PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892663

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892663

DC Motor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

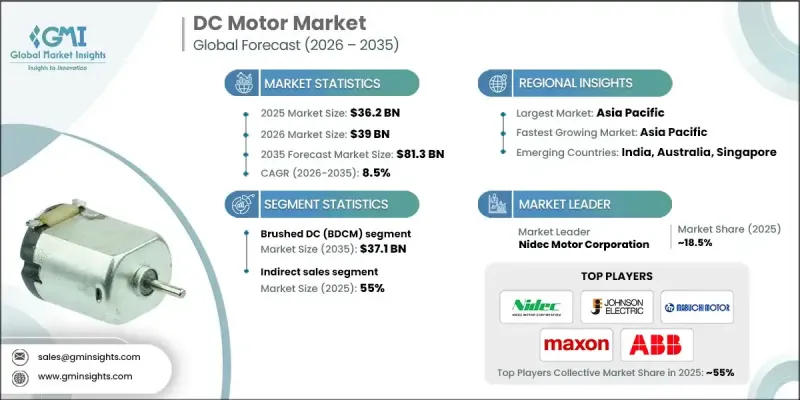

The Global DC Motor Market was valued at USD 36.2 billion in 2025 and is estimated to grow at a CAGR of 8.5% to reach USD 81.3 billion by 2035.

The expanding electric vehicle landscape is reshaping the industry as regulatory pressures, rising environmental awareness, and steady technological improvements continue to accelerate EV adoption. Lower production costs for EV components and the strong need for high-torque, efficiently controlled motors at low speeds have increased the use of both brushed and brushless DC motors in propulsion systems. Ongoing advancements in charging networks and battery systems are further boosting demand. Industrial automation is also becoming a major contributor to DC motor growth, as these motors act as the operational core for automated machinery across multiple sectors. Their precise speed regulation and seamless integration with digital control systems make them the preferred choice for applications that require accuracy and adaptable performance. The growing utilization of robotic systems, advanced handling equipment, and precision tools highlights the essential role DC motors play in maintaining production quality and throughput.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $36.2 Billion |

| Forecast Value | $81.3 Billion |

| CAGR | 8.5% |

The brushed DC (BDCM) category reached USD 20.3 billion in 2025 and is forecast to rise to USD 37.1 billion by 2035. This segment remains influential across consumer electronics due to its straightforward design, cost-effective structure, and reduced manufacturing complexity. Their mechanical commutation systems allow for a product that is easy for manufacturers to produce and maintain, while also requiring limited initial investment from buyers. These attributes make BDCMs an appealing option in markets where pricing considerations outweigh enhanced performance requirements.

The indirect sales channel generated USD 19.9 billion in 2025, accounting for a 55% share. Indirect distribution through partners such as third-party vendors, dealers, and regional distributors provides companies with broader market access and faster delivery capabilities. Well-established networks within key sectors enable manufacturers to scale more efficiently without building extensive in-house sales infrastructures. This channel is expected to expand in developing regions where distributors possess strong local insight and can streamline product deployment and customer service.

U.S. DC Motor Market was valued at USD 5.4 billion in 2025 and is projected to achieve a CAGR of 7.7% from 2026 to 2035. The rising share of electric vehicles in the U.S., increasing from 0.2% in 2011 to 4.6% in 2021, has created consistent momentum for DC motors used in EV systems. Government-backed infrastructure plans aiming to deploy millions of EVs and charging stations by 2030 are expected to intensify demand. As investment increases across mobility platforms, DC motors used in drivetrain components, cooling units, pumps, and auxiliary systems are expected to see significant market expansion, positioning the U.S. as one of the fastest-growing regions for mobility-focused DC motor applications.

Key companies in the Global DC Motor Market include ABB, AMETEK, Allied Motion, Inc., ARC Systems Inc., Continental AG, DENSO Corporation, Dunkermotoren GmbH, Johnson Electric Holdings Limited, Mabuchi Motor, Maxon Motor, Minebea Mitsumi, Nidec Motor Corporation, ORIENTAL MOTOR CORP, Robert Bosch, and Zhejiang Songtian Automotive Motor System Co., Ltd. Companies competing in the Global DC Motor Market are implementing several strategies to strengthen their overall position. Many are investing in advanced motor design to enhance torque density, energy efficiency, and digital compatibility, supporting the shift toward automation and electrified mobility. Firms are also expanding manufacturing capacity and regional production hubs to meet rising global demand while reducing lead times. Strategic collaborations with EV manufacturers, industrial automation firms, and system integrators are helping companies secure long-term supply agreements. Organizations are diversifying product portfolios to serve emerging applications, while also adopting sustainability-driven practices to align with environmental regulations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Motor type trends

- 2.2.3 Power rating trends

- 2.2.4 End use industry trends

- 2.2.5 Distribution channel trends

- 2.3 CXO perspective: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

- 2.5 Strategic recommendations

- 2.5.1 Supply chain diversification strategy

- 2.5.2 Product portfolio enhancement

- 2.5.3 Partnership and alliance opportunities

- 2.5.4 Cost management and pricing strategy

- 2.6 Decision framework

- 2.6.1 Investment priority matrix

- 2.6.2 ROI analysis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Regulatory framework

- 3.5.1 By region

- 3.6 Porter's five forces analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Product portfolio benchmarking

- 4.7 Key developments

- 4.7.1 Mergers & acquisitions

- 4.7.2 Partnerships & collaborations

- 4.7.3 New Product Launches

- 4.7.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Motor Type 2022 - 2035 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Brushed DC (BDCM)

- 5.3 Brushless DC (BLDC)

Chapter 6 Market Estimates & Forecast, By Power Rating, 2022 - 2035 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Micro Motors (< 1W)

- 6.3 Fractional HP Motors (1W - 750W)

- 6.4 Integral HP Motors (750W - 75 kW)

- 6.5 Large Motors (>75 kW)

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2022 - 2035 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Automotive

- 7.3 Robotics

- 7.4 Consumer Electronics and Appliance

- 7.5 Industrial Automation and Manufacturing

- 7.6 Medical Devices and Healthcare

- 7.7 HVAC and Building Automation

- 7.8 Aerospace and Defense

- 7.9 Agriculture and Construction

- 7.10 Marine and Shipbuilding

- 7.11 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Direct Sales

- 8.3 Indirect Sales

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 U.K.

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 10.1 ABB

- 10.2 AMETEK

- 10.3 Allied Motion, Inc.

- 10.4 ARC Systems Inc

- 10.5 Continental AG

- 10.6 DENSO Corporation

- 10.7 Dunkermotoren GmbH

- 10.8 Johnson Electric Holdings Limited.

- 10.9 Mabuchi Motor

- 10.10 Maxon Motor

- 10.11 Minebea Mitsumi

- 10.12 Nidec Motor Corporation

- 10.13 ORIENTAL MOTOR CORP

- 10.14 Robert Bosch

- 10.15 Zhejiang Songtian Automotive Motor System Co., Ltd