PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892798

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892798

Window Coverings Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

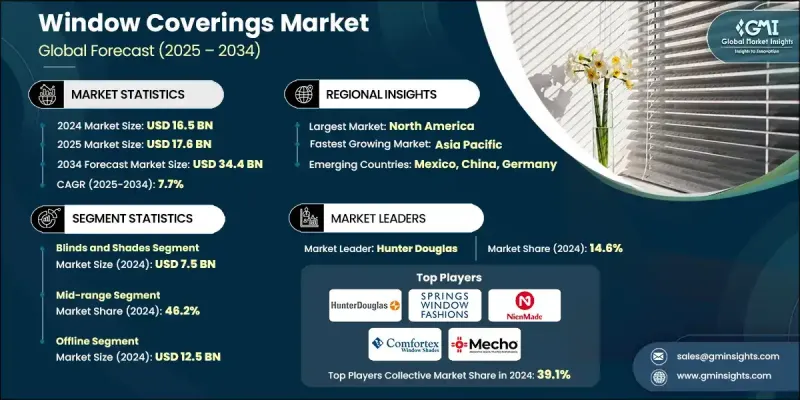

The Global Window Coverings Market was valued at USD 16.5 billion in 2024 and is estimated to grow at a CAGR of 7.7% to reach USD 34.4 billion by 2034.

Growth is fueled by rising interest in connected living and smart home automation, which continues to reshape consumer expectations. As smart speakers and home automation hubs become household norms, motorized blinds and shades are evolving into accessible everyday solutions. These products offer remote operation, customizable schedules, and improved safety features that help create the appearance of an occupied home. The integration of IoT capabilities also enables window coverings to communicate with HVAC and lighting systems, contributing to enhanced energy efficiency and more streamlined home management. With increasing emphasis on reducing energy consumption, consumers are gravitating toward high-performance coverings designed to regulate indoor temperatures. Products such as cellular shades are gaining popularity due to their insulating structure, making them a key component of energy-conscious home design. As global awareness of sustainable living and smart automation grows, the window coverings industry continues to experience steady momentum across both residential and commercial markets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $16.5 Billion |

| Forecast Value | $34.4 Billion |

| CAGR | 7.7% |

The blinds and shades segment generated USD 7.5 billion in 2024, maintaining its leadership position due to its adaptability and broad design range. Their strong appeal across multiple interior styles and functionality needs continues to reinforce their dominant market presence.

The mid-range segment accounted for a 46.2% share in 2024 and remains the largest pricing category. This segment appeals to consumers seeking products that blend durability, style, and advanced features without premium-level pricing. Increasingly, mid-tier offerings include options such as motorized control, improved insulation materials, and enhanced UV protection, making them an attractive middle ground for practical and style-focused buyers.

U.S. Window Coverings Market held 71.2% share in 2024, generating USD 3.8 billion during 2025-2034. Its leadership is supported by a robust home renovation culture and widespread adoption of smart home technologies. Consumers across the region continue to favor automated and energy-efficient window solutions that align with modern lifestyle expectations and sustainability priorities.

Key companies active in the Global Window Coverings Market include Bombay Dyeing & Manufacturing Co Ltd., Ching Feng Home Fashions Co., Comfortex Window Fashions, Coulisse B.V., Griesser AG, Hunter Douglas Inc., MechoShade Systems, LLC, Lafayette Interior Fashions, Insolroll Window Shading Systems, Nien Made Enterprise Co. Ltd, Schenker Storen AG, SKANDIA WINDOW FASHIONS, INC., Springs Window Fashions, TOSO CO. LTD, and Welspun.

Companies in the Global Window Coverings Market are strengthening their presence by expanding their portfolios with smart, app-enabled, and motorized products that align with growing home automation trends. Many manufacturers are investing in energy-efficient fabrics, sustainable materials, and customizable design options to appeal to environmentally conscious and style-oriented consumers. Partnerships with smart home technology providers, along with e-commerce expansion, allow brands to reach wider audiences. Firms are also prioritizing automated production techniques and advanced material engineering to enhance product durability and reduce lead times. Marketing strategies focused on personalization, virtual visualization tools, and direct-to-consumer channels further help companies capture market share in a rapidly evolving home decor landscape.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Material

- 2.2.4 Technology

- 2.2.5 Price range

- 2.2.6 Opacity level

- 2.2.7 End use

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid integration of smart home ecosystems

- 3.2.1.2 Resurgence in residential renovation and urbanization

- 3.2.1.3 Demand for energy-efficient solutions

- 3.2.2 Pitfalls & Challenges

- 3.2.2.1 Volatility in raw material prices

- 3.2.2.2 Stringent safety regulations

- 3.2.3 Opportunities

- 3.2.3.1 Expansion into eco-friendly and recycled materials

- 3.2.3.2 democratization of motorization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Gap Analysis

- 3.9 Risk assessment and mitigation

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Consumer behaviour analysis

- 3.12.1 Purchasing patterns

- 3.12.2 Preference analysis

- 3.12.3 Regional variations in consumer behaviour

- 3.12.4 Impact of e-commerce on buying decision

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Blinds and shades

- 5.3 Curtains and drapes

- 5.4 Shutters

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Natural

- 6.3 Synthetic

Chapter 7 Market Estimates and Forecast, By Technology, 2021 - 2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Manual covers

- 7.3 Smart covers/automatic covers

Chapter 8 Market Estimates and Forecast, By Price Range, 2021 - 2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Economy

- 8.3 Mid-range

- 8.4 Premium

Chapter 9 Market Estimates and Forecast, By Opacity level, 2021 - 2034 (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Blackout

- 9.3 Room darkening

- 9.4 Light filtering

- 9.5 Sheer/transparent

Chapter 10 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 Residential

- 10.3 Commercial

Chapter 11 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 Online

- 11.2.1 E-commerce

- 11.2.2 Company websites

- 11.3 Offline

- 11.3.1 Specialty stores

- 11.3.2 Retail stores

- 11.3.3 Others

Chapter 12 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Million Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 Japan

- 12.4.3 India

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 Middle East and Africa

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Bombay Dyeing & Manufacturing Co Ltd.

- 13.2 Ching Feng Home Fashions Co.

- 13.3 Comfortex Window Fashions

- 13.4 Coulisse B.V.

- 13.5 Griesser AG

- 13.6 Hunter Douglas Inc.

- 13.7 Insolroll Window Shading Systems

- 13.8 Lafayette Interior Fashions

- 13.9 MechoShade Systems, LLC

- 13.10 Nien Made Enterprise Co. Ltd

- 13.11 Schenker Storen AG

- 13.12 SKANDIA WINDOW FASHIONS, INC.

- 13.13 Springs Window Fashions

- 13.14 TOSO CO. LTD

- 13.15 Welspun