PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911458

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911458

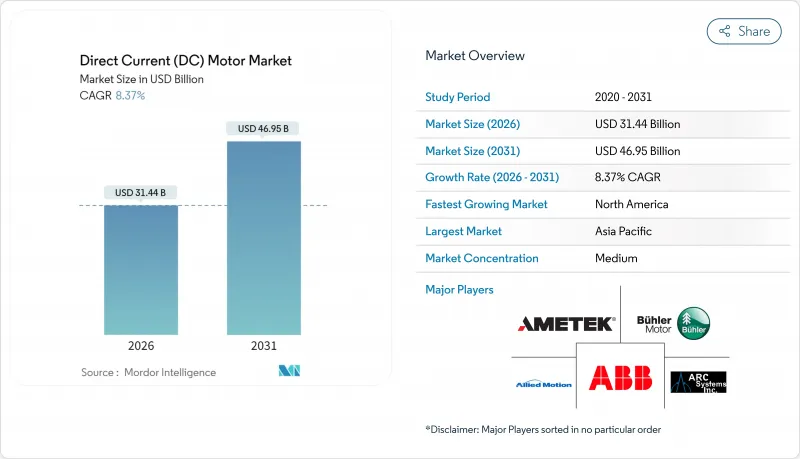

Direct Current (DC) Motor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

DC motor market size in 2026 is estimated at USD 31.44 billion, growing from 2025 value of USD 29.01 billion with 2031 projections showing USD 46.95 billion, growing at 8.37% CAGR over 2026-2031.

This robust DC motor market growth rides on electric-vehicle penetration, Industry 4.0 automation, and widening renewable-energy deployments. Brushless DC (BLDC) motors are displacing brushed designs because they cut maintenance, elevate efficiency, and support smart-control functions. Manufacturers strengthen supply chains for rare-earth magnets while experimenting with ferrite alternatives to contain costs. Strategic investments in 48 V automotive systems, IoT-enabled predictive maintenance, and high-power drives for wind and solar tracking broaden adoption opportunities. Asia-Pacific dominates the DC motor market thanks to its manufacturing concentration and policy support, whereas South America registers the fastest revenue acceleration due to utility-scale solar and wind installations.

Global Direct Current (DC) Motor Market Trends and Insights

Accelerating Adoption of Electric Vehicles

Soaring battery-electric and hybrid production reshapes DC motor demand as traction, thermal-management, and auxiliary systems switch to BLDC designs for tighter torque control and higher power density. Tesla's permanent-magnet strategy validated cost and efficiency advantages and prompted mainstream OEMs to follow suit. European carbon-reduction rules intensify the shift, while China bolsters domestic capacity through subsidies for integrated motor-drive lines. Although rare-earth sourcing remains a vulnerability, vertical integration by BYD and supply-reward programs under the U.S. Inflation Reduction Act mitigate immediate risks. Combined, these forces keep the DC motor market on a steep electrification trajectory.

Transition to Energy-Efficient Industrial Automation

Manufacturers embracing Industry 4.0 invest in intelligent DC drives that feed live health metrics into plant clouds. Siemens MindSphere deployments show unplanned downtime cuts of up to 30% when BLDC motors stream vibration and temperature data into predictive-maintenance algorithms. ABB retrofittable smart sensors widen addressable installed bases, enabling lifecycle optimization beyond new-equipment sales. The combination of rising labor costs in Asia and stricter emission rules in the EU strengthens value propositions, while cybersecurity standards such as IEC 62443 dictate secure-by-design firmware. As factories target lights-out operations, the DC motor market benefits from control granularity unavailable in many AC alternatives.

Higher Upfront Cost vs. AC Induction Alternatives

DC solutions often command 15-30% higher purchase prices than comparable AC induction units, impeding uptake where capital budgets are tight. Small and midsize enterprises in emerging economies prioritize near-term cash preservation, so two-year payback hurdles rule out many BLDC retrofits. Vendors introduce leasing models tying monthly fees to verified energy savings, yet these structures depend on reliable smart-meter data and long contracts that some customers resist. Economic slowdowns amplify hesitancy, creating short-term headwinds that temper the DC motor market expansion.

Other drivers and restraints analyzed in the detailed report include:

- Growing HVAC Retrofit Demand for BLDC Fans and Blowers

- Government Incentives for High-Efficiency Motors

- Supply-Chain Volatility of Rare-Earth Magnets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The BLDC segment claimed 62.75% of the DC motor market in 2025 and is tracking toward a 10.02% CAGR up to 2031, underscoring its entrenched leadership. Inner-rotor variants dominate cooling fans, fuel pumps, and robotics, delivering compact form factors and high rpm ceilings. Outer-rotor architectures conquer direct-drive HVAC and wheel-motor roles by slashing gearbox losses and boosting reliability. As rare-earth supply stabilizes, permanent-magnet strengths outnumber cost risks, which sustains premium adoption.

Brushed motors linger in cost-sensitive appliances, starter motors, and workshop tools where simple drive electronics and ample service expertise still appeal. Even so, brush wear limits uptime in mission-critical environments, steering OEM roadmaps toward sensorless BLDC upgrades. The push toward 48 V automotive auxiliaries shines a spotlight on electronically commutated designs able to exploit regenerative energy. Continuous design wins in EV pumps and steer-by-wire systems keep the DC motor market tilted firmly toward brushless innovations.

Motors rated 75-750 W captured 46.05% of the DC motor market size in 2025, thanks to ubiquity across conveyors, HVAC blowers, and small industrial pumps. Standardized footprints and global IEC flanges ease interchangeability, shrinking switching costs for OEMs. High-volume orders help manufacturers optimize automation and squeeze cost curves, reinforcing segment dominance.

Motors above 75 kW show a leading 9.51% CAGR as EV traction, utility-scale trackers, and heavy industrial servos request precise high-torque control. Integrated encoders, thermal sensors, and SiC-based inverters extract additional efficiency, justifying premium prices. At the other end, sub-75 W designs serve consumer electronics where miniaturization, low noise, and battery optimization trump absolute energy-conversion gains. Altogether, diverse power-band dynamics safeguard a resilient DC motor market.

The Direct Current (DC) Motor Market Report is Segmented by Motor Technology (Brushed DC Motors, and Brushless DC Motors), Power Rating (Less Than 75W, 75-750W, 0. 75-75kW, and More), Voltage Class (Less Than 60V, 60-300V, and Greater Than 300V), End-Use Industry (Automotive, Industrial, HVAC, Consumer Electronics, Healthcare, Water Treatment, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retains the crown with 44.00% of 2025 revenue as China's vertically integrated giants internalize magnet, winding, and inverter production. Production-linked incentives in India invite fresh capacity for automotive and industrial motors, while Japan and South Korea leverage precision-engineering reputations to supply micro-motors for electronics and robotics. These structural advantages ensure the region remains the anchor of the DC motor market well beyond the forecast horizon.

North America posts steady gains amid federal credits for clean-energy manufacturing and reshoring moves that expand domestic motor lines. Mexico's automotive corridor absorbs nearshored parts programs, strengthening the cross-border supply chain. Canada's mining and energy sectors specify rugged BLDC drives for remote operations, underpinning specialized demand.

South America leads growth at a 9.18% CAGR into 2031 as Brazil and Argentina commission utility-scale solar and wind arrays that require slew drives and pitch systems using high-torque DC motors. Industrial modernization programs in Brazil add automation projects, and local content rules encourage greenfield motor plants. Europe remains an efficiency-first market; Germany pushes IE4+ adoption in machinery exports, while Nordic countries deploy high-voltage BLDC units in offshore wind farms. Collectively, regional nuances diversify risk for DC motor market stakeholders.

- ABB Ltd.

- Allied Motion Technologies Inc.

- AMETEK Inc.

- Arc Systems Inc.

- Buhler Motor GmbH

- Delta Electronics Inc.

- FAULHABER Group

- Franklin Electric Co., Inc.

- Johnson Electric Holdings Limited

- Maxon Motor AG

- MinebeaMitsumi Inc.

- Nidec Corporation

- Oriental Motor Co., Ltd.

- Portescap SA

- Regal Rexnord Corporation

- Robert Bosch GmbH

- Siemens AG

- Toshiba International Corporation

- WEG S.A.

- Yaskawa Electric Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating adoption of electric vehicles

- 4.2.2 Transition to energy-efficient industrial automation

- 4.2.3 Growing HVAC retrofit demand for BLDC fans and blowers

- 4.2.4 Government incentives for high-efficiency motors

- 4.2.5 48-V electrical architectures in light-duty vehicles

- 4.2.6 IoT-enabled smart DC motor modules

- 4.3 Market Restraints

- 4.3.1 Higher upfront cost vs. AC induction alternatives

- 4.3.2 Supply-chain volatility of rare-earth magnets

- 4.3.3 EMC/EMI compliance hurdles for high-switch-frequency drives

- 4.3.4 Thermal-management limits in compact high-power designs

- 4.4 Industry Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape and Standards

- 4.6 Technological Outlook (Edge and AI analytics)

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Motor Technology

- 5.1.1 Brushed DC (BDC) Motors

- 5.1.1.1 Shunt Wound

- 5.1.1.2 Series Wound

- 5.1.1.3 Compound Wound

- 5.1.1.4 Permanent-Magnet DC (PMDC)

- 5.1.2 Brushless DC (BLDC) Motors

- 5.1.2.1 Inner-Rotor BLDC

- 5.1.2.2 Outer-Rotor BLDC

- 5.1.1 Brushed DC (BDC) Motors

- 5.2 By Power Rating (Output)

- 5.2.1 Less than 75 W

- 5.2.2 75 - 750 W

- 5.2.3 0.75 - 75 kW

- 5.2.4 Greater than 75 kW

- 5.3 By Voltage Class

- 5.3.1 Less than 60 V

- 5.3.2 60 - 300 V

- 5.3.3 Greater than 300 V

- 5.4 By End-Use Industry

- 5.4.1 Automotive and Transportation

- 5.4.2 Industrial Machinery and Automation

- 5.4.3 HVAC and Refrigeration

- 5.4.4 Consumer Electronics and Appliances

- 5.4.5 Healthcare and Medical Devices

- 5.4.6 Oil, Gas and Mining

- 5.4.7 Water and Wastewater

- 5.4.8 Renewable Energy Systems

- 5.4.9 Other Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Russia

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 Saudi Arabia

- 5.5.4.1.2 United Arab Emirates

- 5.5.4.1.3 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Egypt

- 5.5.4.2.3 Rest of Africa

- 5.5.4.1 Middle East

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ABB Ltd.

- 6.4.2 Allied Motion Technologies Inc.

- 6.4.3 AMETEK Inc.

- 6.4.4 Arc Systems Inc.

- 6.4.5 Buhler Motor GmbH

- 6.4.6 Delta Electronics Inc.

- 6.4.7 FAULHABER Group

- 6.4.8 Franklin Electric Co., Inc.

- 6.4.9 Johnson Electric Holdings Limited

- 6.4.10 Maxon Motor AG

- 6.4.11 MinebeaMitsumi Inc.

- 6.4.12 Nidec Corporation

- 6.4.13 Oriental Motor Co., Ltd.

- 6.4.14 Portescap SA

- 6.4.15 Regal Rexnord Corporation

- 6.4.16 Robert Bosch GmbH

- 6.4.17 Siemens AG

- 6.4.18 Toshiba International Corporation

- 6.4.19 WEG S.A.

- 6.4.20 Yaskawa Electric Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment