PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885915

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885915

Lithium-Ion Battery Recycling Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

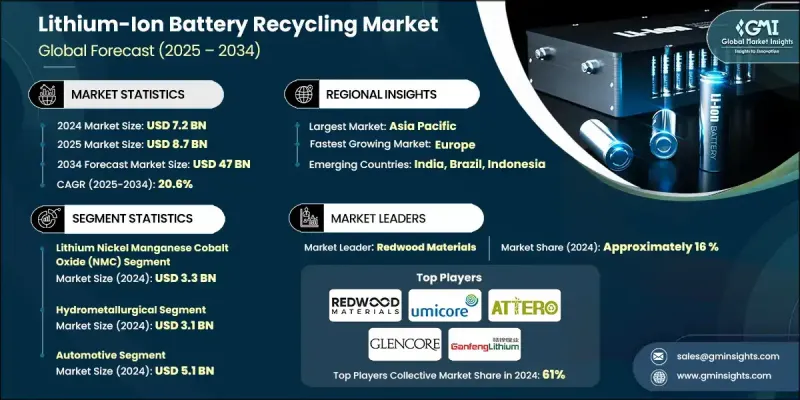

The Global Lithium-Ion Battery Recycling Market was valued at USD 7.2 billion in 2024 and is estimated to grow at a CAGR of 20.6% to reach USD 47 billion by 2034.

The industry has rapidly shifted from a specialized environmental service to a central part of the clean energy supply chain worldwide. Over the past few years, hydrometallurgical processes have become the preferred option due to their ability to recover high-value metals such as lithium, cobalt, and nickel with far greater precision than conventional smelting. This transition is further supported by updated regulatory frameworks, including new global rules that reward recyclers achieving high metal recovery efficiencies, encouraging wider adoption of water-based refining technologies. The industry is also experiencing strong momentum in the production and trade of black mass, which serves as an intermediate material for further metal extraction. Smaller recyclers are increasingly participating in this segment by supplying black mass to larger hydrometallurgical refiners. With the growing volume of battery waste generated from electric mobility, energy storage projects, and manufacturing scrap, the market is positioned for accelerated expansion throughout the forecast period.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.2 Billion |

| Forecast Value | $47 Billion |

| CAGR | 20.6% |

The hydrometallurgical segment was valued at USD 3.1 billion in 2024 and is forecast to grow at a 20.9% CAGR through 2034, reaching 36.1% of the global market. The shift toward hydrometallurgy is driven by its higher recovery efficiency, lower emissions profile, and ability to reclaim more than 90% of critical metals. Producers are scaling up water-based refining facilities to align with rising sustainability expectations and strengthen their metal recovery capabilities.

The automotive segment was valued at USD 5.1 billion in 2024 and is projected to grow at a 20.5% CAGR from 2025 to 2034, accounting for a 71.2% share. Most recyclable lithium-ion batteries originate from electric vehicles and related manufacturing activities. As EV production expands globally, the availability of end-of-life and defective batteries continues to increase, making the automotive sector a key contributor to recycling supply streams and long-term industry growth.

U.S. Lithium-Ion Battery Recycling Market generated USD 1.21 billion in 2024. Growth in the country is supported by large-scale recycling projects backed by policy incentives, funding programs, and expanding domestic battery manufacturing. Federal and state-level support is accelerating the development of recycling hubs near major production facilities, reinforcing the recovery of essential metals such as lithium, nickel, and cobalt.

Major companies active in the Lithium-Ion Battery Recycling Market include Redwood Materials, Ganfeng Lithium, Umicore, Glencore, and Attero Recycling. Companies in the Lithium-Ion Battery Recycling Market are implementing multiple strategies to strengthen their presence and expand their competitive advantage. Many are investing heavily in hydrometallurgical capacity to improve recovery rates and reduce environmental impact, while also modernizing facilities with automation and advanced separation technologies. Firms are forging long-term supply agreements with EV manufacturers and battery producers to secure consistent waste streams. Strategic collaborations with government agencies help unlock funding and regulatory support for large-scale recycling initiatives.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Chemistry

- 2.2.3 Process

- 2.2.4 Source

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Chemistry, 2025 - 2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Lithium Nickel Manganese Cobalt Oxide (NMC)

- 5.3 Lithium Iron Phosphate (LFP)

- 5.4 Lithium Cobalt Oxide (LCO)

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Process, 2025 - 2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Pyrometallurgical

- 6.3 Hydrometallurgical

- 6.4 Physical/Mechanical

Chapter 7 Market Estimates and Forecast, By Source, 2025 - 2034 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Automotive

- 7.2.1 Commercial vehicles (electric buses, vans)

- 7.2.2 Off-road electric vehicles (construction, mining fleets)

- 7.2.3 Battery manufacturing scrap (giga factories and rejects)

- 7.2.4 Passenger electric vehicles (BEVs and PHEVs)

- 7.3 Non-Automotive

- 7.3.1 Power tools and industrial electronics (cordless drills, UPS units)

- 7.3.2 Stationary energy storage systems (grid and residential)

- 7.3.3 Micromobility devices (e-scooters, bikes, drones)

- 7.3.4 Consumer electronics (smartphones, laptops, tablets)

Chapter 8 Market Estimates and Forecast, By Region, 2025 - 2034 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 3R Recycler

- 9.2 ACE Green Recycling

- 9.3 American Battery Technology Company

- 9.4 Attero Recycling

- 9.5 BatX Energies

- 9.6 Cirba Solutions

- 9.7 Ganfeng Lithium

- 9.8 Glencore

- 9.9 Li-Cycle Holdings Corporation

- 9.10 Lohum Cleantech

- 9.11 Neometals

- 9.12 RecycLiCo Battery Material

- 9.13 Redwood Materials

- 9.14 SK TES

- 9.15 Umicore