PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892673

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892673

North America Compact Recloser Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

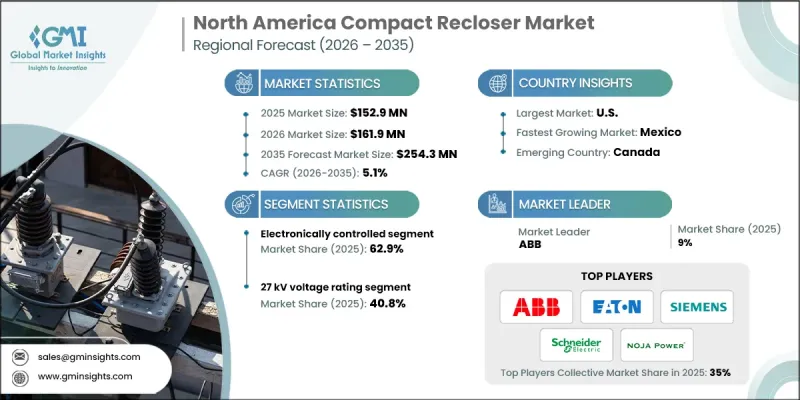

North America Compact Recloser Market was valued at USD 152.9 million in 2025 and is estimated to grow at a CAGR of 5.1% to reach USD 254.3 million by 2035.

Utilities across the region are investing heavily in grid resilience and distribution automation, driven by extreme weather events, growing load demands, and federal programs supporting modernization. Compact reclosers are critical for sectionalizing feeders and enabling rapid fault clearing, forming a key component of self-healing networks and FLISR (Fault Location, Isolation, and Service Restoration) strategies. Federal cost-sharing and resilience objectives allow utilities to deploy advanced devices with remote controls, communications, and smarter protection logic. These installations help reduce outage minutes, accelerate restoration, and improve reliability KPIs. Utilities are increasingly embedding reclosers with sensors and automated switches to reroute power around faults, minimizing disruptions, reducing affected customers, shortening interruptions, and enabling faster patrol and repair, making compact reclosers essential in modern field designs.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $152.9 Million |

| Forecast Value | $254.3 Million |

| CAGR | 5.1% |

The electronically controlled compact reclosers segment held a 62.9% share in 2025 and is expected to grow at a CAGR of 5.7% by 2035. These devices are preferred for their compatibility with advanced grid automation systems, offering remote configuration, adaptive protection settings, and real-time communication with ADMS and DERMS platforms. Electronic controls also provide dynamic fault response, programmable curves, and cybersecurity features, supporting grids integrating distributed energy resources.

The 27 kV voltage rating segment accounted for a 40.8% share in 2025 and is projected to grow at a CAGR of 4.6% through 2035. This class is increasingly adopted in semi-urban and industrial corridors to support higher loads. Reclosers in this segment deliver extended interrupting capacity and robust insulation for long feeder runs. Utilities specify 27 kV devices with electronic controls to enable remote switching and adaptive protection in line with DOE-funded resilience initiatives.

U.S. Compact Recloser Market generated USD 60.5 million in 2024, holding 56.5% share. Federal resilience programs, utility modernization, extreme weather, electrification, and DER integration are key drivers. Utilities are prioritizing reclosers with advanced electronic controls to support FLISR, adaptive protection, and remote operations. Initiatives such as DOE's Grid Resilience and Innovation Partnerships (GRIP) are channeling substantial funding into distribution automation, including recloser deployment on critical feeders.

Leading players in the North America Compact Recloser Market include Siemens, G&W Electric, ABB, SEL (Schweitzer Engineering Laboratories), Schneider Electric, Eaton, NOJA Power Switchgear Pty Ltd, Arteche Group, Milbank Manufacturing, S&C Electric Company, Howard Industries, Camlin Group, Hughes Power System, Hubbell Power Systems, Rockwill Electric Group, ENTEC Electric & Electronic Co., Ltd, NovaTech Automation, Southern States LLC, GE Grid Solutions, and Tavrida Electric. Companies in the North America Compact Recloser Market strengthen their presence by investing in R&D to enhance electronic controls, adaptive protection features, and remote communication capabilities. Strategic partnerships with utilities and smart grid solution providers accelerate adoption and integration into distribution networks. Firms focus on expanding manufacturing capacity, ensuring high-quality, reliable devices that comply with federal standards and resilience programs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022 - 2035

- 2.1.1 Business trends

- 2.1.2 Control trends

- 2.1.3 Interruption trends

- 2.1.4 Voltage trends

- 2.1.5 Country trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technology factors

- 3.6.5 environmental factors

- 3.6.6 Legal factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digitalization and IoT integration

- 3.7.2 Emerging market penetration

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Control, 2022 - 2035 (USD Million, Units)

- 5.1 Key trends

- 5.2 Electronic

- 5.3 Hydraulic

Chapter 6 Market Size and Forecast, By Interruption, 2022 - 2035 (USD Million, Units)

- 6.1 Key trends

- 6.2 Oil

- 6.3 Vacuum

Chapter 7 Market Size and Forecast, By Voltage Rating, 2022 - 2035 (USD Million, Units)

- 7.1 Key trends

- 7.2 15 kV

- 7.3 27 kV

- 7.4 38 kV

Chapter 8 Market Size and Forecast, By Country, 2022 - 2035 (USD Million, Units)

- 8.1 Key trends

- 8.2 U.S.

- 8.3 Canada

- 8.4 Mexico

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 Arteche Group

- 9.3 Camlin Group

- 9.4 Eaton

- 9.5 ENTEC Electric & Electronic Co., Ltd

- 9.6 G&W Electric

- 9.7 GE Grid Solutions

- 9.8 Howard Industries

- 9.9 Hubbell Power Systems

- 9.10 Hughes Power System

- 9.11 Milbank Manufacturing

- 9.12 NOJA Power Switchgear Pty Ltd

- 9.13 NovaTech Automation

- 9.14 S&C Electric Company

- 9.15 Schneider Electric

- 9.16 SEL (Schweitzer Engineering Laboratories)

- 9.17 Siemens

- 9.18 Southern States LLC

- 9.19 Rockwill Electric Group

- 9.20 Tavrida Electric