14.1 Operator CAPEX in RCS Infrastructure

- 3.14.2 CPaaS Platform Funding Rounds

- 3.14.3 M&A Activity (Tata-Kaleyra, Google-Jibe)

- 3.14.4 Venture capital investment in messaging startups

- 3.14.5 Strategic partnerships & joint ventures

- 3.15 Consumer & enterprise sentiment analysis

- 3.15.1 Consumer awareness & understanding

- 3.15.2 Enterprise adoption sentiment

- 3.16 Message traffic & network impact analysis

- 3.16.1 Global RCS message volume trends

- 3.16.2 Network bandwidth & capacity requirements

- 3.16.3 Infrastructure load & performance

- 3.16.4 Quality of service (QoS) metrics

- 3.16.5 Network monetization & traffic management

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

- 4.7 Product and service benchmarking

- 4.8 R&D investment analysis

- 4.9 Vendor selection criteria

Chapter 5 Market Estimates & Forecast, By Communication Type, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 A2P

- 5.3 P2A

- 5.4 P2P

Chapter 6 Market Estimates & Forecast, By Deployment Model, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Cloud

- 6.3 On-premises

Chapter 7 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Large enterprises

- 7.3 SME

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Rich calls and messaging

- 8.3 Cloud storage

- 8.4 Marketing and advertising campaign

- 8.5 Content delivery

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Industry Vertical, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Rich calls and messaging

- 9.3 Cloud storage

- 9.4 Marketing and advertising campaign

- 9.5 Content delivery

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.3.8 Poland

- 10.3.9 Romania

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Vietnam

- 10.4.7 Indonesia

- 10.4.8 Pakistan

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Iran

Chapter 11 Company Profiles

- 11.1 Global companies

- 11.1.1 AT&T

- 11.1.2 China Mobile

- 11.1.3 Deutsche Telekom

- 11.1.4 Google

- 11.1.5 Huawei Technologies

- 11.1.6 Infobip

- 11.1.7 KDDI

- 11.1.8 Orange

- 11.1.9 Sinch

- 11.1.10 Tata Communications

- 11.1.11 Telefonica

- 11.1.12 Verizon Communications

- 11.1.13 Vodafone Group

- 11.2 Regional players

- 11.2.1 Clickatell

- 11.2.2 CM.com

- 11.2.3 Gupshup

- 11.2.4 Syniverse

- 11.2.5 Tanla Platforms

- 11.3 Emerging players

- 11.3.1 Telnyx

- 11.3.2 Webex Connect