PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892657

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892657

Europe Wearable Bioelectronics Skin Patches Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

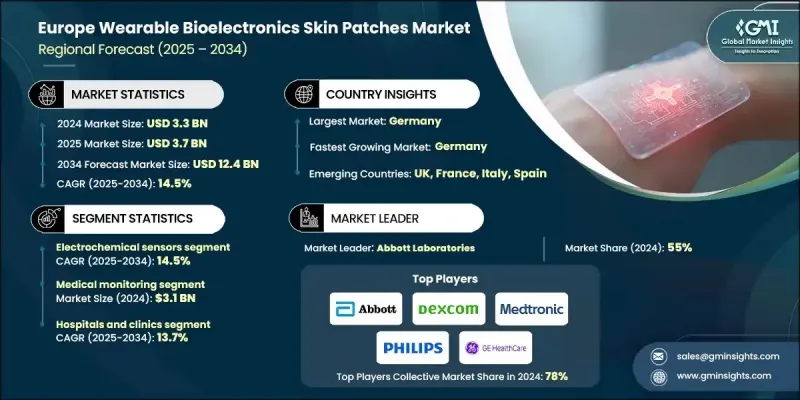

Europe Wearable Bioelectronics Skin Patches Market was valued at USD 3.3 billion in 2024 and is estimated to grow at a CAGR of 14.5% to reach USD 12.4 billion by 2034.

Steady market momentum is supported by the rising burden of chronic and lifestyle-related illnesses, stronger interest in round-the-clock health tracking, and major progress in flexible electronics and biointegrated materials. Wearable bioelectronic skin patches are designed to conform to the skin and continuously monitor various physiological signals, including hydration levels, heart rhythm patterns, muscle activity, and glucose levels. Their ability to capture real-time data without invasive procedures has made them essential to personalized healthcare, supporting early condition detection and more proactive disease management. These advanced patches combine embedded sensors with wireless connectivity, allowing seamless monitoring across medical, fitness, and wellness-focused environments. With consumer health technology gaining widespread acceptance, manufacturers are increasing their focus on intuitive designs, comfort-driven materials, and seamless smartphone or wearable-device integration. This shift has broadened usage across daily routines, transforming skin-contact bioelectronics into a mainstream component of personal and remote health management throughout Europe.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.3 billion |

| Forecast Value | $12.4 billion |

| CAGR | 14.5% |

The electrochemical sensors segment is projected to grow at a 14.5% CAGR throughout 2025-2034. This segment leads due to its strong ability to deliver accurate biochemical insights in real time, allowing reliable monitoring of biomarkers such as electrolytes, lactate, glucose, and pH based on measurable chemical reactions at sensor interfaces.

The medical monitoring segment generated USD 3.1 billion in 2024, maintaining the largest share of the market. This segment continues to dominate due to Europe's focus on enhancing chronic disease oversight and reducing avoidable hospital admissions. These patches provide continuous monitoring for long-term health conditions, making them valuable for managing issues such as diabetes, post-surgical recovery, and irregular cardiac activity.

Germany Wearable Bioelectronics Skin Patches Market accounted for USD 693.2 million in 2024. The country is emerging as a key growth center across Europe, supported by its sizable population, sophisticated healthcare infrastructure, and rising prevalence of chronic illnesses that require ongoing monitoring and preventive management.

Prominent companies operating in Europe Wearable Bioelectronics Skin Patches Market include Screente, SmartCardia, Medtronic plc, SteadySense, Xsensio, GE Healthcare Technologies, Abbott Laboratories, Dexcom, Insulet Corporation, 2M Engineering, Beneli, Baxter International, Boston Scientific, Sencure, and Koninklijke Philips N.V. Companies in Europe's wearable bioelectronics skin patches market are reinforcing their market presence by advancing sensor technology, enhancing device comfort, and integrating platforms with digital health ecosystems. Many firms are prioritizing R&D to achieve higher accuracy, longer wear duration, and improved biocompatibility. Collaborations with healthcare providers, research institutes, and wellness-tech developers help accelerate product validation and broaden adoption. Manufacturers are also expanding their product portfolios to address multiple clinical and consumer needs, from chronic disease tracking to fitness monitoring. Investments in wireless communication, mobile applications, and cloud-based analytics improve real-time data interpretation and user engagement.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Country trends

- 2.2.2 Type trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for non-invasive and real-time health monitoring solutions

- 3.2.1.2 Technological advancements in flexible and stretchable electronics

- 3.2.1.3 Growing prevalence of chronic diseases

- 3.2.1.4 Increasing health awareness and fitness consciousness

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development and manufacturing costs

- 3.2.2.2 Concerns regarding data privacy and the security

- 3.2.3 Market opportunities

- 3.2.3.1 AI-driven analytics and predictive health insights

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Patent analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Key developments

- 4.7.1 Mergers and acquisitions

- 4.7.2 Partnerships and collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Electrochemical sensors

- 5.3 ECG sensors

- 5.4 Temperature sensors

- 5.5 EMG sensors

- 5.6 Other types

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Fitness and wellness

- 6.3 Medical monitoring

- 6.4 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospital and clinics

- 7.3 Home care settings

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Country, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Germany

- 8.3 France

- 8.4 UK

- 8.5 Italy

- 8.6 Spain

- 8.7 Netherlands

Chapter 9 Company Profiles

- 9.1 2M Engineering

- 9.2 Abbott Laboratories

- 9.3 Beneli

- 9.4 Baxter International

- 9.5 Boston Scientific

- 9.6 Dexcom

- 9.7 GE Healthcare Technologies

- 9.8 Insulet Corporation

- 9.9 Koninklijke Philips N.V.

- 9.10 Medtronic plc

- 9.11 Sencure

- 9.12 Screentec

- 9.13 SmartCardia

- 9.14 SteadySense

- 9.15 Xsensio