PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892677

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892677

Europe Laser Welding Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

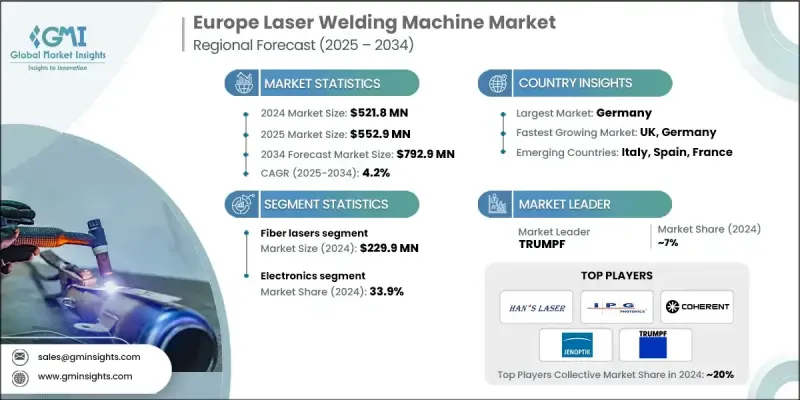

Europe Laser Welding Machine Market was valued at USD 521.8 million in 2024 and is estimated to grow at a CAGR of 4.2% to reach USD 792.9 million by 2034.

The market is driven by the automotive sector's increasing adoption of advanced welding technologies to support the production of lightweight vehicles, electric vehicles (EVs), and high-performance components. Laser welding enables precise, efficient, and strong joining of complex materials such as aluminum and high-strength steel, which is essential for improving fuel efficiency, optimizing EV battery performance, and reducing emissions. Industrial activities across Europe are expanding, with automation and the resurgence of electronics, aerospace, and medical device manufacturing fueling demand. Companies are investing in laser welding solutions to boost productivity, reduce cycle times, and achieve consistent quality. The high-speed, accurate, and repeatable nature of laser welding makes it an integral part of modern automated production lines.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $521.8 Million |

| Forecast Value | $792.9 Million |

| CAGR | 4.2% |

The fiber lasers segment generated USD 229.9 million in 2024 and is expected to grow at a CAGR of 3.2% from 2025 to 2034. Fiber lasers are favored for their superior beam quality, energy efficiency, and minimal maintenance requirements, offering faster welding speeds and higher precision. Their capability to process reflective metals such as aluminum and copper makes them especially valuable for the automotive, aerospace, and electronics industries.

The electronics segment held a 33.9% share in 2024 and is projected to grow at a CAGR of 2.7% from 2025 to 2034. Growth is driven by the expanding consumer electronics, semiconductor, and EV component sectors, which demand high-precision, low-distortion welding for miniature and intricate parts. Laser welding ensures consistent performance, minimal thermal impact, and reliability, which is critical for advanced electronic and microelectronic applications.

Germany Laser Welding Machine Market accounted for USD 127.5 million in 2024 and is anticipated to grow at a CAGR of 3.3% from 2025 to 2034. The country's strong automotive OEM base, Tier-1 suppliers, and electronics industry drive demand for laser welding machines. Germany's focus on Industry 4.0, smart factories, and automation integration, along with aerospace and defense sector requirements for high-strength and complex material welding, further supports market growth.

Key companies operating in the Europe Laser Welding Machine Market include Han's Laser Technology Industry Group, TRUMPF, IPG Photonics, Amada Weld Tech Inc., Jenoptik, Coherent, Laser Star Technologies, Huagong Laser Engineering, KEYENCE, CHIRON Group, Penta Laser, Laser line, Laser Technologies, Precitec, and Emerson Electric. Companies in the Europe Laser Welding Machine Market are strengthening their position through continuous innovation, expanding regional distribution, and strategic partnerships. Manufacturers focus on developing fiber and high-precision laser systems to cater to automotive, electronics, and aerospace requirements. Collaborations with Tier-1 suppliers and automation integrators help them secure long-term contracts and ensure seamless adoption in smart factories. Firms are also investing in R&D for energy-efficient and maintenance-light solutions to reduce operating costs for end-users. Marketing strategies highlight precision, speed, and compatibility with Industry 4.0, reinforcing brand credibility.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Technology

- 2.2.2 Mode of operation

- 2.2.3 System type

- 2.2.4 Welding mode

- 2.2.5 End use

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of the automotive industry

- 3.2.1.2 Surge in manufacturing activities

- 3.2.1.3 Technological advancements in laser welding

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment and maintenance costs

- 3.2.2.2 Limited skilled workforce for operation and programming

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By technology

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034, (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Fiber lasers

- 5.3 CO2 lasers

- 5.4 Diode lasers

- 5.5 Others (disk, green/blue, ultrafast)

Chapter 6 Market Estimates & Forecast, By Mode of Operation, 2021 - 2034, (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Manual laser welding machines

- 6.3 Automatic laser welding machines

- 6.4 Robotic laser welding systems

Chapter 7 Market Estimates & Forecast, By System type, 2021 - 2034, (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Handheld laser welding systems

- 7.3 Robotic/automated laser welding systems

- 7.4 Fixed/stationary laser welding systems

Chapter 8 Market Estimates & Forecast, By Welding Mode, 2021 - 2034, (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Continuous wave

- 8.3 Pulsed laser welding

- 8.4 Quasi-continuous wave

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Automotive

- 9.3 Medical

- 9.4 Electronics

- 9.5 Aerospace & defiance

- 9.6 Jewellery

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct

- 10.3 Indirect

Chapter 11 Market Estimates & Forecast, By Country, 2021 - 2034, (USD Million) (Thousand Units)

- 11.1 Key trends

- 11.2 Germany

- 11.3 UK

- 11.4 France

- 11.5 Italy

- 11.6 Spain

- 11.7 Russia

- 11.8 Rest of Europe

Chapter 12 Company Profiles

- 12.1 Amada Weld Tech Inc.

- 12.2 CHIRON Group

- 12.3 Coherent

- 12.4 Emerson Electric

- 12.5 Han's Laser Technology Industry Group

- 12.6 Huagong Laser Engineering

- 12.7 IPG Photonics

- 12.8 Jenoptik

- 12.9 KEYENCE

- 12.10 Laser Technologies

- 12.11 Laser line

- 12.12 Laser Star Technologies

- 12.13 Penta Laser

- 12.14 Precitec

- 12.15 TRUMPF