PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892660

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892660

North America Window Coverings Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

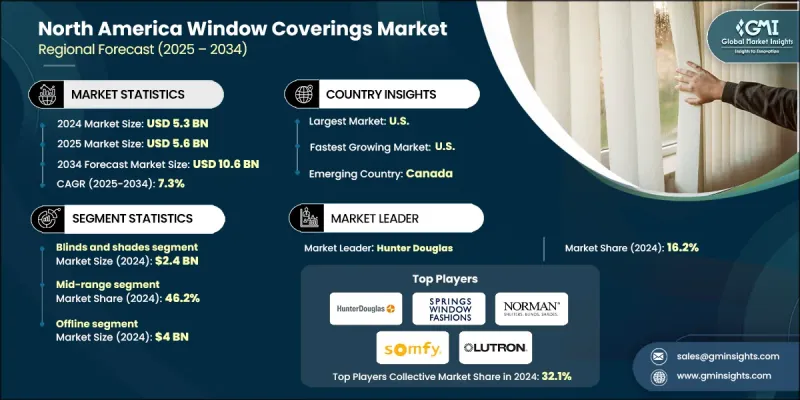

North America Window Coverings Market was valued at USD 5.3 billion in 2024 and is estimated to grow at a CAGR of 7.3% to reach USD 10.6 billion by 2034.

Growth across the region is shaped by the expanding adoption of smart home technologies and a noticeable shift in consumer expectations for convenience-driven products. As connected home ecosystems become more common, homeowners increasingly look for window coverings that seamlessly integrate with their digital environments. Motorized solutions that can be controlled through mobile apps or voice-enabled platforms are becoming standard selections rather than premium upgrades. These systems enable remote operation, automated scheduling, and enhanced home security by simulating occupancy, supporting a more intelligent, energy-efficient living experience. The growing incorporation of IoT sensors and AI technologies is elevating the market further by enabling window coverings that respond intuitively to environmental changes such as light levels, temperature variations, and energy usage patterns. This transition from manual or basic motorized products to more predictive, data-driven systems underscores the market's shift toward fully interconnected home automation. As a result, North American consumers increasingly prioritize functionality, efficiency, and comfort, driving continued interest in advanced, smart-ready window covering solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.3 Billion |

| Forecast Value | $10.6 Billion |

| CAGR | 7.3% |

In 2024, the blinds and shades segment generated USD 2.4 billion. Their widespread appeal stems from their versatility, visual appeal, and ability to meet a broad range of functional requirements, making them suitable for residential, commercial, and institutional spaces.

The mid-range price segment accounted for a 46.2% share in 2024. This category remains dominant because it blends affordability with dependable quality. Consumers seeking durable and visually appealing window coverings often choose mid-range products, which now commonly incorporate upgraded features once limited to premium collections.

U.S. Window Coverings Market held 71.2% share in 2024, generating USD 4.1 billion. Demand for motorized and smart-enabled coverings continues to rise as households adopt integrated smart home systems. Features such as remote-control capabilities, automated scheduling, and compatibility with voice-operated platforms have become highly attractive to consumers seeking greater home convenience and customization.

Prominent companies in the North America Window Coverings Market include Lutron Electronics, Kirsch, Comfortex Window Fashions, Normann Window Fashions, Somfy, MechoShade Systems, Bali, Graber, Alta Window Fashions, Hunter Douglas, Chicology, Springs Window Fashions, Levolor, Insolroll Window Shading Systems, and 3 Day Blinds. Companies in the North America Window Coverings Market are strengthening their presence by expanding smart-enabled product portfolios, enhancing integration with home automation platforms, and focusing on energy-efficient designs. Many manufacturers are investing in motorization technologies, app-based control systems, and voice-assistant compatibility to meet growing consumer expectations for connected living. Firms are also prioritizing partnerships with homebuilders, interior designers, and automation specialists to broaden distribution. Product customization, improved material quality, and sustainability-driven innovations help companies differentiate in a competitive landscape. In addition, brands are leveraging digital marketing, e-commerce channels, and virtual design tools to improve customer engagement.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional

- 1.3.2 Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Country

- 2.2.2 Product

- 2.2.3 Material

- 2.2.4 Technology

- 2.2.5 Price range

- 2.2.6 Opacity level

- 2.2.7 End use

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid integration of smart home ecosystems

- 3.2.1.2 Resurgence in residential renovation and urbanization

- 3.2.1.3 Demand for energy-efficient solutions

- 3.2.2 Pitfalls & Challenges

- 3.2.2.1 Volatility in raw material prices

- 3.2.2.2 Stringent safety regulations

- 3.2.3 Opportunities

- 3.2.3.1 Expansion into eco-friendly and recycled materials

- 3.2.3.2 Democratization of motorization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By country

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Country regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Gap Analysis

- 3.9 Risk assessment and mitigation

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Consumer behaviour analysis

- 3.12.1 Purchasing patterns

- 3.12.2 Preference analysis

- 3.12.3 Regional variations in consumer behaviour

- 3.12.4 Impact of e-commerce on buying decision

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By country

- 4.2.1.1 U.S.

- 4.2.1.2 Canada

- 4.2.1 By country

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Blinds and shades

- 5.3 Curtains and drapes

- 5.4 Shutters

- 5.5 Others (valances, etc.)

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Natural

- 6.3 Synthetic

Chapter 7 Market Estimates and Forecast, By Technology, 2021 - 2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Manual covers

- 7.3 Smart covers/automatic covers

Chapter 8 Market Estimates and Forecast, By Price Range, 2021 - 2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Economy

- 8.3 Mid-range

- 8.4 Premium

Chapter 9 Market Estimates and Forecast, By Opacity level, 2021 - 2034 (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Blackout

- 9.3 Room darkening

- 9.4 Light filtering

- 9.5 Sheer/transparent

Chapter 10 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 Residential

- 10.3 Commercial

Chapter 11 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 Online

- 11.2.1 E-commerce

- 11.2.2 Company websites

- 11.3 Offline

- 11.3.1 Specialty stores

- 11.3.2 Retail stores

- 11.3.3 Others (interior design studios & boutiques, etc.)

Chapter 12 Market Estimates and Forecast, By Country, 2021 - 2034 (USD Billion) (Million Units)

- 12.1 Key trends

- 12.2 U.S.

- 12.3 Canada

Chapter 13 Company Profiles

- 13.1 3 Day Blinds

- 13.2 Alta Window Fashions

- 13.3 Bali

- 13.4 Chicology

- 13.5 Comfortex Window Fashions

- 13.6 Graber

- 13.7 Hunter Douglas

- 13.8 Insolroll Window Shading Systems

- 13.9 Kirsch

- 13.10 Levolor

- 13.11 Lutron Electronics

- 13.12 MechoShade Systems

- 13.13 Norman Window Fashions

- 13.14 Somfy

- 13.15 Springs Window Fashions