PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892916

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892916

Wearable Bioelectronic Skin Patches Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

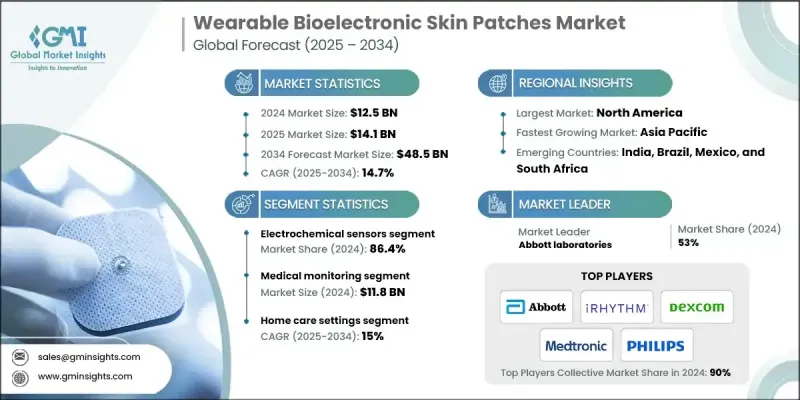

The Global Wearable Bioelectronic Skin Patches Market was valued at USD 12.5 billion in 2024 and is estimated to grow at a CAGR of 14.7% to reach USD 48.5 billion by 2034.

Market growth is driven by rising adoption of real-time health monitoring, increasing prevalence of chronic diseases, and rapid advancements in flexible biosensing technologies. These next-generation patches integrate multi-sensor systems, wireless connectivity, and AI-enabled analytics, offering continuous insights into cardiovascular, metabolic, and physiological parameters. As healthcare systems shift toward preventive and remote care models, wearable bioelectronic patches are becoming indispensable for long-term monitoring, early diagnosis, and personalized therapy management. The growing global focus on telehealth, combined with patient preference for non-invasive solutions, further accelerates market uptake. With expanding R&D in stretchable electronics and biocompatible materials, these patches are evolving into advanced platforms that seamlessly integrate with digital health ecosystems, enhancing clinical outcomes and reducing patient burden.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.5 Billion |

| Forecast Value | $48.5 billion |

| CAGR | 14.7% |

The market is primarily segmented by type, with the electrochemical sensors segment holding 86.4% share in 2024, making it the highest revenue segment in the global market. Electrochemical sensors dominate due to their precision in biochemical monitoring, especially in glucose tracking, electrolyte assessment, and lactate analysis. Their integration within wearable patches supports a wide range of applications from diabetes management to sports performance, owing to high sensitivity, cost-effectiveness, and compatibility with flexible substrates. These sensors transform chemical reactions into electrical signals, enabling accurate and continuous monitoring through sweat and interstitial fluids.

In terms of application, the medical monitoring segment generated USD 11.8 million in 2024, making it the dominant application segment globally. This segment is driven by the need for uninterrupted monitoring of chronic conditions such as arrhythmia, diabetes, hypertension, and post-surgical recovery. Medical monitoring patches provide continuous, high-quality data outside clinical environments, reducing hospital readmissions and enabling early detection of complications. Their use is expanding rapidly as healthcare providers increasingly adopt remote patient monitoring platforms and hybrid care models. As hospitals and clinicians prioritize precision diagnostics, cost reduction, and improved patient outcomes, bioelectronic skin patches are becoming central to modernized care delivery.

North America Wearable Bioelectronic Skin Patches Market held 44.4% share in 2024. Strong healthcare infrastructure, high adoption of digital health tools, and widespread use of remote monitoring systems are key growth drivers. The region benefits from rapid integration of biosensor technologies into clinical workflows, rising chronic disease burden, and expanding reimbursement for remote monitoring devices. Additionally, major industry players headquartered in North America, such as Abbott, Dexcom, and iRhythm, continue to invest in R&D, product innovation, and large-scale commercialization. The strong presence of telehealth platforms, combined with increasing consumer awareness of continuous health tracking, positions North America as a long-term leader in wearable bioelectronic skin patches.

Key players in the Global Wearable Bioelectronic Skin Patches Market include 2M Engineering, Abbott Laboratories, Baxter International, Biolinq, Boston Scientific, Dexcom, Epicore Biosystems, GE Healthcare Technologies, GENTAG, Insulet Corporation, iRhythm Technologies, Koninklijke Philips, LifeSignals, Medtronic, Sinocare, SmartCardia, VitalConnect, and VivaLNK Companies. The wearable bioelectronic skin patches market is focusing on multi-layered strategies to strengthen its market foothold. Leading players are investing heavily in R&D to develop flexible, biocompatible materials, advanced electrochemical and ECG sensor platforms, and AI-driven analytics that enhance clinical accuracy and user comfort. Strategic partnerships with hospitals, digital health platforms, and research institutions are accelerating the integration of patches into remote patient monitoring and telehealth ecosystems.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Production trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for non-invasive and real-time health monitoring solutions

- 3.2.1.2 Technological advancements in flexible and stretchable electronics

- 3.2.1.3 Growing prevalence of chronic diseases

- 3.2.1.4 Increasing health awareness and fitness consciousness

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development and manufacturing costs

- 3.2.2.2 Concerns regarding data privacy and the security

- 3.2.3 Market opportunities

- 3.2.4 Remote health monitoring

- 3.2.5 Integration with AI and IoT for personalized healthcare

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Asia Pacific

- 3.4.3 Europe

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Key developments

- 4.7.1 Mergers and acquisitions

- 4.7.2 Partnerships and collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Electrochemical sensors

- 5.3 ECG sensors

- 5.4 Temperature sensors

- 5.5 EMG sensors

- 5.6 Other types

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Fitness and wellness

- 6.3 Medical monitoring

- 6.4 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals and clinics

- 7.3 Home care settings

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.3 Germany

- 8.3.4 UK

- 8.3.5 France

- 8.3.6 Spain

- 8.3.7 Italy

- 8.3.8 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 2M Engineering

- 9.2 Abbott Laboratories

- 9.3 Biolinq

- 9.4 Baxter International

- 9.5 Boston Scientific

- 9.6 Dexcom

- 9.7 Epicore Biosystems, Inc.

- 9.8 GE Healthcare Technologies Inc.

- 9.9 GENTAG, Inc.

- 9.10 Insulet Corporation

- 9.11 iRhythm Technologies, Inc.

- 9.12 Koninklijke Philips N.V.

- 9.13 LifeSignals, Inc.

- 9.14 Medtronic plc

- 9.15 Sinocare

- 9.16 SmartCardia Inc.

- 9.17 VitalConnect

- 9.18 VivaLNK, Inc.